Comprehensive Guide to CMS Compliance for Medical Coders

Compliance with the Centers for Medicare & Medicaid Services (CMS) isn't just a regulatory requirement—it's the foundation of ethical, audit-proof coding. For medical coders, CMS guidelines serve as the benchmark for acceptable coding practices, billing integrity, and documentation quality. With policies shifting rapidly and enforcement mechanisms becoming more aggressive, coders who fall short risk triggering audits, claim denials, and severe penalties. This guide unpacks the full scope of CMS compliance, showing coders not only what to follow—but why each detail matters.

Most compliance issues stem not from malicious intent but from gaps in understanding complex CMS directives. Many coders struggle with local vs. national coverage determinations, real-time updates to billing guidance, or the fine line between upcoding and accurate service representation. By mastering CMS compliance inside and out, coders can reduce financial risk, improve reimbursement accuracy, and position themselves as indispensable assets to any healthcare team. Through this guide—and AMBCI’s Medical Billing and Coding Certification—you’ll get clarity, precision, and tactical insight into staying compliant in 2025 and beyond.

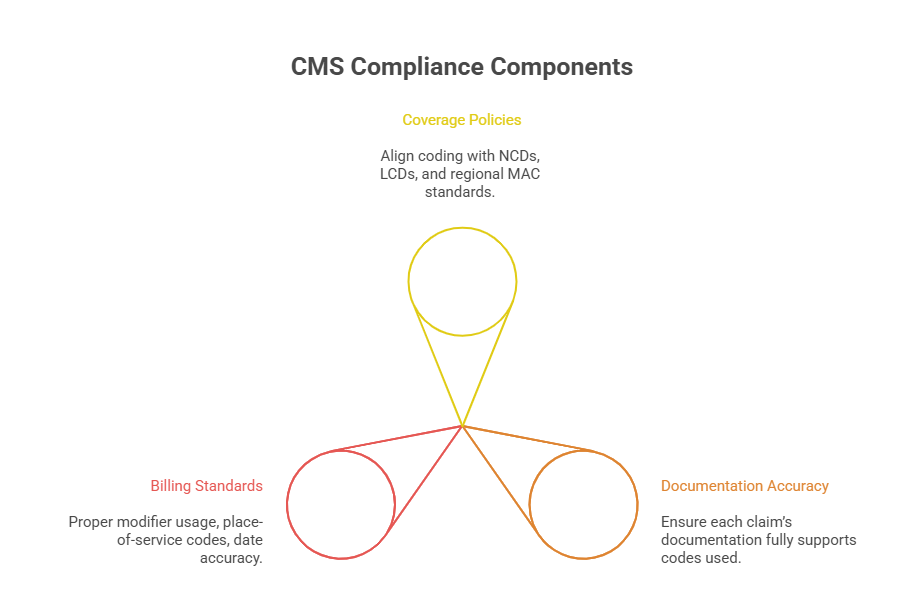

What CMS Compliance Encompasses

CMS compliance refers to the coder’s ability to accurately apply medical codes, submit claims, and document services in full alignment with federal billing regulations and reimbursement policies. This isn’t a static skill—it demands constant adaptation to rule changes, new value-based care initiatives, and evolving audit triggers. Coders must navigate a system where clinical accuracy, administrative precision, and policy fluency intersect. Missing a coverage condition, misapplying a code, or incorrectly interpreting an NCD can open the door to rejected claims or civil monetary penalties.

Understanding CMS compliance begins with identifying how coverage decisions influence coding behavior. Every code submitted must reflect a medically necessary service supported by policy-specific documentation. CMS uses national and local determinations to define this necessity. Failing to align with them means services may be flagged as not reimbursable—even if they were clinically justified. For coders, this means compliance isn’t just about avoiding mistakes; it’s about proactively ensuring alignment between services, documentation, and federal expectations.

Let’s break down the two core pillars of CMS compliance coders deal with daily: coverage policies and documentation standards.

