Essential Guide to Certification in Finance: Top Options and Benefits

What’s scarier than a bear market? Walking into a finance job interview without a certification! Do not be fooled; finance is one of those high stake games and you are walking into it with missing pieces. Some of the things you may be planning on doing include analyzing billion-dollar portfolios, building wealth strategies, or even managing corporate budgets, and therefore, getting certified is the way to go in order to be able to prove that you know what you are doing.

Now, let’s break it all down—because we’re about to dive deep into the most valuable finance certifications of 2025, their career impact, and the industry trends shaping the future.

What is a Finance Certification?

A finance certification is a professional accreditation that guarantees your knowledge and experience in a specific area of finance. These certifications are provided by professional organizations and are meant to prove to employers that you are more than just a data entry person; you are an expert in your field.

Whether you're an investment banker, risk manager, or financial planner, a finance certification can significantly boost your credibility and earning potential.

Why Do Finance Certifications Matter in 2025?

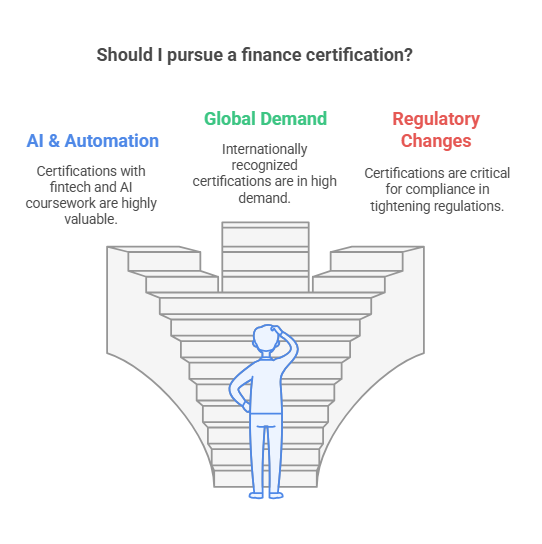

The finance industry is evolving faster than ever. Here’s why staying certified is essential:

✅ AI & Automation: Companies prefer professionals who can blend technology with finance. Certifications that include fintech and AI-related coursework are more valuable than ever.

✅ Global Demand: More firms now require internationally recognized certifications like CFA, CPA, and CFP.

✅ Regulatory Changes: Governments worldwide are tightening financial regulations, making certifications even more critical for compliance roles.

✅ Higher Salaries: Certified finance professionals earn up to 25-50% more than their non-certified counterparts.

Top Finance Certifications for 2025

Let’s explore the most sought-after finance certifications this year, categorized by specialization.

Investment & Risk Management Certifications

These certifications are important for finance professionals working in asset management, trading or risk assessment.

Chartered Financial Analyst (CFA)

The gold standard for investment professionals.

Focuses on investment analysis, portfolio management, and ethical finance.

Recognized worldwide and highly respected.

Financial Risk Manager (FRM)

Specialized in risk assessment for banks, investment firms, and hedge funds.

Essential for those dealing with financial regulations and compliance.

Certified Investment Management Analyst (CIMA)

Ideal for professionals in portfolio management and investment consulting.

Provides deep insights into asset allocation strategies.

Certified Hedge Fund Professional (CHP)

A niche certification for professionals managing hedge funds.

Covers alternative investments and trading strategies.

Corporate Finance & Accounting Certifications

If you’re into budgeting, financial strategy, or corporate treasury management, these certifications will help you climb the corporate ladder.

Certified Management Accountant (CMA)

Focuses on corporate finance, accounting, and strategic management.

A must-have for professionals in business finance roles.

Certified Corporate Financial Planning & Analysis Professional (FPAC)

Essential for financial analysts and CFO aspirants.

Provides expertise in financial planning, forecasting, and reporting.

Certified Public Accountant (CPA)

The ultimate certification for accountants and auditors.

Also opens doors to roles in taxation, forensic accounting, and financial advisory.

Certified Treasury Professional (CTP)

Focuses on cash management, financial risk, and liquidity planning.

Highly valued in corporate finance and banking.

Financial Planning & Wealth Management Certifications

If you dream of managing assets for high-net-worth individuals, these certifications are perfect for you.

Certified Financial Planner (CFP)

The most respected certification for financial advisors.

Covers estate planning, retirement, tax strategies, and investment planning.

Chartered Financial Consultant (ChFC)

A strong alternative to CFP, with additional focus on risk management.

Chartered Life Underwriter (CLU)

Specializes in life insurance, estate planning, and wealth transfer.

Emerging Trends in Finance Certifications for 2025

🔹 Rise of AI and Fintech Certifications: AI-driven financial analysis is growing. Expect new certifications in blockchain finance and algorithmic trading.

