Comprehensive Coding Guide for Bariatric Surgery

Bariatric surgery is one of the highest-risk and highest-reimbursement specialties in medical coding — and it’s also one of the most frequently audited. With multiple payer rules, bundled billing pitfalls, and strict documentation mandates, even small coding errors can trigger claim denials or post-payment audits. Whether you’re handling laparoscopic sleeve gastrectomies, gastric bypasses, or revisions, each step requires precise CPT and ICD-10 selection paired with robust documentation support.

This guide breaks down every element coders need to master bariatric coding — from pre-authorization criteria to surgical modifiers to common denial triggers. We’ll cover high-risk CPT and ICD-10 codes, red-flag documentation issues, payer-specific quirks, and tools that help coders reduce errors and improve compliance. If you're preparing for audits or looking to future-proof your coding workflow, this is your definitive resource.

CPT & ICD-10 Codes for Bariatric Procedures

Common CPT Codes (e.g., 43775, 43845)

CPT coding for bariatric surgery requires granular accuracy because procedure types can vary significantly in complexity, approach, and reimbursement levels. Among the most frequently used codes:

43775 – Laparoscopic sleeve gastrectomy

43644 – Laparoscopic gastric bypass with Roux-en-Y

43845 – Open gastric bypass with short limb Roux-en-Y

43770 – Laparoscopic adjustable gastric banding

Each of these CPT codes comes with unique documentation expectations. For example, 43775 requires clear operative notes showing resection of a large portion of the stomach, not just stapling. In contrast, 43644 documentation must verify both gastric pouch creation and Roux-en-Y reconstruction to meet payer guidelines. Coders should always confirm operative details such as anastomosis technique and use of robotic assistance, as these impact modifier and add-on code usage.

When coding revisions or removals (e.g., 43771, 43848), extra care is needed in distinguishing intent—whether the procedure is staged, corrective, or unrelated to the initial bariatric operation. Inaccurate CPT selection is a major audit trigger, especially when combined with vague or templated surgical reports.

ICD-10 Procedure and Diagnosis Codes

Correct ICD-10-PCS coding hinges on detailed operative reports. For example:

0DB64Z3 – Excision of stomach, laparoscopic approach, for sleeve gastrectomy

0D164ZA – Bypass stomach to jejunum, open approach, with anastomosis

0DV64CZ – Restriction of stomach, percutaneous endoscopic approach

The difference between excision, bypass, and restriction codes depends entirely on how the stomach is altered—not just the end result. Without operative language specifying the surgical method, coders risk misclassification and DRG assignment errors.

On the diagnosis side, ICD-10-CM codes like E66.01 (morbid obesity due to excess calories) and Z68.41-Z68.45 (BMI ranges) are essential to establish medical necessity. Secondary diagnoses such as hypertension (I10) or type 2 diabetes (E11.9) must be coded when present and supported by documentation, as payers often cross-reference these for pre-op eligibility.

Some coders overlook Z98.84 (bariatric surgery status) in follow-up care coding, but this is crucial for claims clarity. It distinguishes active surgical treatment from postoperative management, reducing E/M denial risk.