NCDs, LCDs, and Coverage Policies

National Coverage Determinations (NCDs) and Local Coverage Determinations (LCDs) are the backbone of CMS reimbursement policy. An NCD outlines whether Medicare will pay for a specific service nationwide, while LCDs are developed by regional Medicare Administrative Contractors (MACs) and apply to certain jurisdictions. These policies tell coders when a service is reimbursable, under what circumstances, and what documentation is required to prove necessity.

For example, if a coder assigns a CPT code for a diagnostic test, CMS will check if the test aligns with the patient’s ICD-10 diagnosis code and the related NCD or LCD. If the diagnosis isn’t listed as covered for that test, the claim may be denied—even if the test was medically sound. Many denials result from this misalignment between diagnosis and coverage policy, not because the coding was technically incorrect.

Coverage policies also require coders to stay updated on policy revisions, retirements, or regional changes, especially since LCDs can vary between states. Using outdated coverage guidance, or ignoring jurisdiction-specific policies, could result in payment delays or flagged claims. Coders must regularly cross-reference their codes with both NCDs and relevant LCDs—and ensure physicians provide documentation that supports the coverage criteria outlined in those determinations.

Billing Standards and Documentation

Beyond coverage, CMS sets detailed billing standards that determine how services must be reported. This includes modifier usage, place-of-service codes, and date-of-service accuracy. Misreporting even one of these elements can result in overpayment recoupments or fraud investigations. CMS expects coders to apply edits like Correct Coding Initiative (CCI) rules and recognize when two services are bundled or billable separately.

Documentation, meanwhile, serves as the coder’s defense mechanism. It must clearly support the level of service billed, demonstrate medical necessity, and match all CPT/HCPCS and ICD-10-CM codes used. If a note lacks detail or contains conflicting information, CMS will consider the claim unsupported—regardless of whether the coding was technically correct.

Coders should ensure that documentation includes precise time notations (for time-based codes), clear signatures, and specificity in history, exam, and medical decision-making. EMR templates should never be overused to the point where they generate identical notes across patients, which CMS views as cloning and a red flag for fraud. In essence, documentation isn’t just a formality—it’s the legal justification for reimbursement and must be bulletproof against audit scrutiny.

Coding Accuracy and CMS Audits

The CMS audit ecosystem is engineered to detect patterns, outliers, and anomalies in billing behavior. Coders serve as the first line of defense against audit exposure, yet coding errors—whether from oversight or systemic issues—are one of the top triggers for federal investigation. CMS deploys algorithms, data analytics, and contractor-driven reviews (like RACs, UPICs, and MAC audits) to catch improper payments, unbundled codes, upcoding, and unsupported services. Accurate coding, then, isn’t a suggestion—it’s the foundation of compliance accountability.

Many coders assume that so long as the CPT and ICD-10 codes are technically valid, they're compliant. But CMS looks deeper: Was the code appropriate for the diagnosis? Did the provider’s documentation justify the service level? Was the modifier used accurately? Errors in these areas are seen not just as mistakes—but as potential indicators of fraud or abuse. And once flagged, coders and providers are held accountable for every detail.

Let’s explore how these coding missteps lead directly to audits and what the financial and legal consequences can look like.

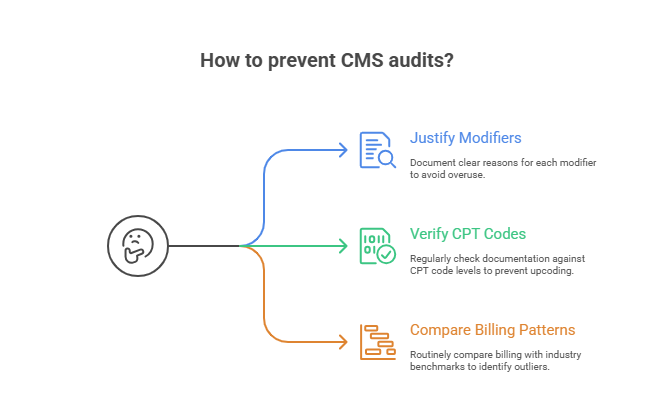

How Errors Trigger Audits

Audits are rarely random. Most are triggered by patterns that raise red flags in CMS databases or third-party contractor reports. Examples include consistently high E/M levels, billing services outside scope-of-practice for a specialty, or using modifiers like -25 or -59 too frequently. These patterns suggest overutilization, upcoding, or circumvention of bundling rules—all audit targets.

