Understanding Medical Coding Audits: Comprehensive Guide

Medical coding audits are no longer optional—they are a non-negotiable pillar of compliance and revenue integrity for healthcare providers. With constant ICD, CPT, and HCPCS code updates, even seasoned coders can make errors that go unnoticed until payers launch investigations or deny reimbursements. Coding audits serve as the critical checkpoint to proactively catch these mistakes before they snowball into penalties, repayment demands, or compliance violations.

This guide breaks down everything: what medical coding audits involve, how they’re structured, what tools auditors use, and how you can train your staff to pass them with confidence. Whether you're a coder, biller, compliance officer, or healthcare administrator, mastering audits is key to long-term revenue success and regulatory resilience.

What Is a Medical Coding Audit and Why It’s Essential

A medical coding audit is a structured review of clinical documentation and corresponding medical codes to assess the accuracy, completeness, and compliance of a provider’s coding and billing process. It’s not just a “check-the-box” task—it’s a vital defense against payer audits, claim denials, and compliance investigations.

By comparing coded data (like ICD-10, CPT, HCPCS) to the provider’s documentation, an audit helps uncover billing inconsistencies, documentation flaws, or incorrect code usage. These audits are foundational to revenue cycle integrity because they allow healthcare practices to self-correct before government or commercial payers step in.

Medical coding audits are essential because they:

Prevent revenue leakage from undercoding or incomplete documentation

Help avoid civil or criminal penalties for overbilling and fraud

Strengthen internal documentation workflows

Provide insights to improve coder training and physician education

Build confidence with payers by showcasing proactive compliance

Without regular audits, providers risk accumulating errors that may result in recoupment requests, pre-payment reviews, or even program exclusion—especially under programs like Medicare and Medicaid, where audits are increasing in frequency and scrutiny.

Audits can be proactive or reactive. Proactive audits help detect problems before claims go out the door. Reactive audits respond to trends like frequent denials, complaints, or payer inquiries. In both cases, the goal is to minimize risk and maximize accuracy across the board.

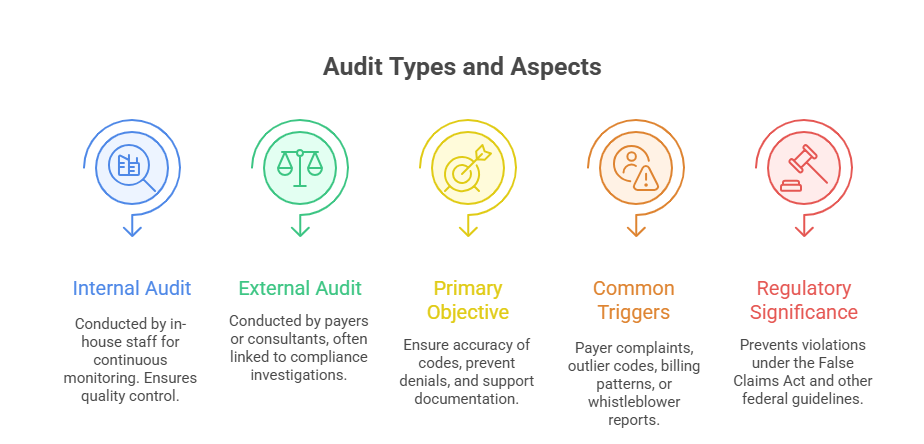

Internal vs External Audits

Internal audits are conducted by a provider’s in-house compliance or billing team. These audits are typically more frequent and targeted toward specific departments, payers, or procedures. Internal reviews help identify patterns of concern early and allow for education before claims are submitted.

External audits are initiated by third parties such as Medicare contractors, commercial payers, or external consulting firms. These are often unannounced, and the stakes are higher—because findings can lead to penalties, repayment demands, or formal investigations.

The best organizations implement both audit types—internal for continuous improvement and external for independent validation.

Compliance, Revenue Integrity & Risk Reduction

The stakes of coding accuracy are higher than ever. Inaccurate codes don’t just hurt reimbursement—they expose providers to legal risk under regulations like the False Claims Act. A single wrong modifier or misused diagnosis code can trigger massive repayment obligations or exclusion from payer networks.

Audits provide a firewall. They ensure that documentation supports the codes billed and that every claim stands up to external scrutiny. This is where the intersection of compliance, coding precision, and risk mitigation becomes critical.