| Code Type | Description |

|---|---|

| 43775 | Laparoscopic sleeve gastrectomy |

| 43644 | Lap gastric bypass with Roux-en-Y |

| 43845 | Open gastric bypass |

| E66.01 | Morbid obesity due to excess calories |

| Z68.45 | BMI 70 or greater |

| 0DB64Z3 | Laparoscopic excision of stomach |

| Z98.84 | Bariatric surgery status |

Pre-Op, Intra-Op, and Post-Op Coding Requirements

What to Include Before Surgery

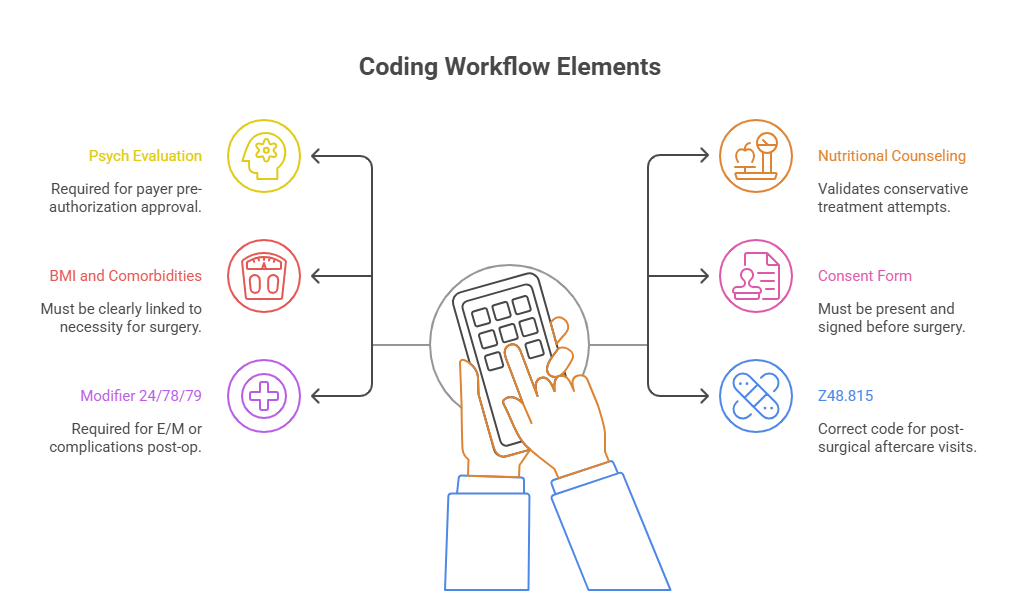

Preoperative documentation is foundational for both prior authorization approval and proper code selection. Coders must ensure the record includes:

Multidisciplinary evaluations, including nutritionist and psychological clearance

A clearly documented 6-month medically supervised weight loss program

BMI verification through vitals and imaging or lab work

Comorbid conditions that support necessity, such as E11.9 (type 2 diabetes) or I10 (essential hypertension)

Behavior modifications or lifestyle counseling documentation

Payers often reject bariatric claims not because of the surgery itself, but due to missing or insufficient pre-op records. Every insurance carrier differs slightly in how they define “medical necessity,” but almost all require evidence that non-surgical weight loss attempts failed. The documentation must reflect longitudinal treatment, not just isolated visits.

Coders should also verify whether the payer requires specific ICD-10-CM codes (e.g., Z71.3 for dietary counseling) to validate that pre-surgical services were rendered. Failing to include these will delay or deny reimbursement before the patient even reaches the OR.

Modifier Use for Aftercare

Postoperative coding is not just about E/M levels — it's about accurately conveying care continuity and avoiding bundling pitfalls. Common CPT codes for aftercare visits must include:

Modifier 24 – When reporting an unrelated E/M service during the postoperative period

Modifier 78 – For related unplanned return to the OR

Modifier 79 – For unrelated procedure during global period

Modifier 54/55 – If surgical care and post-op follow-up are split between providers

Each modifier must be supported by detailed progress notes or operative reports. For instance, a wound dehiscence requiring drainage in the post-op period could warrant modifier 78, but only if the documentation clearly states it was unplanned and related.

Another overlooked area: Z48.815 (Encounter for surgical aftercare following surgery on the digestive system). Coders frequently default to Z09, which is incorrect post-surgery. Using Z48.815 instead signals that the provider is managing recovery, not simply doing a check-up, and reduces risk of medical necessity denials.

