Maximizing Revenue Through Accurate Modifier Application

Maximizing reimbursement isn’t about charging more—it’s about coding right. Modifier application is one of the most overlooked revenue levers in medical billing. These two-character CPT and HCPCS additions can be the deciding factor between full payment and claim denial, yet they’re frequently misused, misunderstood, or misapplied. In the eyes of payers, a misplaced modifier signals red flags: questionable documentation, bundling errors, or non-compliance. Even skilled coders often struggle with modifier 25, modifier 59, and others when navigating evolving payer rules or complex procedures.

When modifiers are applied accurately, they unlock cleaner claim submissions, reduce audit risks, and optimize the revenue cycle health of your practice. But when used incorrectly, they cause denials, downcoding, delays, and lost income. This blog dives deep into the most impactful modifiers, the financial consequences of misuse, and real-world best practices for applying them with precision. Whether you're billing for surgical assists, lab work, or multi-service visits, modifier mastery is essential to ensure your practice is paid what it's owed—and remains compliant doing so.

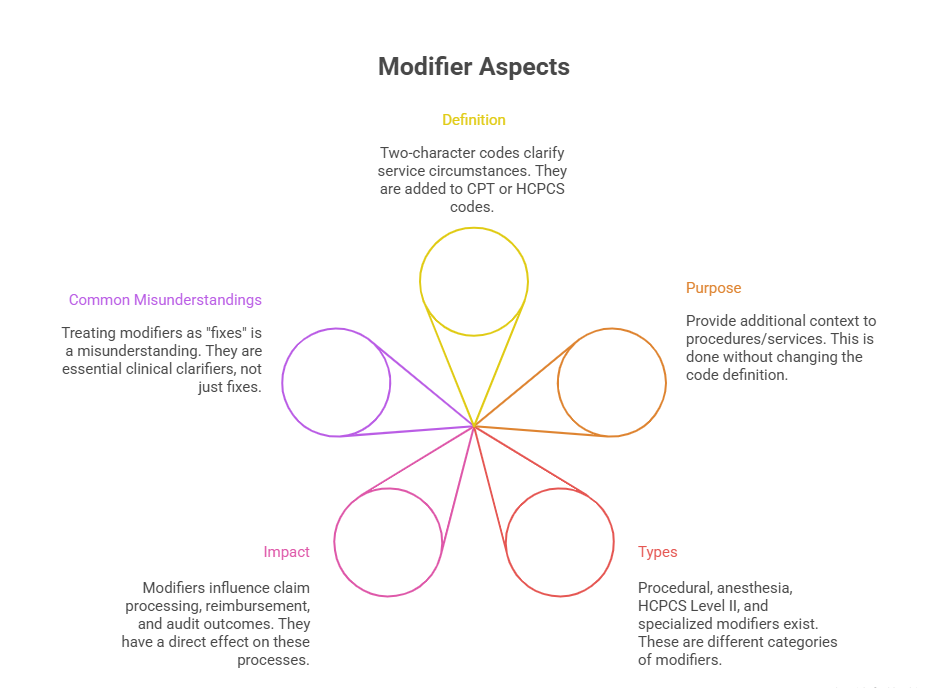

What Are CPT Modifiers and Why They Matter

CPT modifiers are two-character codes—numeric or alphanumeric—that provide additional context to a primary procedure or service code. They clarify the specifics of a service, such as whether it was altered, performed multiple times, or done by more than one provider. These distinctions are critical in helping payers determine appropriate reimbursement and ensure accurate claim adjudication.

Incorrect or omitted modifiers don’t just confuse the payer—they change the perceived intent of a service. A modifier tells the story of the encounter in more detail than the CPT code alone. For example, modifier 51 indicates multiple procedures during a single encounter, which affects how payers calculate payment. Without that detail, a payer might process only one code and deny the rest.

Modifier Types and Use-Cases

Modifiers are grouped based on what they describe:

Procedural Modifiers (CPT): Like modifier 59 for distinct procedural services or modifier 26 for professional component of a diagnostic service.