🔹 Demand for ESG & Sustainable Finance Certifications: Sustainability is now a top priority in finance. Certifications in green finance and ethical investing are on the rise.

🔹 Greater Focus on Global Accreditation: Employers prefer certifications that are internationally recognized.

How to Choose the Right Finance Certification

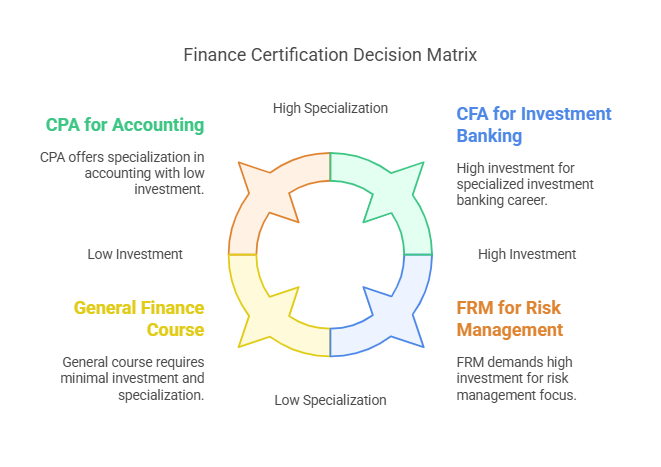

Picking the best certification depends on your career path. Ask yourself:

Do I want to specialize in investments, accounting, or risk management?

Do I need an internationally recognized certification?

How much time and money am I willing to invest in my certification?

5 Less Commonly Known Facts About Finance Certifications

The CFA exam has a lower pass rate than the U.S. Bar Exam.

According to the CFA Institute, the average pass rate for Level I of the CFA exam from 2015 to 2024 was 40%, with Level II at 45% and Level III at 51%.

cfainstitute.org

In contrast, the overall pass rate for the U.S. Bar Exam in 2021 was approximately 60%.

legal.uworld.com

This indicates that the CFA exam has a lower pass rate compared to the U.S. Bar Exam.

Some hedge funds only hire CFA or CHP-certified professionals.

While the Chartered Financial Analyst (CFA) designation is widely recognized and valued in the investment industry, including hedge funds, the Certified Hedge Fund Professional (CHP) designation is less known. Discussions among industry professionals suggest that the CHP is relatively obscure, and it's uncommon to see hedge fund analysts or portfolio managers with this designation.

wallstreetoasis.com

Therefore, while the CFA is often sought after by hedge funds, the CHP is not a common requirement.

The CFP requires ongoing education credits every two years.

Certified Financial Planner (CFP) professionals are required to complete 30 hours of continuing education (CE) every two years to maintain their certification. This ensures that CFPs stay current with industry standards and practices.

en.wikipedia.org

AI and machine learning are now part of some finance certification exams.

The CFA Institute has incorporated topics on artificial intelligence and big data into its curriculum since 2019. This addition reflects the growing importance of these technologies in the finance industry.

en.wikipedia.org

The CPA exam pass rate is around 50%.

The overall pass rate for the CPA Exam has been approximately 50% in recent years. For instance, in 2024, the cumulative pass rate for the Financial Accounting and Reporting (FAR) section was 41.16%, and for the Auditing and Attestation (AUD) section, it was 45.71%.

efficientlearning.com

📌 Database Resource: Check out the U.S. Bureau of Labor Statistics (BLS Database) for data on finance jobs and salary projections.

FAQs About Finance Certifications

1. Are finance certifications really worth it?

Yes! Certified professionals earn 25-50% more and have better job security.

2. Which certification is best for investment banking?

The CFA is the gold standard for investment banking and portfolio management.

3. How long does it take to complete a finance certification?

Depends on the certification—CPA (18 months), CFA (3-4 years), FRM (1-2 years).

4. Can finance certifications replace a degree?

No, but they greatly enhance your resume and open doors to better jobs.

5. Do employers prefer certain certifications?

Yes, globally recognized ones like CFA, CPA, and CFP carry more weight.

6. Are there online finance certification programs?

Absolutely! Platforms like Coursera, edX, and CFA Institute offer online prep.

7. Which finance certification is easiest?

CIMA and CFP are easier compared to CPA or CFA.

8. What’s the highest-paying finance job with a certification?

CFA charterholders in hedge funds can earn over $500,000 per year.

Final Thoughts: Get Certified & Level Up

Finance certifications are an investment in your career. Whether you want to manage investments, analyze risks, or lead financial planning, getting certified can give you the competitive edge you need.

And if you're in the medical field, check out AMBCI for the best medical coding and billing certificates.

It’s time to invest in yourself—because in finance, knowledge truly is power!