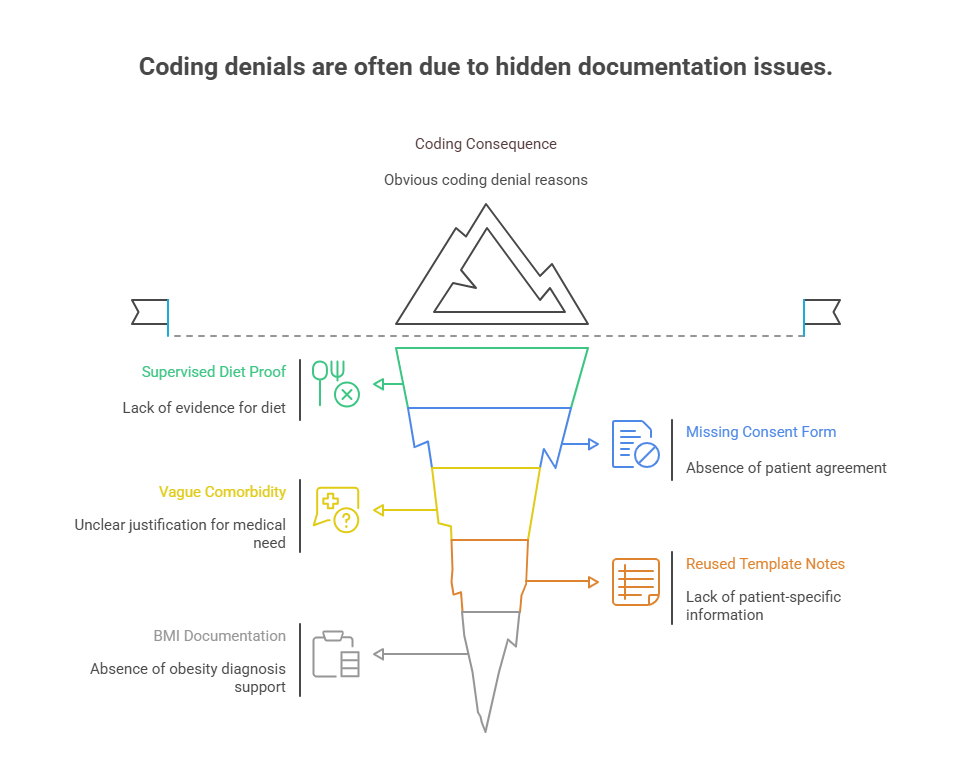

Documentation Red Flags That Lead to Denials

Missing Criteria or Consent

One of the most common reasons for bariatric surgery claim denial is missing or incomplete documentation of pre-authorization criteria. Coders often receive operative reports without supporting documents showing that:

The patient underwent a medically supervised weight-loss program

Comorbidities were evaluated and documented

A signed informed consent was obtained pre-procedure

Psychological clearance was secured before approval

When this supporting documentation is absent or disconnected from the surgical encounter, payers flag it as incomplete. Even if the CPT and ICD-10 codes are accurate, lacking eligibility proof will result in a denial that no modifier or appeal can fix.

Another issue is documentation that vaguely references comorbidities without connecting them to surgical necessity. For example, listing “hypertension” in a past medical history section isn’t enough—there needs to be explicit mention of how it exacerbates obesity-related risks to justify surgery.

Lack of Comorbidity Documentation

Coders should never assume payers will infer risk from BMI alone. Without detailed entries on comorbid conditions, most morbid obesity surgeries get flagged for review or denial. Key red flags include:

No linkage between obesity and secondary conditions like diabetes or GERD

Comorbidities only noted in the problem list, not elaborated in the assessment or plan

Missing lab data or vitals to substantiate diagnoses

Lack of documentation showing the patient failed prior non-surgical treatment

Payers are increasingly using AI audit tools to auto-deny claims that don’t align with policy bullet points. If your documentation doesn’t clearly show that criteria are met line-by-line, denials will spike — especially with Medicare Advantage and large commercial plans.