HCPCS Level II Modifiers: Often represent anatomical sites, e.g., modifier RT (right side) or service settings like modifier GY for non-covered services.

Anesthesia Modifiers: Such as modifier AA, indicating services performed personally by an anesthesiologist.

Each modifier communicates a specific clinical scenario, impacting not just whether a claim is accepted—but how much is paid.

Correct use is situation-specific:

Modifier 25 is only valid for significant, separately identifiable E/M services on the same day.

Modifier 59 must be used sparingly and only when no other modifier suffices to bypass National Correct Coding Initiative (NCCI) edits.

Modifier 76 applies to repeat procedures by the same provider, while modifier 77 applies if a different provider repeats it.

Using these appropriately requires deep familiarity with both payer rules and coding guidelines.

Common Pitfalls in Modifier Misuse

Modifier misuse is a leading cause of claim denials. Common mistakes include:

Overuse of modifier 59 to bypass edits without justification.

Inappropriate use of modifier 25 when documentation doesn’t support a distinct service.

Applying anatomical modifiers to bilateral procedures incorrectly (e.g., using RT/LT instead of modifier 50).

Some practices treat modifiers as universal fixes for denials, but this creates long-term compliance risks. Payers flag suspicious modifier patterns and initiate audits, especially when modifiers are consistently used to increase reimbursement without strong documentation.

Moreover, when modifiers are bundled incorrectly—such as combining modifier 26 with global codes without justification—the result can be downcoded claims, reimbursement delays, or full-out rejections. Practices must train coders not just on what modifiers mean, but on when they are truly applicable.

Modifiers That Impact Reimbursement

Not all modifiers affect payment directly—but several are tied explicitly to how much you’re paid. These modifiers instruct payers to evaluate a procedure differently, sometimes reimbursing more (or less) than the standard rate. Applied correctly, they ensure full compensation for services actually rendered. Applied incorrectly, they signal red flags that trigger downcoding, bundling, or audits. In a field where pennies per claim add up to thousands annually, mastering high-impact modifiers is a non-negotiable skill.

Modifier 25, 59, and 26 Explained

Modifier 25 is used when a significant, separately identifiable E/M service is provided by the same provider on the same day as another procedure. It’s often misused because many providers assume that any E/M visit with a procedure qualifies. But for modifier 25 to be valid, documentation must clearly show that the E/M service was above and beyond the standard pre- and post-procedure work.

Modifier 59 is a high-risk, high-reward modifier. It denotes distinct procedural services that would normally be bundled. It’s only appropriate when no other modifier (like XU or XE) can explain the situation. Overuse or improper use of modifier 59 is a leading trigger of audits by Medicare and commercial payers.

Modifier 26 splits a service between professional and technical components. For example, a radiologist reading an x-ray would bill with modifier 26 to indicate that they only performed the interpretation, not the technical aspect. Misapplying this modifier—like billing it with a service already split or global—leads to denials or duplicate payments, which often get clawed back during audits.

Correct use of these three modifiers can preserve thousands in reimbursement per provider annually, but only if documentation backs the claim.

Payer-Specific Considerations

Each payer interprets modifier rules slightly differently. For instance:

Medicare has strict National Correct Coding Initiative (NCCI) edits that govern when modifiers like 59 are accepted. The claim must meet exact conditions, or it will be denied—even if the modifier is technically correct.

Commercial payers like Aetna, UnitedHealthcare, and Cigna may have internal edits that differ from CMS, requiring coders to maintain separate modifier logic when dealing with non-Medicare plans.

Medicaid programs vary state to state. Some require additional documentation or prior authorization when using modifiers that affect payment.

Blue Cross Blue Shield plans often apply stricter scrutiny to modifiers like 25 and 59 and may request medical records even for routine services.