Medical coding audits also reinforce revenue integrity. By ensuring that every billed service is properly supported, providers avoid both underbilling (lost revenue) and overbilling (regulatory exposure). In today’s aggressive audit landscape, this balance is not optional—it’s essential.

Key Phases of a Medical Coding Audit

A successful medical coding audit is never random—it’s an organized process that moves through deliberate phases, each with its own purpose and deliverables. These phases help ensure the review is thorough, actionable, and aligned with compliance goals.

Audits typically unfold in three core stages: pre-audit planning, active audit execution, and post-audit reporting. Together, these phases form a complete cycle of risk detection, corrective insight, and performance improvement.

Pre-Audit Planning and Record Selection

Before the first record is ever reviewed, a well-structured plan is critical. Pre-audit planning includes:

Defining the audit scope (e.g., E/M codes, procedures, providers, specialties)

Identifying the timeframe for sampled claims (e.g., previous quarter, fiscal year)

Selecting sample size and sampling method (random, risk-based, focused)

Confirming which coding guidelines and payer rules will be applied

During this phase, leadership also decides whether to conduct a concurrent (real-time) or retrospective (post-bill) review. The choice depends on whether the focus is preventive or corrective.

Equally important is record selection. Many audits fail when the selected sample is too small, biased, or lacks diversity. Best practice involves statistically valid sampling techniques, like RAT-STATS or focused sampling based on prior denials or high-revenue codes.

This phase sets the foundation. A poorly scoped or inconsistently sampled audit leads to unreliable results—and missed opportunities for systemic fixes.

Audit Execution and Post-Audit Reporting

Once planning is complete, auditors dive into the records and begin a systematic comparison:

Does the documentation support the codes billed?

Are E/M levels justified by the exam, history, and decision-making notes?

Were modifiers correctly applied—and are they medically necessary?

Does each service meet payer-specific and national coding policies?

Auditors use structured tools such as checklists, rubrics, or coding compliance software to ensure consistency and thoroughness. Any deficiencies—whether minor or significant—are noted with explanations, references, and severity indicators.

After the review, the results are compiled into a post-audit report. This report includes:

An error rate (overall and by category)

Specific examples of coding/documentation mismatches

Recommended corrective actions

Training or policy changes needed

The post-audit phase is where value is fully realized. An audit without follow-up reporting is just a record review. A strong post-audit phase gives your team a roadmap for process improvement, education, and risk reduction.

| Audit Phase | Key Actions |

|---|---|

| Pre-Audit Planning | Define scope, sampling method, timeframe, and applicable coding guidelines. |

| Record Selection | Choose claims using random or risk-based sampling methods to ensure valid representation. |

| Audit Execution | Compare coded claims to documentation, apply payer rules, and identify discrepancies. |

| Post-Audit Reporting | Compile error rates, categorize issues, and recommend corrective actions and training. |

| Follow-Up & Training | Conduct staff re-education, update workflows, and implement compliance improvements. |

