How to Transition from Medical Coder to Coding Auditor

Medical coders today aren’t just supporting healthcare—they’re shaping its financial accuracy. As hospitals and insurers demand tighter compliance, more coders are being promoted into auditor roles, where the focus shifts from assigning codes to verifying them. Auditors are the safeguard between clinical documentation and legal billing, flagging overcoding, undercoding, and missed revenue.

This guide walks you step by step through that transition—from coder to auditor. You’ll learn how to build the right skill set, use compliance-focused tools, and pursue certifications that fast-track your advancement. AMBCI’s CPC + CPB Medical Billing and Coding Certification equips you with both coding accuracy and billing oversight training—making you audit-ready from the ground up.

What Does a Medical Coding Auditor Actually Do?

Responsibilities That Go Beyond Coding

Medical coding auditors play a fundamentally different role from coders. Instead of assigning CPT or ICD codes, auditors review documentation for accuracy, ensure that codes align with payer requirements, and flag inconsistencies that could lead to denials or fraud investigations. They protect revenue by verifying that every billed service is properly supported in the medical record.

Their audits often involve analyzing entire encounters—from physician notes to submitted claims—and verifying whether documentation justifies each coding decision. This process includes tracking documentation consistency and audit trails, as explained in AMBCI’s Understanding Medical Coding Audit Trails. It also forms the quality assurance layer of post-coding review, ensuring internal controls are met, as detailed in their Quality Assurance in Medical Coding guide.

Work Settings and Career Scope

Auditors are found in compliance departments, revenue cycle teams, insurance carriers, and even governmental healthcare auditing agencies. Their insight helps prevent reimbursement errors, catch overpayments, and align documentation with legal billing frameworks. The growing emphasis on audit trails and CDI (Clinical Documentation Integrity) has made this role one of the most in-demand pathways in healthcare revenue management.

What Does a Medical Coding Auditor Actually Do?

Medical coding auditors ensure more than just coding accuracy — they validate billing defensibility, documentation integrity, and payer compliance. Their job is to review claims end-to-end, flag inconsistencies, and confirm that every CPT or ICD code is properly supported in the clinical record.

This means cross-referencing provider notes with submitted codes, detecting fraud triggers, and preparing documentation for payer audits or legal review. Their role sits at the intersection of quality assurance and revenue protection.

They work in compliance teams, payer agencies, hospitals, and QA departments. As medical billing scrutiny rises, auditors are becoming vital to both private and public healthcare systems.

Learn more with:

Key Differences Between Medical Coders and Coding Auditors

Operational vs. Oversight Focus

While coders are focused on producing accurate claims based on clinical documentation, auditors are the oversight function that evaluates those claims for integrity. Coders assign ICD-11 and CPT codes in real time. Auditors go back through those same records—line by line—and assess whether every coding choice was justified, compliant, and defensible.

They check for upcoding, downcoding, and missed modifiers, examining trends across departments and teams. This post-claim evaluation role means auditors must apply payer policy, CMS guidelines, and internal protocols with precision.

Skill Set Comparison

Whereas coders must know medical terminology and code sets, auditors take it further. They need deep familiarity with documentation standards, billing compliance triggers, and legal definitions of improper billing. A key requirement is fraud and abuse awareness—knowing how to flag risky behavior in billing logic.

This is why auditors study concepts like waste, fraud, and abuse red flags, outlined in AMBCI’s Guide to FWA Terms for Coders. That foundation separates a technical coder from a compliance-ready auditor.

| Aspect | Medical Coders | Coding Auditors |

|---|---|---|

| Primary Role | Assign ICD-11/CPT codes based on clinical documentation | Review submitted codes for compliance, justification, and accuracy |

| Workflow Timing | Real-time or near-time coding during patient billing cycle | Post-claim, retrospective evaluation and compliance checking |

| Skill Set | Medical terminology, anatomy, ICD/CPT coding rules | Documentation analysis, audit compliance, fraud detection |

| Tools Used | EHRs, coding books, billing software | Audit trails, compliance dashboards, CMS/FWA references |

| Compliance Focus | Accuracy and code assignment integrity | Regulatory alignment, payer policy compliance, defensibility |

| Reference Resource | ICD-11 and CPT official manuals | Guide to FWA Terms for Coders |