Understanding these payer nuances is essential to avoid automatic denials or payment reductions. Coders must track modifier denial trends by payer and adjust their workflows accordingly—especially when submitting claims with modifiers that historically result in high scrutiny or documentation requests.

| Modifier | Function | Reimbursement Impact |

|---|---|---|

| Modifier 25 | Significant, separately identifiable E/M service | Enables payment for E/M in addition to same-day procedure |

| Modifier 59 | Distinct procedural service to bypass bundling edits | Unlocks payment for procedures normally bundled |

| Modifier 26 | Professional component of technical services | Allows separate billing of interpretation services |

| Modifier 22 | Increased procedural service complexity | May increase reimbursement with strong documentation |

| Modifier 76 | Repeat procedure by same provider | Allows billing for repeated procedures on the same day |

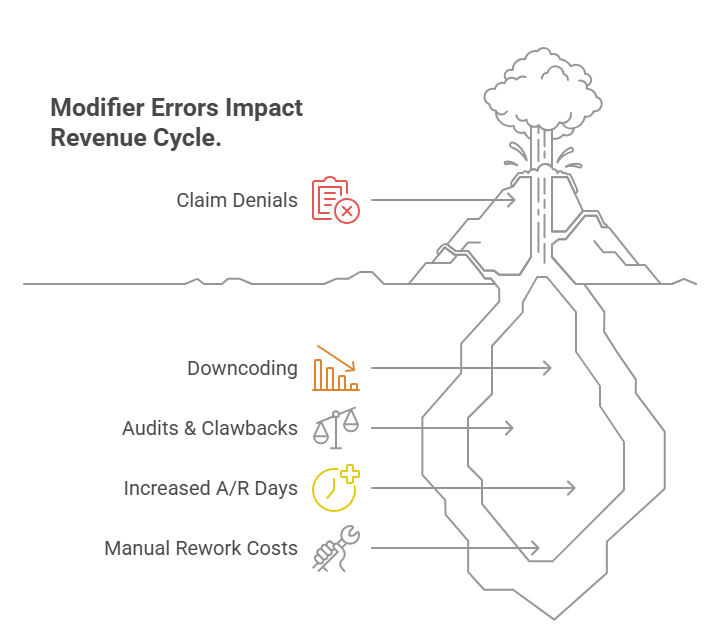

Revenue Loss from Incorrect Modifier Usage

Modifier misuse isn’t just a compliance issue—it’s a financial liability. Incorrect or inconsistent application of modifiers can lead to claim denials, reimbursement downgrades, and long delays in cash flow. The true cost, however, goes beyond a single rejected claim. It affects payer trust, triggers post-payment audits, and requires manual rework that drains billing team resources. Worse, repeated errors can lead to systemic revenue leakage that costs practices thousands every quarter.

Denials, Downcoding, and Audits

Every modifier signals a specific exception or condition in care delivery. If that exception isn’t properly documented, the modifier becomes a liability. A few high-impact examples:

Modifier 25 denials often result from vague or templated E/M notes that don’t establish medical necessity.

Modifier 59 rejections spike when distinct services are performed in the same anatomical area or lack time separation, yet documentation fails to justify unbundling.

Modifier 26 audits emerge when providers bill for the professional component without proof of access to the technical part.

These denials are not minor—they often block $100–$300 per claim, with recoupment risk if already paid. Repeated misuse invites payer audits that can result in clawbacks across dozens of claims, sometimes stretching back months or years.

Even more damaging is downcoding—when a claim isn’t denied outright but is paid at a reduced level. For example, a complex visit coded with modifier 25 might be reimbursed as a basic encounter if the documentation doesn’t clearly separate the E/M work from the procedure. This quiet underpayment leads to invisible revenue loss that accumulates rapidly.

Cost to Practice Revenue Cycle

Incorrect modifier usage triggers operational strain. Each denial creates a manual follow-up task, requiring coders to review documentation, correct the claim, and resubmit. This increases the average cost per claim and reduces staff productivity.

A single modifier denial can cost $15–$25 in rework labor.