Small errors repeated over time are more dangerous than one-off mistakes. A coder who misapplies certain ICD-10 codes to meet coverage policy, even unintentionally, could flag a practice for statistical outlier reviews. The same applies to poor use of modifiers: using -59 to bypass edit pairs without documentation support almost guarantees an audit.

Coders must also understand how CMS data-mining tools analyze peer comparisons, geographic trends, and temporal anomalies. If a provider’s services stand out from national or regional norms, even if the codes are accurate, that anomaly can prompt a focused probe. CMS isn’t just checking individual claims—they’re scanning for long-term deviation from expected behavior, and that makes consistent coding integrity critical.

Financial and Legal Implications

The consequences of failing a CMS audit can be severe. First, there’s recoupment—CMS demands repayment for every overpaid claim, often going back several years. For high-volume providers, this can total tens or hundreds of thousands of dollars. If the audit uncovers systemic issues, CMS may expand to a full-scope audit, placing all claims under review and freezing reimbursements.

Beyond repayment, coders and providers may face civil monetary penalties under the False Claims Act, even for negligent errors. Submitting unsupported or misleading codes can be interpreted as billing fraud—even if the coder believed the documentation was sufficient. This can lead to legal liability, loss of billing privileges, and placement on the CMS exclusion list, which blocks participation in Medicare and Medicaid entirely.

For coders employed by providers, poor audit outcomes often result in termination, personal liability (in rare cases), or future employability issues. The coding profession demands a meticulous mindset—because every claim filed under your name could later appear in a CMS audit request. Precision isn’t just about correctness—it’s your legal shield.

Real CMS Compliance Violations and Lessons

Understanding CMS rules isn’t enough—coders must internalize how violations play out in real-world audits. Case-based learning reveals exactly how coding missteps escalate into penalties, investigations, and sometimes criminal charges. From upcoding errors to documentation deficiencies, CMS violations leave clear trails—and every certified coder is expected to know how to spot and prevent them.

While many violations stem from lack of training or workflow flaws, CMS does not differentiate between intentional fraud and negligent noncompliance in initial enforcement. That’s why it's essential for coders to proactively build internal safeguards and learn from high-profile examples. Below are two critical perspectives: what the most common violations are—and how they could’ve been avoided.

Top Violations and Penalties

One of the most cited violations is billing services without adequate documentation. A coder may correctly apply a CPT code, but if the provider’s note lacks detail—such as time spent, exam findings, or clinical justification—CMS will deny the claim. Repeat offenses trigger overpayment recovery audits, and if they show a pattern, providers may face civil penalties or exclusion from Medicare.

Another frequent issue is improper use of modifiers—especially -25 (separate E/M service) and -59 (distinct procedural service). Coders often apply them by habit rather than based on supporting notes. In one real case, a multispecialty clinic was fined over $500,000 for overuse of -59 without documentation, flagged during a MAC prepayment review.

Also, upcoding Evaluation and Management (E/M) services remains a major violation. A provider may routinely bill level 4 or 5 visits, but unless notes reflect that complexity, CMS may see this as deliberate inflation. These claims are often audited through comparative analysis tools that flag outlier patterns and trigger extrapolated overpayment estimates—adding up to millions in clawbacks.

What Could Have Prevented Them

Every violation above could have been prevented with routine internal chart audits, policy-driven coder education, and tighter coder-provider collaboration. Coders must insist that every claim be backed by clear, specific documentation—not just to justify the service but to defend it in an audit. Establishing a culture of proactive compliance is key.