Additionally, coders should ensure Z codes like Z71.3 or Z72.4 are included where applicable, to signal that counseling occurred. These minor details reinforce that conservative care was exhausted before surgery, strengthening audit defensibility.

Insurance Requirements and Prior Auth Tips

Medical Necessity Proof

Every bariatric coding workflow must begin with payer-specific medical necessity criteria, not just correct coding. Each insurance plan — Medicare, Medicaid, Blue Cross, Aetna, etc. — defines eligible BMI thresholds, comorbidity requirements, and documentation protocols differently. A universal red flag is failing to align the chart with these conditions.

To avoid denial, coders must verify:

BMI ≥ 40, or ≥ 35 with comorbidities (e.g., type 2 diabetes, OSA, hypertension)

Clear documentation of failed non-surgical interventions over 6–12 months

Multispecialty team input — dietitian, psychologist, PCP

Notes showing daily functional impairment or obesity-related morbidity

Merely listing obesity codes like E66.01 isn't enough. The narrative must explain why surgery is medically necessary now, supported by diagnostic testing, prescription history, and care plans. When a payer policy says “must include conservative therapy for ≥6 months,” coders must ensure each encounter includes ICD-10 codes for that care (e.g., Z71.3, Z72.4).

Failure to show longitudinal effort or lifestyle modification almost always leads to a pre-auth denial or post-op recoupment — even if surgery was performed appropriately.

Appeal Letters That Work

When denials happen despite solid coding, strong appeals often recover payment. Coders must collaborate with providers to craft detailed, policy-specific appeals that:

Quote the payer’s own criteria line-by-line

Attach clinical notes clearly aligned with each requirement

Reference CPT Assistant or AHA Coding Clinic guidance where code interpretation is disputed

Include objective documentation of medical necessity, not generic templates

Successful appeals typically come from non-template letters that cite the patient’s BMI, failed treatments, and risk profile in direct alignment with payer policy wording. Coders should avoid vague justifications and instead present structured clinical timelines supported by claims data and documentation excerpts.

Additionally, citing peer-reviewed literature supporting bariatric surgery’s effectiveness in the patient’s condition can sway clinical reviewers. Even with correct code usage, denials tied to "lack of necessity" require deep clinical-context framing in appeals — and coders must take the lead in identifying documentation gaps that can be corrected before submission.

Tools and Checklists for Accuracy

EMR Integration Tips

Your electronic medical record (EMR) system can either reduce audit risk—or compound it. Coders must configure EMR templates to pull in necessary pre- and post-operative data automatically. This includes:

BMI history, comorbidities, and behavioral intervention history

Auto-populated fields for documenting nutritional counseling, psychological evaluations, and failed weight loss attempts

Embedded alerts for missing documentation (e.g., informed consent or conservative therapy timelines)

Integrated CPT/ICD-10 coding crosswalks with links to payer-specific policies

One of the most overlooked issues in audit-prone bariatric claims is relying too heavily on templated notes. If every patient’s progress note looks identical, it signals to payers that documentation may not reflect actual patient-specific evaluations. To avoid this, coders should work with clinical teams to customize EMR workflows so notes include:

Personalized comorbidity discussions

Narrative justifications for surgery

Explicit linkage between symptoms and obesity

These enhancements improve defensibility and reduce downcoding risk during claims review.

Specialty Coding Guides

Coders should never rely solely on general coding handbooks when dealing with bariatric claims. Instead, they should utilize:

AMBCI’s CPC + CPB Certification study materials, which include specialty modules on gastrointestinal and bariatric coding

Payer-specific coding guidelines, such as Medicare NCD 100.1, which defines bariatric eligibility

Regularly updated code-specific guidance from CPT Assistant and AHA Coding Clinic, especially for surgical nuances

Internal audit checklists, built from past denials and compliance audits

An effective checklist should include:

Is BMI supported by vitals documentation in every pre-op note?

Are comorbidities coded consistently across all visits?

Are CPT modifiers applied based on post-op care distribution or complications?

