Top Claims Processor Training Programs for 2025

Medical claims processing plays a pivotal role in the healthcare industry, ensuring that healthcare providers receive timely reimbursement for services rendered. To effectively handle medical claims, professionals need to develop proficiency in medical terminology, insurance procedures, customer service, and administrative tasks. As the healthcare sector evolves, staying current with the latest regulations and procedures is essential, which is why specialized training programs are vital for career advancement.

Key Takeaways for Success in Medical Claims Processing Training

Medical claims processing involves managing patient data, submitting insurance claims, and ensuring reimbursements are accurately processed. The field requires professionals to be well-versed in various legal and compliance issues, such as the False Claims Act and the No Surprises Act. Earning a medical billing and coding certification from a trusted provider like AMBCI equips individuals with the essential skills and knowledge needed in this complex industry. Successful claims processors not only need to understand medical billing procedures but also must be proficient in navigating the regulations that govern healthcare reimbursements.

Top training programs, such as those offered by the American Business Communications Institute (ABCI) and SUNY Schenectady, provide comprehensive education in claims processing, insurance billing, and customer service. Certification programs enhance employability and career prospects, helping professionals stay competitive in the field.

Understanding Medical Claims Processing

Medical claims processing is integral to the healthcare system, ensuring that providers are reimbursed appropriately for their services. Mismanagement of claims leads to billions of dollars in losses annually, emphasizing the need for accurate and efficient processing. The claims process involves interpreting patient data, filing insurance claims, and pursuing outstanding payments. Additionally, understanding the rules surrounding claims, such as the No Surprises Act, which mandates upfront cost projections for out-of-network care, is essential.

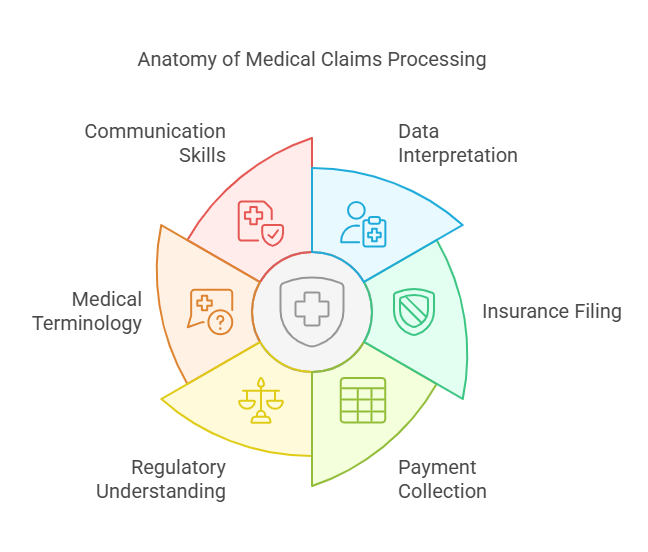

A strong grasp of medical terminology is crucial, as it allows professionals to understand and communicate complex healthcare information. Alongside technical skills, effective communication with patients and insurance providers is key to ensuring smooth claim processing. Regular education and adherence to updated guidelines are essential to maintain compliance and avoid legal issues.

Essential Skills for Claims Processors

Claims processors must have a broad skill set. A solid understanding of medical terminology is foundational, allowing processors to accurately interpret and manage patient data. Administrative skills are also critical for ensuring that claims are filed efficiently and promptly, minimizing delays in reimbursement. Furthermore, strong communication skills are necessary to interact with patients, healthcare professionals, and insurance providers. These skills help resolve disputes and ensure the ongoing trust and satisfaction of those involved in the claims process.

Certification in medical claims processing can enhance job prospects and demonstrate expertise in the field. Credentials from respected organizations, such as ABCI and SUNY Schenectady, can significantly boost employability. These certifications validate the holder's specialized knowledge and may be required by certain insurers.