For modifier misuse, coders should never apply edits without a policy reference or documentation quote justifying the decision. Using tools like CMS’s NCCI edits checker and payer-specific policies reduces guesswork. Upcoding prevention begins with coding-to-documentation reconciliation—a step-by-step review ensuring that the visit level, complexity, and time align with CMS’s E/M guidelines.

Coders must also engage in ongoing training tied to real violations—learning from past mistakes across the industry. CMS publishes audit findings and compliance reports that are valuable for pinpointing trends. These aren’t just cautionary tales—they’re roadmaps to airtight compliance.

| Common Violation | Preventative Measure |

|---|---|

| Documentation Deficiencies | Ensure every claim is supported by detailed provider notes. Implement internal chart audits to catch missing time notations, vague exam findings, or incomplete histories before submission. |

| Modifier Misuse | Coders should reference CMS NCCI edit tools and only apply modifiers when documentation explicitly supports separate services or distinct procedures. Avoid defaulting to -25 or -59 without justification. |

| Evaluation & Management (E/M) Upcoding | Match the level of E/M service to actual documentation. Use decision trees, time logs, and provider prompts to avoid inflating visit levels. Conduct monthly E/M reconciliation reviews across providers. |

| Misaligned Diagnosis & Procedure Codes | Cross-check ICD-10 codes with LCD/NCD guidance to ensure diagnoses justify the procedures billed. Use coding software alerts and MAC lookup tools to verify coverage compatibility. |

| Unbundling of Procedures | Follow CCI bundling rules rigorously. Coders must review code pair edits and understand when services should be reported as a single comprehensive procedure, rather than fragmented separately. |

Tools and Policies Coders Must Know

Coders cannot meet CMS compliance standards without a working knowledge of the tools and systems that govern provider enrollment, claims routing, and value-based payment models. Mastering coding alone isn’t enough—today’s coding professionals must understand how CMS frameworks interact with their daily workflow. Systems like PECOS, MACs, and QPP don’t just sit in the background; they shape how services are billed, reimbursed, and audited.

Equally important is staying current. CMS policy updates are issued weekly. These can affect modifier guidance, diagnosis code pairing, CCI edits, or coverage decisions. Coders need trusted sources for real-time updates, not outdated PDFs or static training binders. Whether it’s through official CMS feeds or private compliance trackers, up-to-date visibility is the only way to avoid outdated claims and costly rework.

Let’s break this down further into the two core areas every coder must master.

PECOS, MACs, and QPP

PECOS (Provider Enrollment, Chain, and Ownership System) isn’t directly a coding platform—but it controls whether a provider can legally submit claims to Medicare. Coders working with non-enrolled or incorrectly enrolled providers will see denials for every service submitted. PECOS also tracks reassignments, group affiliations, and provider taxonomy, all of which impact specialty billing rules and claim edits.

MACs (Medicare Administrative Contractors) are regional payers contracted by CMS. Each MAC publishes jurisdiction-specific coverage policies (LCDs), claim submission rules, and audit instructions. Coders must know which MAC governs their state or facility and bookmark its policy page for weekly updates. Using the wrong MAC guidelines—even with correct coding—can result in rejections or post-payment audits.

Then there’s QPP (Quality Payment Program). This system determines whether a provider is reimbursed under MIPS (Merit-based Incentive Payment System) or Advanced APMs. Coders play a key role in ensuring that services are billed in ways that support quality reporting and avoid penalties. QPP reporting includes CPT II codes and quality data elements, which must be submitted accurately for proper performance scoring and reimbursement adjustment.

A coder who doesn’t grasp these frameworks is working blind—every claim they file must move through these systems, and any mismatch can delay, deny, or flag it.

Resources for Real-Time Updates

CMS doesn’t wait for the end of the year to release updates. Coders must monitor weekly transmittals, quarterly NCCI edits, and monthly policy changes to stay compliant. The best way to do this is through layered monitoring—combine direct CMS subscriptions with alerts from MACs and tools like AAPC Codify or specialty-specific coding newsletters.