Do ICD-10 codes support both surgical intent and necessity?

Is the claim bundled appropriately or incorrectly unbundled?

These tools help teams identify gaps in documentation before submission, avoid denials, and remain compliant with payer and federal guidelines.

| Tool/Checklist Element | Why It Matters |

|---|---|

| EMR Alerts for Missing Fields | Ensures vital data isn’t left out |

| BMI Auto-Population | Supports Z68.x codes with vitals |

| Specialty Coding Modules | Improves understanding of GI and bariatric coding |

| CPT + ICD Crosswalks | Reduces miscode and improves compliance |

| Claim Review Templates | Helps pre-check every component before submission |

How AMBCI’s Certification Covers Bariatric Coding

Specialty Modules on GI and Bariatrics

The AMBCI CPC + CPB Certification program includes comprehensive training on specialty coding, with entire modules dedicated to gastrointestinal, metabolic, and bariatric procedures. These aren’t surface-level overviews — they offer deep dives into:

CPT code differentiation for laparoscopic vs. open procedures

ICD-10 documentation requirements for morbid obesity and related comorbidities

Pre-op medical necessity qualifiers and payer policy variations

The proper use of modifiers like 24, 78, and 54/55 in global surgical periods

What makes this training stand out is that it walks coders through real-world claim setups, showing how to interpret complex operative reports and link them with the correct coding hierarchy. The program also addresses payer denial trends specific to bariatric claims and teaches coders how to preemptively adjust workflows to reduce audit exposure.

For coders aiming to transition into high-risk, high-reimbursement coding specialties, this training serves as both a compliance framework and a career advancement tool.

Real Claims Case Practice

A standout feature of the AMBCI certification is its real claims simulation training, where coders work with de-identified case files pulled from bariatric and GI coding audits. These include:

Documentation reviews of operative notes, pre-op workups, and post-op visits

Mock denial appeals that require crafting compliant letters using payer guidelines

Hands-on walkthroughs of electronic claim forms (CMS-1500, UB-04) with proper modifier and diagnosis linking

Exercises focused on unbundling, overcoding, and undercoding identification

The benefit of this applied training is coders don’t just memorize code lists — they learn the audit traps, see how real mistakes are made, and get coached on how to avoid them. This is particularly useful for practices with high bariatric volume or for coders preparing for roles in billing compliance or revenue cycle management.

Additionally, certified coders can access AMBCI’s ongoing updates, including quarterly modules that reflect current CMS and commercial payer changes, ensuring they remain audit-resistant and aligned with real-time coding trends.

Frequently Asked Questions

-

The most commonly denied CPT codes in bariatric claims include 43775 (laparoscopic sleeve gastrectomy), 43644 (lap gastric bypass with Roux-en-Y), and 43845 (open gastric bypass). Denials often occur due to missing preauthorization, insufficient documentation of comorbidities, or unclear surgical intent in operative reports. Even if the procedure is medically necessary, lack of detail in linking the diagnosis to the surgical intervention can lead to a denial. Payers also flag inconsistencies between the BMI range and ICD-10-CM coding, or when conservative treatment timelines aren’t documented properly. Coders must cross-reference payer guidelines and ensure clinical notes explicitly reflect each eligibility requirement before submission.

-

Most commercial payers and Medicare require a 6–12 month medically supervised weight loss program before bariatric surgery approval. This includes monthly visits documented by a primary care provider or dietitian, showing dietary counseling, exercise plans, and behavioral therapy. Coders must confirm that each visit includes appropriate ICD-10-CM codes such as Z71.3 (dietary counseling) or Z72.4 (lack of physical exercise) to show that non-surgical interventions were attempted. Absence of these codes or vague visit notes often leads to denial. Each visit should reflect progress or setbacks, reinforcing the medical necessity of surgical intervention.