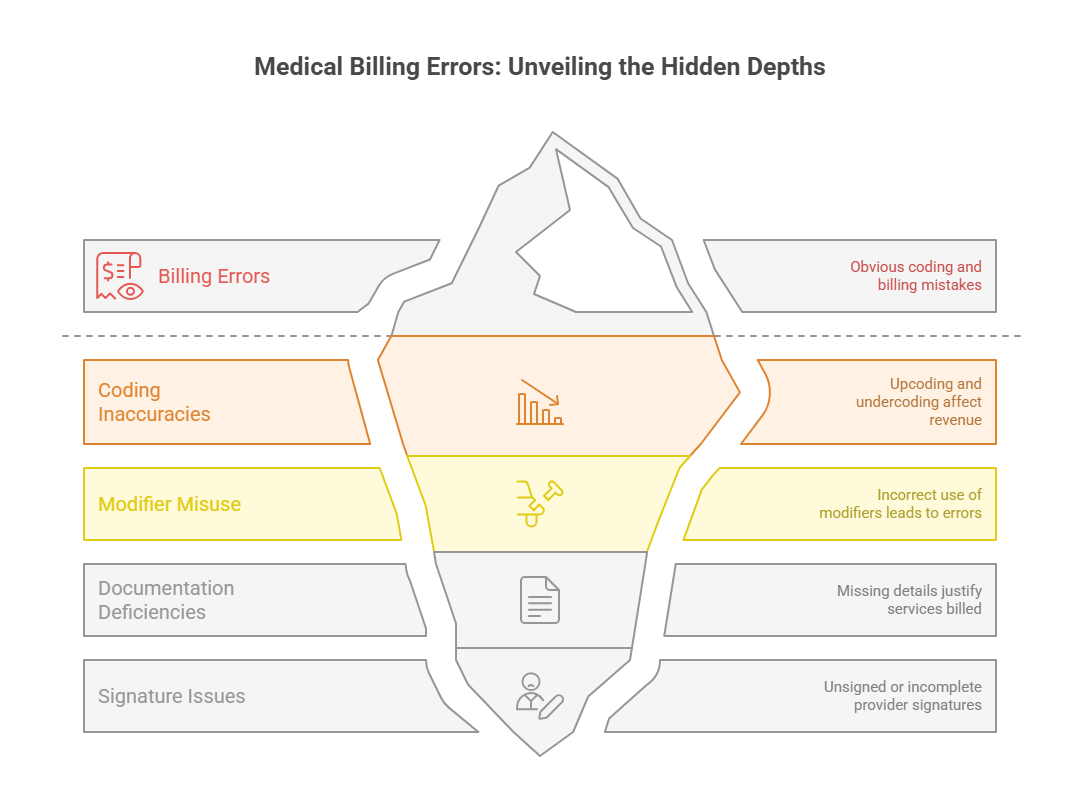

Most Common Coding Errors Caught in Audits

Medical coding audits consistently reveal recurring errors that compromise revenue integrity and open organizations to compliance risks. These aren’t random mistakes—they’re often systemic and predictable, which makes identifying and correcting them mission-critical for any coding or billing team.

The most frequent audit findings fall into two broad categories: code selection errors and documentation deficiencies.

Upcoding, Undercoding, Modifier Misuse

Upcoding is one of the most serious issues uncovered during audits. It refers to assigning a higher-level CPT or E/M code than what the documentation supports. This can lead to overpayments and False Claims Act violations, especially in federally funded programs.

Undercoding, while less likely to trigger legal action, is equally damaging. It occurs when providers select a code that fails to reflect the full scope of services rendered, often out of caution or habit. The result? Consistent revenue loss and underreporting of care intensity.

Modifiers are another audit hot spot. Modifier misuse includes:

Applying modifier 25 to E/M services when not separately identifiable

Using modifier 59 for procedures that don’t meet distinct procedural criteria

Stacking modifiers in ways that don’t comply with NCCI edits

Incorrect modifier usage doesn’t just reduce payment—it flags claims for deeper review by payers and regulators.

Auditors look for patterns of misuse, not just one-off errors. If trends show systematic overuse of certain modifiers, payers may initiate focused audits or clawbacks.

Documentation and Signature Gaps

No matter how accurate the codes are, if documentation doesn’t support them, the claim fails.

Documentation gaps commonly identified in audits include:

Missing or vague chief complaints

Incomplete HPI (history of present illness), ROS (review of systems), or medical decision-making components

Failure to justify diagnostic testing or medical necessity

Lack of time statements for time-based codes

Illegible or unsigned progress notes

Signature issues are particularly risky. A missing provider signature can void the entire encounter from a billing standpoint. Even electronic health records can trigger issues if signature attestations are incomplete or noncompliant with payer standards.

Medical necessity is another crucial documentation flaw. Even when a code appears correct, if the record doesn’t establish clear rationale for the service, the claim is at risk. Auditors frequently deny payment for services deemed not clinically justified—regardless of the coding precision.

These errors may seem small, but they create ripple effects throughout the revenue cycle. The good news is they’re predictable—and fixable—when caught early through a strong auditing program.

Tools and Techniques Used by Medical Auditors

Medical auditors rely on a mix of automated software tools and manual review strategies to perform accurate, compliant, and efficient coding audits. These tools aren’t just for error detection—they’re designed to help auditors validate patterns, streamline reviews, and produce evidence-based reports that stand up to payer scrutiny.

By combining technology with expert analysis, auditors can identify both isolated mistakes and systemic workflow breakdowns that compromise billing accuracy.