CMS’s official email updates can be segmented by topic—E/M services, DME coding, ICD-10 updates—so coders aren’t overloaded with irrelevant data. MAC websites often include alert systems and policy comparison tools that flag what's changed since the last update. These are essential for practices operating across multiple states, where LCDs differ jurisdictionally.

Coders should also establish a weekly compliance checkpoint: time set aside to review CMS transmittals, OIG reports, and industry alerts. Using centralized tools like CMS MLN (Medicare Learning Network) or AAPC’s compliance briefings gives coders curated, relevant data without hunting across multiple platforms.

In a fast-moving policy landscape, real-time awareness is the most critical compliance tool coders can possess. Without it, even skilled coders can become noncompliant by using rules that expired weeks ago.

| Tool / Policy | Role in CMS Compliance |

|---|---|

| PECOS (Provider Enrollment, Chain, and Ownership System) | Ensures providers are properly enrolled with Medicare. Coders must verify that claims are only submitted under active PECOS-enrolled providers to avoid denials and audit flags. |

| MACs (Medicare Administrative Contractors) | MACs publish jurisdiction-specific Local Coverage Determinations (LCDs) and billing guidance. Coders must follow their region's MAC rules for code usage, documentation requirements, and coverage conditions. |

| QPP (Quality Payment Program) | Impacts provider reimbursement based on quality performance. Coders are responsible for submitting accurate CPT II codes and other QPP-related data that contribute to MIPS scoring or APM reporting. |

| NCCI Edits (National Correct Coding Initiative) | Prevents unbundling of procedures that should be reported together. Coders must apply CCI edits to ensure proper modifier use and avoid overbilling for related services. |

| CMS Transmittals and MLN Updates | Deliver weekly policy changes, documentation rules, and compliance alerts. Coders must monitor these updates to maintain real-time alignment with CMS requirements and avoid using outdated rules. |

Internal Checks to Stay CMS Compliant

Compliance is proactive, not reactive—coders must build internal checkpoints into their daily workflow to reduce CMS audit risk. While external audits are valuable, internal monitoring prevents errors from reaching claims submission, saving time, money, and protecting reputation. Robust internal compliance isn’t optional; it’s mandatory for sustainable billing practices.

Two key internal strategies include structured chart audits and double reviews and targeted coding team training protocols. Both create a self-correcting culture where mistakes are caught early and corrected promptly, rather than flagged externally by CMS or payers.

Chart Audits and Double Reviews

Internal chart audits should happen regularly—not just annually. Practices must implement monthly random claim reviews by experienced coding auditors. These audits confirm alignment between provider documentation, medical necessity, and code selection, immediately identifying discrepancies before CMS can flag them. Auditors focus on high-risk services like modifiers, E/M upcoding, and procedural bundling, documenting common errors for targeted retraining.

Additionally, implementing double reviews—where another coder independently verifies complex or high-dollar claims—can drastically reduce errors. A second set of eyes catches overlooked details and enforces accountability. This systematic internal control doesn’t just ensure compliance—it builds consistency in coding practices across the team.

Coding Team Training Protocols

Effective training is more than annual updates. Coders need structured, monthly education sessions based on internal audit findings and CMS updates. Each session should focus on real-world scenarios: common mistakes, recent policy changes, or CMS audit case studies.

Training protocols should mandate attendance, include competency assessments, and provide immediate feedback. Incorporating platforms like AMBCI’s Medical Billing and Coding Certification ensures continuous alignment with CMS compliance requirements. Ongoing education turns coders into proactive compliance experts who confidently navigate policy shifts rather than merely react to them.

Why AMBCI’s Training is CMS-Focused

CMS compliance isn’t just part of AMBCI’s curriculum—it’s the very foundation. AMBCI’s Medical Billing and Coding Certification places an unparalleled emphasis on understanding, internalizing, and applying CMS guidelines because the program recognizes that coding mastery is meaningless if it’s not audit-proof. AMBCI training proactively addresses evolving CMS frameworks, integrating compliance deep into its certification modules. Coders who complete the program don’t merely memorize codes—they gain a strategic, compliance-focused mindset enabling them to protect healthcare practices from audits, penalties, and reimbursement losses.