-

The primary ICD-10-CM code for bariatric surgery is E66.01 (morbid obesity due to excess calories), often supported by Z68 codes indicating BMI (e.g., Z68.41–Z68.45). However, these alone are rarely sufficient. Payers expect additional comorbidity codes like E11.9 (type 2 diabetes), I10 (hypertension), G47.33 (obstructive sleep apnea), or K21.9 (GERD) to establish necessity. Coders must ensure these conditions are not just listed but discussed in the assessment and plan. Including behavioral Z codes (Z71.3, Z72.4) and post-op indicators (Z98.84) is also essential for audit-proof claims. Proper linkage between diagnosis and surgical indication is key to reimbursement.

-

Essential modifiers include Modifier 24 (unrelated E/M during global period), Modifier 78 (related return to OR), Modifier 79 (unrelated procedure during global period), and Modifiers 54/55 (split surgical and post-op care). Coders must understand the global period for each bariatric CPT code and apply modifiers when E/M services are billed separately. For instance, if a patient has a wound infection requiring drainage during recovery, Modifier 78 is appropriate. In shared-care settings, Modifier 54 (surgeon only) and 55 (aftercare provider) must be clearly documented. Each modifier must be justified in the documentation, especially when coding during postoperative windows.

-

Coders play a critical role in denial prevention by implementing pre-submission checklists that cover both documentation and coding. This includes verifying that all payer-required criteria (BMI, comorbidities, conservative treatment history, signed consent, psych eval) are documented and linked to valid CPT/ICD-10 pairs. Coders must also review pre-auth approvals to confirm they match submitted CPT codes exactly. Denials often occur when providers change the procedure intraoperatively but fail to update the authorization or codes. Coders should also train staff on modifier use, conduct routine chart audits, and maintain payer-specific documentation templates for bariatric workflows.

-

If documentation lacks conservative weight loss treatment (dietary counseling, exercise plans, behavior modification), most insurers will deny the claim outright. Even when the surgery is medically indicated, lack of prior intervention evidence violates payer policy. Coders should ensure at least 6 months of documented visits with relevant ICD-10 Z codes (Z71.3, Z72.4) are present. These visits should demonstrate patient engagement, adherence, or failure. Retroactive documentation is rarely accepted during audits. Instead, coders should flag these issues before claim submission and work with clinical teams to either document the history accurately or postpone billing until requirements are met.

-

Yes, coding differences between laparoscopic and open procedures are significant. For example, 43775 is the laparoscopic sleeve gastrectomy CPT code, while open procedures like 43845 represent open gastric bypass. Similarly, ICD-10-PCS codes differ by approach: 0DB64Z3 denotes laparoscopic excision of the stomach, whereas 0DB60Z3 is for open approach. Coding the incorrect surgical approach can result in DRG misassignment and denial. Coders must review operative reports for terms like "laparoscopic," "robotic-assisted," or "converted to open" and choose CPT and PCS codes accordingly. Accurate approach coding is a key audit defense tool for bariatric claims.

Conclusion

Bariatric coding isn’t just about selecting the right CPT and ICD-10 codes—it’s about building airtight documentation that stands up to payer scrutiny and audit pressure. With rising reimbursement comes higher compliance expectations, and even minor coding errors can lead to denials, delays, or financial penalties. From pre-op requirements and modifier usage to EMR setup and appeal strategies, coders must approach bariatric claims with both technical precision and regulatory awareness.

By mastering the tools, checklists, and policies detailed in this guide—and reinforcing your skills through training like the AMBCI CPC + CPB Certification—you’ll not only protect revenue but position yourself as a coding leader in surgical specialties. In high-stakes specialties like bariatrics, precision isn’t optional—it’s your advantage.

| Poll: Which part of bariatric coding do you find most challenging? | |

|---|---|

| Option 1 | CPT & ICD-10 selection |

| Option 2 | Documentation for pre-op requirements |

| Option 3 | Appeals and denial handling |