Coding Audit Software

Modern coding audits often begin with specialized audit software platforms. These tools help auditors:

Import large volumes of claims and documentation for review

Flag discrepancies between clinical notes and submitted codes

Cross-reference billing data against payer rules, NCCI edits, and LCD/NCD guidelines

Generate real-time analytics on error rates and compliance risks

Popular platforms include tools like 3M CodeFinder, Optum Audit Manager, and AAPC’s Practicode. These systems use rule engines that apply CPT, ICD-10, HCPCS, and modifier logic to flag outliers or noncompliant claims.

More advanced tools integrate AI-based predictive coding or pattern recognition, helping auditors identify chronic issues like excessive use of level 5 E/M codes or repeated modifier misuse.

What makes audit software indispensable is consistency and scalability. For large health systems or multi-specialty groups, manual audits alone can’t match the volume or precision these platforms provide.

Manual Review Checklists and Reporting Templates

Even with automation, manual review remains essential. Auditors use structured checklists to ensure every record meets documentation and coding requirements. These often include:

Verification of chief complaint, HPI, ROS, and MDM levels

Time justification for codes like psychotherapy or prolonged services

Cross-checks for supporting documentation behind each code and modifier

Manual techniques are especially critical when auditing nuanced services like surgical bundling, telehealth coding, or complex chronic care management, where context matters more than raw data.

Standardized reporting templates also enhance post-audit impact. A good template includes:

Coder/provider ID

Type and date of service

Codes billed vs. codes recommended

Rationale for any discrepancies

Suggested corrective actions or training needs

Together, these tools ensure audits are not only accurate but actionable—helping teams build a culture of accountability and continuous improvement.

| Tool/Technique | Purpose |

|---|---|

| Audit Software | Automates chart reviews, flags errors, and checks claims against coding guidelines and payer rules. |

| Checklists | Ensure consistent manual validation of documentation elements like HPI, MDM, and time-based billing. |

| Rubrics | Standardize assessment of coding accuracy and assign objective error ratings for each record. |

| Compliance Templates | Format audit reports to include findings, recommendations, and next steps. |

| AI/Analytics Tools | Identify trends, outliers, and predictive risk patterns across high-volume claims datasets. |

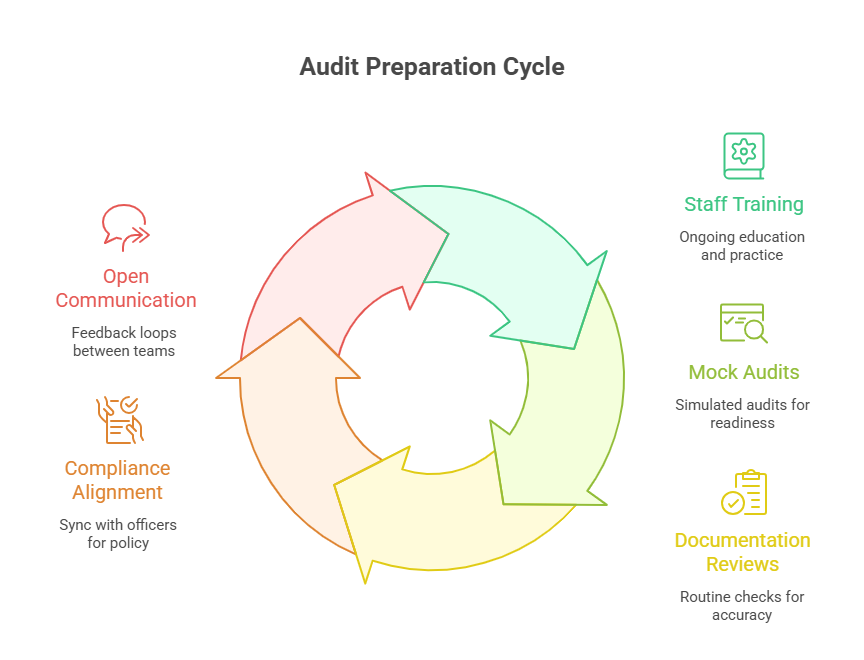

How to Prepare Your Team for a Successful Audit

Audit success isn’t about luck—it’s the result of structured preparation, cross-functional alignment, and continuous training. Coding audits can expose critical revenue vulnerabilities or become powerful opportunities for workflow optimization and team development. The outcome depends entirely on how well-prepared your staff is—before the auditor ever opens a record.