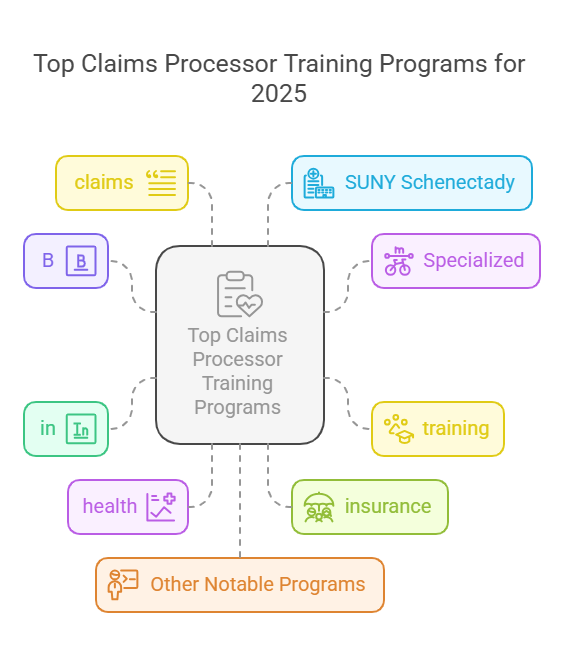

Top Claims Processor Training Programs for 2025

Several top-tier training programs offer comprehensive courses designed to equip individuals with the skills required for successful careers in medical claims processing.

American Business Communications Institute (ABCI)

ABCI offers specialized training in health insurance claims processing. The program includes over 45 hours of coursework focused on medical terminology, insurance vocabulary, and administrative skills, which are vital for anyone entering the field. The Health Insurance Claims Processor course, which spans 61 hours, covers advanced topics like managing healthcare documentation and understanding insurance claims processes.SUNY Schenectady

SUNY Schenectady's Medical Insurance Claims Processor and Customer Service program provides a comprehensive curriculum that covers insurance billing, coding techniques, and customer service. The program’s combination of theoretical and practical education ensures students are well-prepared to navigate the complexities of the healthcare insurance system. Upon completion, students will have the skills necessary to excel in various aspects of medical claims processing.Other Notable Programs

Various community colleges and online platforms offer flexible training programs in medical claims processing. These programs often provide lab experiences and tools to help students prepare for certification exams. Their flexibility allows working professionals to pursue education while continuing their careers.

Course Structure and Content for Claims Processor Training

Training programs for claims processors typically cover a wide range of topics essential for success in the field. These include an introduction to health insurance, customer service within healthcare, and detailed instruction on processing health insurance claims. Key learning outcomes include a solid understanding of insurance policies, health insurance regulations, and customer service practices specific to healthcare environments. Students also gain hands-on experience through case studies and real-world simulations that prepare them for the challenges they will face in the field.

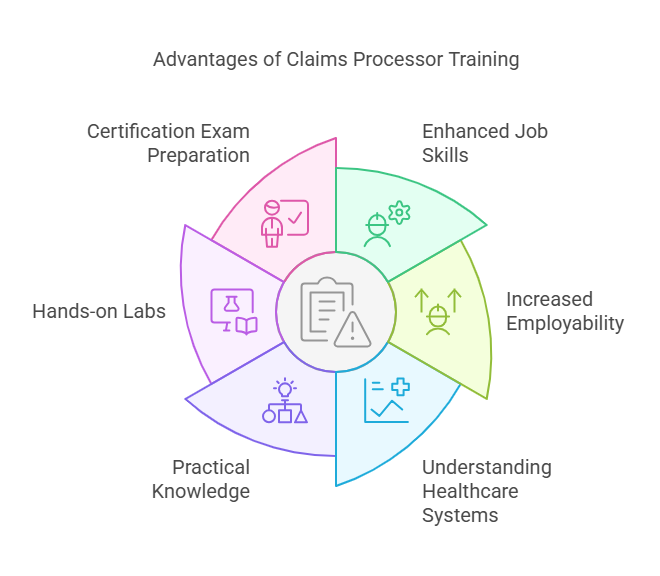

Certification and Career Advancement

Certification is a significant factor in career advancement for claims processors. Programs like those offered by SUNY Schenectady and CoreLogic provide certification that validates expertise in the field. Certification improves job prospects, increases earning potential, and ensures that professionals are equipped to meet the regulatory requirements of the industry. Continuing education is crucial, as it allows claims processors to stay up to date with new laws and best practices in medical claims processing.