Beyond coding basics, AMBCI emphasizes scenario-based learning, exposing coders to realistic compliance challenges, CMS policy updates, and documentation standards. This methodology ensures coders don’t just learn rules—they master how to apply them practically under real-world pressures. Moreover, AMBCI’s training is designed with constant updates, incorporating monthly CMS transmittals, regulatory revisions, and industry trends directly into the course materials. The goal isn’t just short-term certification—it’s lifelong compliance competence.

To understand precisely how AMBCI achieves this, let’s examine its curriculum and direct training outcomes.

Up-to-date Modules and Compliance Training

AMBCI continuously revises its training modules, aligning them directly with CMS publications and policy shifts. Unlike outdated training courses relying on static materials, AMBCI uses dynamic, continuously refreshed online modules that reflect current CMS directives, LCD/NCD changes, and updates to QPP or MAC guidelines.

This real-time focus includes:

Immediate integration of CMS quarterly updates, including NCCI edits, ICD-10-CM revisions, and E/M documentation guidelines.

Interactive coding scenarios modeled after recent CMS audit cases, letting coders practice identifying and correcting common compliance pitfalls before claims reach submission.

Direct inclusion of CMS tools training—PECOS navigation, MAC-specific billing instructions, and compliance resources from CMS’s Medicare Learning Network (MLN).

AMBCI’s structured approach doesn’t just teach coders how to avoid audits—it demonstrates exactly how to confidently pass audits if and when they occur. Coders emerge from the program ready to identify red flags, improve documentation quality, and educate providers on compliance risks, creating a proactive compliance culture from within.

Explore AMBCI’s CMS Compliance-Focused Certification

AMBCI ensures its certification outcomes align directly with measurable CMS compliance benchmarks. Graduates of AMBCI’s Medical Billing and Coding Certification not only achieve high first-attempt certification pass rates but consistently demonstrate lower claims-denial rates, fewer audit triggers, and higher overall documentation accuracy.

AMBCI tracks key compliance metrics from its certified coders, such as:

Reduction in claim denials related to NCD/LCD alignment and modifier misuse.

Improved accuracy in E/M coding, directly aligning levels of service billed with CMS-required documentation.

Enhanced coder confidence and competence measured by internal provider feedback, showing increased collaboration around compliance best practices.

By embedding a direct link to AMBCI’s Medical Billing and Coding Certification page, coders can explore real-world testimonials, CMS-compliance success stories, and detailed training module breakdowns. AMBCI’s transparency in outcomes proves that its graduates don’t just obtain a certificate—they acquire long-term compliance expertise critical for sustained professional growth and job security in a rapidly evolving healthcare landscape.

Frequently Asked Questions

-

CMS audits are typically triggered by unusual billing patterns, statistical outliers, or consistent coding errors. Examples include overusing high-level E/M codes, excessive or inappropriate modifier usage (like -25 or -59), billing procedures outside typical specialty scope, or consistent claims that lack supporting documentation. CMS uses sophisticated data analytics to benchmark providers against peers, spotting anomalies such as frequent unbundling or coding practices inconsistent with patient diagnoses. Providers flagged in these areas face increased scrutiny, often resulting in audits from RACs, MACs, or UPIC contractors. Maintaining strict documentation standards and performing routine internal audits can significantly minimize audit risk.

-

LCDs (Local Coverage Determinations) are policies published by regional Medicare Administrative Contractors (MACs). They outline coverage criteria, diagnosis-to-procedure links, documentation requirements, and clinical indications for reimbursing specific services in their jurisdiction. Unlike National Coverage Determinations (NCDs), LCDs differ between states or regions, and coders must reference them to ensure a service billed is considered medically necessary by CMS. If an LCD specifies that a particular CPT code is only covered with certain ICD-10 codes, coders must align claims accordingly. Ignoring LCDs results in claim denials, recoupments, or audits. Coders should regularly consult the MAC-specific websites for real-time LCD updates to maintain compliance.