Widespread modifier issues inflate your Days in Accounts Receivable (DAR) by up to 20%.

Rejected claims tied to modifiers have lower success rates on appeal, with many payers requiring full chart notes or peer review.

When modifiers are treated as shortcuts rather than clinical tools, practices incur hidden operational costs, lost time, and disrupted revenue cycles—all of which can be avoided with proactive training and audit prevention.

Best Practices for Documentation and Modifier Use

Accurate modifier application is only possible when it’s supported by airtight documentation. Most modifier-related denials are not caused by incorrect coding—but by insufficient, vague, or copy-pasted notes that fail to justify the modifier’s necessity. Effective modifier use requires aligning clinical documentation, CPT code selection, and payer rules in a way that tells a coherent, defensible story. This is where most revenue cycle breakdowns begin—and where the biggest improvements can be made.

Linking ICD and CPT Codes Correctly

Modifiers don’t stand alone. They depend on ICD and CPT code alignment to validate why the modifier is being used. For example:

A procedure billed with modifier 25 must be linked to an E/M code that includes symptoms, assessments, and decisions unrelated to the procedure performed.

Modifier 59 requires a completely separate ICD code if it’s used to unbundle services typically grouped under NCCI edits.

If modifier 22 is used to denote increased procedural complexity, the diagnosis must explain why—such as comorbidities, abnormal anatomy, or complications.

Coders must avoid lazy linking (e.g., copying the same ICD code to multiple CPT lines) because this raises red flags during payer review. Linking should reflect the medical necessity behind each individual service. Smart linking also increases the strength of appeals in case of a denial, providing a clear line of reasoning between diagnosis and procedure.

Strong linkage is best achieved through coded documentation templates within the EHR, which guide providers to complete medically necessary justifications tied to each CPT code.

EMR Integration and Automation Tips

Electronic Medical Records (EMRs) are often underutilized when it comes to improving modifier accuracy. With the right configuration, EMRs can prevent errors before claims are even submitted:

Set up rule-based alerts that flag missing modifiers when certain CPT/ICD combinations are entered.

Use picklists that limit modifier choices based on the provider’s specialty and service type to avoid invalid pairings.

Automate modifier linkage prompts that request justification or documentation snippets before finalizing notes for high-risk modifiers like 59 or 25.

Integrate real-time NCCI edit checkers that guide coders on when a modifier is allowed—and when it’s not.

In addition, EMRs can store payer-specific modifier rules using smart logic. For example, UnitedHealthcare may allow modifier 59 for a service combo that Medicare doesn’t. Coders can assign payer profiles that adapt modifier behavior based on the claim’s destination.

Lastly, dashboards and analytics within modern EMR systems can track modifier usage trends, flag outliers, and identify coders or providers whose documentation consistently results in denials. These insights are gold when preparing for internal audits or improving claim success rates.

When EMRs, ICD/CPT linkage, and coder judgment are aligned, modifier use becomes a profit lever, not a liability. The key is systematizing documentation logic in a way that naturally supports clean, justifiable modifier applications.

| Practice | Description | Benefit |

|---|---|---|

| Accurate ICD-CPT Linking | Align diagnosis codes with procedures supporting modifier use | Improves claim acceptance and audit defense |

| Detailed Provider Notes | Clear, specific documentation supporting modifier justification | Reduces denials and strengthens appeals |

| EMR Automation Tools | Alerts and prompts to flag missing or inappropriate modifiers | Prevents errors before claim submission |

| Payer-Specific Rules | Tailoring modifier use according to individual payer requirements | Minimizes denials and speeds up payment |

| Regular Documentation Training | Ongoing education for providers and coders on modifier application | Sustains compliance and modifier accuracy |

Staff Training and Compliance Importance

Even with the best systems in place, modifier accuracy depends on human judgment. From front-desk intake to coders and billing specialists, everyone in the revenue cycle must understand the impact of modifiers—not just their definitions. A single wrong modifier or a missed one can erode compliance, delay payments, and draw audit scrutiny. That’s why continuous staff training is essential for any practice aiming to scale revenue ethically and efficiently.