Benefits of Claims Processor Training

Participating in a claims processor training program offers numerous benefits, including enhanced job skills, increased employability, and a deeper understanding of healthcare reimbursement systems. Programs like those offered by ABCI and SUNY Schenectady are designed to equip students with the practical knowledge and experience they need to succeed in this dynamic field. Additionally, students can benefit from hands-on labs, which provide real-world scenarios and prepare them for certification exams.

Tips for Success in Claims Processor Training

To succeed in claims processor training, students should adopt a disciplined and structured approach to learning. Regular study sessions, focusing on medical terminology and healthcare reimbursement protocols, will help build a strong foundation. Communication and administrative skills are equally important and should be developed throughout the course. Hands-on experience and practical exercises also play a critical role in reinforcing theoretical knowledge and ensuring career success.

6 Lesser-Known Facts About Claims Processing

The healthcare industry loses over $100 billion annually due to erroneous billing practices, emphasizing the importance of accurate claims processing.

According to the FBI, health care fraud costs American taxpayers an estimated $80 billion a year. Wikipedia

The No Surprises Act, implemented in 2022, protects patients from unexpected out-of-network medical bills by requiring healthcare providers to give upfront cost estimates.

The No Surprises Act, effective January 1, 2022, aims to protect consumers from surprise medical bills and requires healthcare providers to provide good faith estimates of costs. Mayo Clinic+1AARP+1

Claims processors must adhere to regulations such as the False Claims Act and Anti-Kickback Statute to avoid legal repercussions.

Violations of the Anti-Kickback Statute can lead to liability under the False Claims Act, resulting in significant civil and criminal penalties. Wikipedia

Many states require claims processors to complete continuing education courses every few years to maintain their certification.

Specific information on state requirements for continuing education for claims processors varies and is not detailed in the provided sources.

Medical claims processing isn’t limited to hospitals or doctors' offices; it also applies to pharmacies, laboratories, and rehabilitation centers.

Medical claims processing encompasses various healthcare settings, including hospitals, outpatient departments, and ambulatory surgical centers. healthinsurance.org

Some claims processors specialize in specific fields, such as dental or vision claims, which require additional certifications and expertise.

While not explicitly detailed in the provided sources, it's common for claims processors to specialize in areas like dental or vision claims, often necessitating additional certifications and expertise.

FAQs

-

Medical claims processing ensures that healthcare providers are reimbursed appropriately for services rendered, maintaining the financial health of healthcare organizations. It also helps comply with regulations in the industry.

-

A claims processor should have a solid understanding of medical terminology, administrative skills, effective communication, and knowledge of insurance protocols to process claims efficiently.

-

Top training programs include those offered by ABCI and SUNY Schenectady. These programs provide comprehensive education in medical claims processing and customer service.

-

Certification improves job prospects, increases earning potential, and demonstrates expertise in medical claims processing, making certified professionals more competitive in the job market.

-

To succeed, maintain an organized study schedule, focus on medical terminology, improve communication skills, and gain practical experience through case studies and simulations.

Conclusion

Starting a career in medical claims processing is a rewarding path for those who are diligent and committed to learning. With comprehensive training programs like those at ABCI and SUNY Schenectady, individuals can gain the necessary skills to excel in this field. Certification plays a crucial role in career growth and job security, and ongoing education ensures professionals stay aligned with industry changes. By mastering the skills required and staying current with regulatory updates, claims processors can enjoy a successful career in the evolving healthcare industry.