-

Consequences range from claim denials and overpayment recoupment to severe penalties under the False Claims Act. Initially, CMS may demand repayment of incorrectly billed services through extrapolated audits—meaning a few errors can result in substantial recoupments over multiple years. Continued noncompliance or repeated errors elevate enforcement measures, potentially leading to civil monetary penalties, fines, loss of billing privileges, or even provider exclusion from Medicare and Medicaid participation. Coders found complicit in fraudulent coding practices, knowingly or unknowingly, may face termination and long-term reputational harm. Therefore, coding accuracy isn’t just best practice; it’s a necessary safeguard against significant financial and legal exposure.

-

Yes, internal audits significantly reduce the likelihood of external CMS audits by proactively identifying and correcting errors before claims submission. Conducting regular internal reviews—monthly random chart audits and double-review processes—creates a system that flags documentation gaps, incorrect code assignments, and policy violations early. Internal audits mirror CMS’s audit strategies, allowing coders to understand how claims appear to external reviewers. They also reinforce accountability and ensure that documentation consistently meets CMS standards. While no practice can fully eliminate audit risk, robust internal auditing dramatically reduces exposure, increases documentation accuracy, and positions practices favorably in case external audits occur.

-

Coders must regularly use authoritative CMS-related resources, including Medicare Learning Network (MLN) publications, weekly CMS transmittals, MAC-specific LCD/NCD updates, and official CMS policy alerts. Additionally, subscription-based tools like AAPC Codify or dedicated compliance trackers provide tailored alerts aligned specifically with a coder’s specialty or billing requirements. PECOS, CMS’s provider enrollment database, and QPP (Quality Payment Program) portals should be regularly accessed to confirm provider enrollment status and understand value-based billing criteria. Integrating these resources into weekly compliance checkpoints ensures coders remain current with shifting CMS policies, significantly lowering the chance of inadvertent noncompliance or claims errors.

-

PECOS (Provider Enrollment, Chain, and Ownership System) ensures that providers are properly enrolled with CMS to legally bill Medicare. Coders must verify their providers’ enrollment status through PECOS regularly. Claims from improperly enrolled or disenrolled providers are automatically denied. PECOS also tracks crucial provider information like taxonomy, affiliations, and group practice memberships, directly impacting which services providers can bill. Ensuring PECOS accuracy is vital to compliance, as outdated or incorrect enrollment data results in payment delays, denials, or audit triggers. Coders who routinely confirm PECOS accuracy ensure claims move seamlessly through CMS billing systems, supporting financial health and reducing audit risk.

-

AMBCI’s Medical Billing and Coding Certification focuses on CMS compliance because billing accuracy is inseparable from regulatory adherence. AMBCI recognizes that coding expertise is inadequate without thorough knowledge of federal billing rules, audit guidelines, and documentation requirements. Its curriculum constantly integrates CMS policy updates, real-world coding scenarios, and audit case studies, teaching coders how to proactively prevent compliance issues rather than reactively respond. AMBCI-certified coders emerge fully prepared to handle compliance challenges, avoid costly claim denials, and mitigate audit risks, making them highly valuable to employers. This compliance-focused training distinguishes AMBCI coders, significantly enhancing their job readiness and career prospects.

The Takeaway

CMS compliance isn’t an afterthought—it’s the core of medical coding accuracy and career stability. Coders who master CMS rules, proactively track changes, and apply internal controls significantly reduce risk, maximize reimbursements, and enhance their professional value. Compliance proficiency means coders aren't merely technicians; they're strategic healthcare professionals safeguarding practices against audits, denials, and severe penalties.

Choosing a certification program that embeds CMS compliance, like AMBCI’s Medical Billing and Coding Certification, ensures coders remain current and highly effective in real-world scenarios. Through dynamic, constantly updated modules, AMBCI produces coders who confidently navigate audits, align coding practices with national and local policies, and minimize costly errors proactively.