Building Modifier Literacy Across Teams

Modifier literacy must extend beyond coders. Providers, front office staff, and even clinical assistants influence documentation that supports modifier use. Training shouldn’t be a one-time event—it should be:

Scenario-based: Real case studies showing what justified vs. unjustified use looks like.

Payer-specific: Updates on commercial and Medicare rules that affect modifier acceptance.

Specialty-driven: Modifier use varies drastically between surgical, diagnostic, and therapy fields.

Coders should be trained to question vague notes. Providers must learn how to document for modifier justification, not just for clinical care. Billing staff should know how to spot red flags before submission.

When each team member understands how their role supports modifier integrity, practices experience fewer denials, faster payments, and cleaner audit trails.

Internal Audit Prep

Routine internal audits are the most effective way to identify modifier misuse before external payers do. These audits should review a mix of claims:

High-dollar services with modifiers like 22 or 59

E/M visits with modifier 25

Imaging or diagnostics split with modifier 26 or TC

Key areas to assess include:

Does the documentation support the modifier?

Are diagnosis codes aligned?

Are modifiers used consistently across similar encounters?

Audits not only catch errors—they reveal training gaps and system weaknesses that can be corrected before payers take notice. The goal is to build a defensible, compliant revenue cycle, not react to post-payment audits or clawbacks.

| Training Focus Area | Details | Outcome |

|---|---|---|

| Modifier Literacy for Coders | Understanding when and how to apply each modifier | Fewer coding errors and denials |

| Provider Documentation Skills | Teaching providers to document for modifier justification | Stronger clinical notes supporting modifier use |

| Payer Policy Updates | Regular updates on changing payer rules and coding guidelines | Up-to-date compliance and claim success |

| Internal Audits | Routine review of modifier use and documentation | Early identification of errors and targeted corrective action |

| Cross-Functional Training | Educating billing, coding, and clinical teams together | Enhanced collaboration and streamlined revenue cycle |

Upskill with AMBCI's Coding Certification

Revenue integrity begins with knowledgeable, certified coders who understand more than just code sets—they understand payer behavior, compliance risk, and the financial impact of every modifier used. That’s exactly what the CPC + CPB Medical Billing and Coding Certification from AMBCI delivers. This dual certification equips professionals with advanced-level training in both coding accuracy and full-spectrum billing strategy—making graduates the most valuable asset to any healthcare revenue cycle.

Course Details and Career Outcomes

The CPC + CPB Certification is designed to go far beyond textbook theory. It covers:

Advanced instruction in CPT, HCPCS, and ICD-10 coding, including real-world use of modifiers 25, 59, 26, 22, 76, and more

Training on how to spot and correct modifier misuse before claims go out

Deep dives into payer-specific coding strategies and how to prevent denials

Workflow modules for documentation alignment, EMR utilization, and denial management

Graduates are trained not just to code—but to think like revenue strategists. That’s why CPC + CPB dual holders often rise quickly to senior coding, auditing, or billing leadership roles. Employers recognize that this training produces professionals who reduce modifier denials, improve compliance, and maximize claim acceptance rates.

Whether you’re starting out or upskilling mid-career, this certification aligns perfectly with roles such as:

Medical Coder (Inpatient/Outpatient)

Coding Auditor or Compliance Analyst

Billing and Claims Specialist

Revenue Cycle Manager

Certified professionals report earning 15–25% higher than non-certified peers, thanks to their ability to handle modifier-heavy claims and reduce rework costs.

Explore the Certification Program and Register Now

If you’re ready to eliminate modifier guesswork, avoid costly errors, and become a revenue-driving expert—AMBCI’s CPC + CPB Medical Billing and Coding Certification is your next step.