Staff Training & Documentation Review

The most common audit findings often tie back to inconsistent documentation or coder misunderstandings, not intentional misconduct. That’s why preparation begins with education across all roles—not just coders, but also physicians, billers, and front-desk staff.

Start with these essentials:

Ensure coders receive ongoing training in ICD-10, CPT, and payer-specific rules

Educate providers on documentation essentials like HPI, MDM clarity, and time statements

Offer mock audits and case studies to help teams apply theory to real scenarios

Maintain a coding policy manual and update it with regulatory or payer changes

Documentation reviews should be proactive, not reactive. Implement regular peer reviews or random chart audits to identify gaps before they show up in formal audits. Encourage physicians to ask coders about ambiguous documentation, creating a feedback loop that improves clarity and consistency.

Audit readiness is also about mindset. Teams need to understand that audits aren’t punishments—they’re quality control mechanisms that protect everyone involved.

Communication with Compliance Officers

A successful audit hinges on cross-department coordination, especially with compliance teams. Before audits begin:

Schedule a pre-audit meeting with compliance to align on scope, sample methodology, and priorities

Define roles and responsibilities for each stakeholder (coding team, clinical staff, compliance officer)

Ensure all team members know where to access policies, guidelines, and previous audit reports

During the audit, coders and compliance officers should collaborate closely to address questions in real time. Open communication prevents misunderstandings and helps resolve discrepancies faster.

Post-audit, compliance officers play a crucial role in translating audit results into actionable remediation plans. This includes targeted education, policy updates, or billing corrections. The feedback loop between auditors and compliance staff must remain open to prevent recurring issues.

Well-prepared teams don’t just survive audits—they use them as a launchpad for performance elevation, reduced denial rates, and stronger payer relationships.

How AMBCI’s CPC/CPB Course Equips You for Audit Success

In today’s high-stakes healthcare billing environment, coders who understand audits have a competitive edge. The CPC/CPB Medical Billing and Coding Certification from AMBCI is designed to build that edge—by embedding audit-readiness into every part of its curriculum. This isn’t just about passing exams—it’s about thriving in real-world audits, denials, and payer reviews.

Graduates of this program don’t just memorize codes—they’re trained to analyze documentation, recognize risk triggers, and prepare claims that stand up to third-party scrutiny. If your goal is to become audit-proof, this course is engineered for that exact outcome.

Built-In Coding Audit Scenarios

Unlike many generic coding programs, AMBCI’s CPC/CPB certification includes hands-on audit training using real-world documentation and claims. Throughout the 200+ module curriculum, learners are exposed to:

Mock internal audits for E/M, procedural, and diagnostic coding

Audit forms based on AAPC and CMS standards

Case-based simulations with error identification and correction tasks

Step-by-step feedback on audit reports, error rates, and compliance gaps

Each audit scenario is designed to simulate what coders will face in hospitals, clinics, or third-party billing firms. The goal is to build audit instincts—the ability to spot subtle errors and defend coding decisions with confidence and evidence.

Students don’t just learn how to code—they learn how to self-audit, identify red flags, and navigate complex payer policies, which are essential skills in any post-COVID audit landscape.

Practice with Real Claims and Corrections

Beyond scenarios, the program includes live exercises where learners correct actual claim errors pulled from anonymized clinical data. These exercises mirror what happens during audits and denials, teaching students to:

Map codes directly to documentation

Justify coding decisions with payer-specific language

Reconstruct claims after audits to ensure full, compliant reimbursement

Communicate corrections effectively with providers and compliance officers

These modules prepare coders for the full audit lifecycle—from identifying the root cause of an error to documenting it properly for re-submission or appeals. This is where AMBCI sets itself apart: the training doesn't stop at "what went wrong," it teaches you how to fix it and prevent it from happening again.

In short, the AMBCI CPC/CPB course builds true audit resilience—the ability to handle scrutiny, defend decisions, and maintain consistent claim integrity across diverse payer environments.

Frequently Asked Questions

-

A medical coding audit exists to verify that submitted claims accurately reflect the clinical services provided, documented, and billed. The core goals are to ensure coding accuracy, regulatory compliance, and payment integrity. Audits prevent revenue leakage from undercoding, protect against legal risks tied to overbilling or upcoding, and help identify training or workflow deficiencies. In today’s climate of increased payer scrutiny, audits also serve as a defensive measure—proving that your organization follows best practices and can withstand third-party review. Whether internal or external, audits ultimately reduce denials, repayment demands, and fraud exposure, making them an indispensable part of healthcare revenue cycle management.