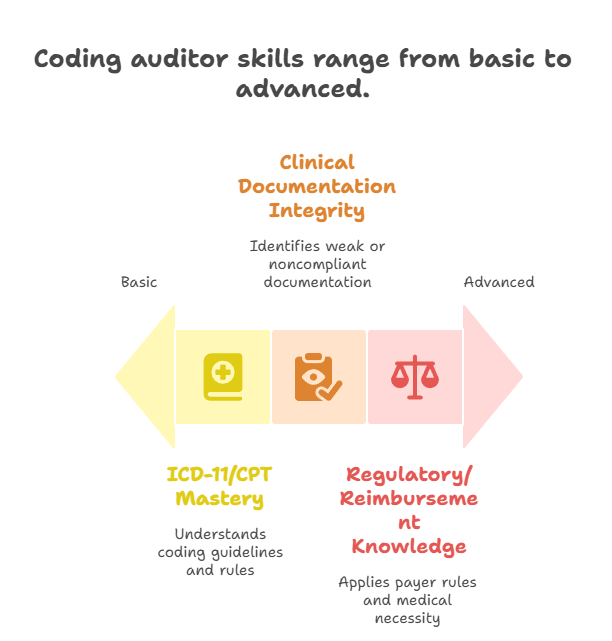

Essential Skills for Coding Auditors

Mastery of ICD-11 and CPT Guidelines

To transition successfully, coders must evolve from code selection to code justification. Auditors are responsible for identifying when codes deviate from clinical intent or payer rules. This means understanding ICD-11’s cluster logic, CPT modifiers, and crosswalks between documentation and billing outcomes.

Auditors also ensure coding aligns with national and payer-specific edits. Misuse of CPT rules is a common audit trigger, which is why auditors must be fluent in coding scenarios outlined in AMBCI’s Detailed Reference for CPT Coding Guidelines.

Clinical Documentation Integrity (CDI)

The ability to spot weak documentation is non-negotiable. Auditors must identify vague, missing, or noncompliant physician notes that lead to improper billing. CDI skills involve recognizing patterns like templated language, ambiguous diagnoses, or disconnected assessment plans.

To be effective, auditors study the core elements of clinical documentation integrity, such as those found in AMBCI’s Guide to Clinical Documentation Integrity Terms, ensuring they understand what constitutes audit-proof documentation.

Regulatory and Reimbursement Knowledge

A great auditor must know how Medicare’s NCDs/LCDs work, understand commercial payer rules, and apply state-specific audit regulations. Skills also include recognizing medical necessity, linking diagnosis to procedure, and understanding denial and appeal trends. This blend of regulatory literacy and audit insight defines the compliance-focused mindset coders must adopt.

Tools & Technologies Used in Medical Auditing

Audit Trail & Compliance Software

Modern auditors rely on specialized platforms to track coding decisions, cross-reference documentation, and maintain defensible records. These include audit trail software, EHR-integrated compliance tools, and coding analysis dashboards. Knowing how to extract and verify documentation is a fundamental part of audit workflows.

CAC Platforms and EHR Integrations

Computer-Assisted Coding (CAC) systems are becoming common in hospitals and billing services—but auditors must validate their outputs. A CAC tool may suggest a code, but auditors determine whether it was applied appropriately and in line with payer requirements.

Understanding how CAC systems can either support or hinder coding accuracy is crucial, and AMBCI’s Understanding Computer-Assisted Coding (CAC) Terms is essential reading for mastering that balance.

| Tool / Technology | What It Enables |

|---|---|

| Audit Trail Software | Tracks all user interactions, edits, and documentation changes for full transparency |

| Compliance Dashboards | Visualizes risk areas, repeat errors, and audit outcomes across teams |

| CAC (Computer-Assisted Coding) | Suggests codes from documentation; auditors validate their accuracy |

| EHR Integration Tools | Embed audit workflows inside clinical systems for real-time checks |

| Code Mapping Platforms | Map ICD-11 and CPT codes with payer edits to prevent denials |

| Reference Guide | Understanding CAC Terms – AMBCI Blog |

Certifications That Help Coders Advance Into Auditor Roles

CPC + CPB – Audit Foundation

The Certified Professional Coder (CPC) and Certified Professional Biller (CPB) certifications offer more than just technical coding fluency—they build a coder’s ability to understand the entire claim lifecycle. Coders transitioning to audit roles benefit from the accuracy, speed, and billing logic taught in both. CPC trains you to code confidently; CPB shows you how that coding impacts payment and denial.

Auditors who’ve mastered these certifications bring an end-to-end mindset. As AMBCI’s Guide to CPC Certified Professional Coder Exam Terms explains, understanding CPT logic, modifier use, and code-to-claim linkages is foundational to audit-readiness.

CCS – Advanced Auditing for Inpatient Environments

If your audit career leans toward inpatient coding or hospital review roles, the Certified Coding Specialist (CCS) credential is critical. It expands your scope to cover DRGs, APR-DRGs, and complex EHR-based documentation systems. CCS-trained auditors assess medical necessity, query opportunities, and CDI alignment in acute care.