Visit our course page to explore:

The full 200+ module curriculum with modifier-specific training

Self-paced format with lifetime access and regular updates

Practice exams and real-world coding scenarios

One-on-one instructor support to master real modifier challenges

Whether you’re aiming for modifier 59 mastery, learning how to defend modifier 25 in audits, or building bulletproof ICD-to-CPT linkage—this course is built to make you the coder every billing department wants.

Explore the Certification and Enroll Now →

With healthcare coding complexity growing every year, the future belongs to professionals who understand how accuracy drives revenue. If that’s your goal, AMBCI’s dual certification gives you the tools, credentials, and confidence to lead from day one.

Frequently Asked Questions

-

CPT modifiers provide additional information about a service or procedure without changing its definition. They clarify that a service was altered, performed multiple times, done by multiple providers, or involved distinct circumstances affecting reimbursement. Using modifiers accurately helps payers understand the exact clinical scenario, ensuring claims are processed correctly and paid fairly. Without modifiers, payers may deny or downcode claims due to ambiguity or bundling rules.

-

Modifier 25 indicates a significant, separately identifiable evaluation and management (E/M) service performed on the same day as another procedure or service. It requires documentation showing the E/M was above and beyond routine pre- or post-procedure work. Modifier 59, on the other hand, denotes distinct procedural services that are normally bundled but are separate based on anatomy, session, or circumstance. While both modifiers are used to unbundle services, modifier 25 applies only to E/M services, and modifier 59 applies to procedural services.

-

Overusing modifier 59 is a common cause of claim denials and audits. Medicare and many commercial payers scrutinize its use closely because it bypasses National Correct Coding Initiative (NCCI) edits designed to prevent improper unbundling. Improper use can lead to payers rejecting claims or conducting costly audits that result in recoupment of payments and penalties. Best practice is to use modifier 59 only when no other specific modifier applies and documentation clearly supports a distinct service.

-

No. Modifier 26 is specifically used to indicate the professional component of a service, such as the interpretation and report of a diagnostic test. The technical component, which covers equipment, supplies, and technician work, is designated by modifier TC. Billing both components separately requires clear documentation and usually applies when the professional and technical parts are performed by different providers or entities.

-

Different payers have varying rules and edits regarding modifier application. Medicare follows strict NCCI edits, while commercial insurers may have customized policies or additional modifier restrictions. Medicaid programs also differ by state. Coders must stay current with payer policies and adjust claims accordingly, sometimes submitting different modifiers or documentation depending on the payer. Failure to comply with payer-specific requirements often results in denials or delayed payments.

-

To justify modifier 25, documentation must clearly show that the E/M service was significant and separately identifiable from the procedure performed on the same day. This includes detailed history, examination, and medical decision-making beyond the usual pre-procedure work. Vague or copied notes do not suffice. Providers should explicitly state the reason for the E/M service and how it differs from routine care tied to the procedure.

-

Modern EMR systems can help prevent modifier errors through built-in alerts, prompts, and automated logic. They can flag when a modifier is missing, suggest appropriate modifiers based on the procedure and diagnosis codes entered, and restrict modifier choices to valid options. Some systems incorporate real-time NCCI edit checks and payer-specific rules, reducing denials by catching issues before claims are submitted. Analytics dashboards also help identify patterns of modifier misuse for targeted training.

Summing Up: Modifier Mastery

Mastering CPT and HCPCS modifiers is essential for maximizing revenue and maintaining compliance in today’s complex billing environment. Accurate modifier application unlocks full reimbursement potential, minimizes denials, and protects your practice from costly audits. By linking modifiers clearly to documentation, understanding payer-specific rules, and investing in continuous staff training, healthcare organizations build a resilient revenue cycle.

AMBCI’s CPC + CPB Medical Billing and Coding Certification equips professionals with the expertise to apply modifiers confidently and correctly—turning a technical detail into a strategic advantage. With modifier mastery, your practice not only safeguards income but also improves operational efficiency, paving the way for sustained financial health.

| Poll: Which modifier do you find most challenging to apply? |

|---|