-

Medical coding audits can be performed by internal auditors, such as compliance officers or certified coders within the organization, or by external auditors hired from third-party firms or insurance payers. Internal audits are generally proactive—conducted on a regular schedule to detect and correct issues before claims go out. External audits, by contrast, are often reactive or investigative and may be triggered by outlier billing patterns, payer requests, or fraud investigations. Credentialed professionals like CPCs, CPBs, or CPAs with audit-specific experience usually lead these reviews. The most effective audit approach uses both internal and external resources to maintain continuous accuracy and unbiased oversight.

-

External audits are often triggered by patterns that suggest billing irregularities. These red flags include frequent use of high-level E/M codes, excessive use of modifier 25 or 59, repeated billing for non-covered services, or claims that statistically stand out compared to peer providers. Auditors may also target providers with unusually low or high denial rates, inconsistent documentation, or claims that appear to bundle or unbundle procedures incorrectly. In some cases, audits are triggered by patient complaints or whistleblower reports. Maintaining internal audit routines helps catch these red flags early, enabling providers to course-correct before external payers initiate formal investigations.

-

The CPC/CPB Medical Billing and Coding Certification from AMBCI is uniquely structured to develop both coding mastery and audit readiness. It includes real-world claim correction drills, audit scenario simulations, and training in compliance documentation. Students gain experience with audit checklists, denial management strategies, and practical exercises that mimic payer reviews. In addition to coding instruction, the course teaches coders how to analyze error patterns, justify decisions based on documentation, and apply payer-specific rules. Graduates enter the workforce with proven skills in audit defense, reporting, and remediation—making them indispensable to any billing or compliance team.

-

Even when codes are technically correct, claims can fail audits due to documentation errors. Common issues include incomplete histories (HPI), missing medical decision-making details, vague or generic notes, and failure to explain medical necessity. Auditors often flag unsigned notes, missing time statements, and lack of detail in areas like reason-for-visit or procedure justification. Templates that are overused or copy-pasted between visits can also raise red flags. These documentation gaps can lead to denials, clawbacks, or compliance violations. That’s why coders and providers alike must be trained to ensure every service billed is clearly supported by precise, individualized records.

-

Internal audits should be conducted on a routine basis, not just when something goes wrong. Best practices recommend quarterly audits for high-volume specialties and semi-annual audits for lower-risk departments. Audits may be conducted more frequently when launching a new service, onboarding a new provider, or changing EHR systems. Practices should also schedule focused audits in response to claim denials, payer feedback, or significant regulation changes. The goal is to create a culture of ongoing improvement and accountability—not a punitive atmosphere. Regular auditing builds confidence with payers, reduces revenue loss, and strengthens the organization’s ability to handle external reviews.

-

Professional auditors use a combination of automated audit software and manual review tools. Software platforms like 3M, Optum, and AAPC Practicode automate the identification of mismatches between billed codes and documentation, check for NCCI edits, and highlight compliance concerns. These tools allow batch processing of large data sets, real-time analytics, and detailed error classification. Manual tools include checklists for each visit component (HPI, ROS, MDM), standard audit templates, coding rubrics, and compliance worksheets. A good audit process integrates both types—technology for efficiency, manual review for nuance and contextual accuracy—to ensure nothing is missed in the coding evaluation.

Final Thoughts

Medical coding audits are no longer reactive—they are now a strategic cornerstone of compliance and revenue success. Whether you're running a private practice or managing a large health system, your ability to survive and thrive in today’s healthcare economy depends on how accurately and defensibly you code. Audits aren’t just about identifying errors; they are the gateway to continuous quality improvement, lower denial rates, and stronger payer relationships.

The key is preparation. Train your team. Use the right tools. Build systems that prioritize documentation clarity and coding accuracy. And if you're just starting out, choosing a certification program like the CPC/CPB Medical Billing and Coding Certification from AMBCI ensures that you’ll be ready for audits before your first claim is even submitted.

A strong audit framework is your best safeguard against penalties—and your most reliable path to profitability.