For coders with CPC training, the CCS is a natural next step. It expands on what you know and prepares you for higher-stakes auditing. AMBCI’s Comprehensive CCS Certified Coding Specialist Exam Guide details what inpatient auditors must master to validate documentation in high-volume hospital systems.

- CPC + CPB Combo – Gives you mastery of both coding mechanics and the financial impact of claim decisions. Builds an auditor’s logic from both ends.

- CPC – Sharpens coding accuracy, CPT understanding, and modifier use. Ideal for outpatient and entry-level audit roles.

- CPB – Teaches billing patterns, denial management, and payer-specific nuances auditors must evaluate.

- CCS – The gold standard for inpatient audits. Trains you on DRGs, query compliance, and CDI strategies in high-volume settings.

Want deeper insights? Visit the CCS Exam Guide – AMBCI

How AMBCI’s Dual Certification Equips You for Audit-Level Roles

CPC + CPB = Full Coding and Billing Oversight Training

The AMBCI Dual CPC + CPB Certification is designed with auditing in mind. While most coders are taught to code quickly, this program teaches you to code critically. You’ll learn to identify revenue leaks, claim bundling errors, modifier misuse, and documentation mismatches—all skills needed in auditing teams.

This dual training gives you the confidence to flag downcoding and overbilling, align claims with medical records, and construct defensible appeals. AMBCI explains these connections in Next Steps After Earning Your CPC Certification, where CPC graduates evolve into analytical, audit-ready coders.

Includes Specialty Coding for Audit Scenarios

Beyond general coding, AMBCI includes 200+ modules covering high-risk specialties like dermatology, cardiology, ambulatory surgery, and DME. These areas are audit hotspots due to frequent upcoding and modifier misuse. Mastering them prepares you to audit nuanced cases where payer scrutiny is highest.

You’ll also explore bundled billing audits, physician-to-facility transitions, and split/shared visit claims. AMBCI’s Mastering Specialty Coding Exams: Cardiology & Vascular Coding provides deep training in areas most targeted by payers.

Built-In Audit Tools and Case Simulations

Real-world preparation includes case studies, redacted audits, and bundled claim simulations. You’ll review real claims, find documentation gaps, and analyze why denials occurred. These exercises mirror what employers expect auditors to do on day one.

From CPT modifier audits to E/M leveling validations, this training prepares you to lead documentation reviews with confidence. It’s the certification that blends front-line coding and back-end audit visibility into one practical pathway.

How confident do you feel transitioning into an audit-focused coding role after earning dual CPC + CPB certification?

Final Thoughts

Becoming a coding auditor isn’t just a promotion—it’s a transformation in how you view healthcare data, compliance, and financial accountability. While medical coders focus on accuracy, auditors focus on integrity, patterns, and risk. You’ll go from assigning codes to detecting revenue gaps, fraud indicators, and compliance breaches.

With the right certifications—especially AMBCI’s Dual CPC + CPB—you gain not only technical skill, but the audit logic and documentation insight employers demand. Whether you’re eyeing a role in hospital compliance, payer-side audits, or government review teams, this transition positions you at the core of revenue cycle leadership. It’s where coders evolve into strategic professionals shaping healthcare outcomes through precision and oversight.

Frequently Asked Questions

-

A coding auditor evaluates medical records, billing statements, and assigned codes to ensure complete alignment with clinical documentation and payer rules. They verify if the ICD-10/ICD-11, CPT, and HCPCS codes accurately reflect the services provided, check for modifiers, and identify overcoding, undercoding, or unbundling issues. Auditors also confirm whether medical necessity is documented clearly and whether the claim is compliant with Medicare, Medicaid, or private payer policies. They typically use audit checklists, compliance software, and reference tools to perform objective evaluations. Their findings often guide policy changes, staff retraining, or reimbursement corrections.

-

A coding auditor focuses specifically on coding accuracy and documentation validation, while a compliance officer oversees broader regulatory adherence across an organization. Auditors are usually part of the revenue cycle or HIM team, conducting retrospective or concurrent audits to identify billing errors. Compliance officers manage HIPAA, OIG standards, training programs, and overall internal audits. While both roles overlap in goals—ensuring ethical and lawful billing—auditors dive into code-level reviews, whereas compliance officers shape organization-wide policies. In many cases, coding auditors report their findings to compliance officers for escalation or systemic resolution.

-

The most effective certifications for transitioning into auditing are CPC (Certified Professional Coder) and CPB (Certified Professional Biller), offered together by AMBCI. These form a strong foundation in both front-end coding and back-end billing logic. For more advanced auditing roles—especially in inpatient or hospital settings—the CCS (Certified Coding Specialist) credential is recommended. It focuses on DRG validation, CDI, and regulatory guidelines across various facilities. All three certifications prepare professionals for reviewing documentation, identifying claim risks, and ensuring audit readiness across specialties and payer types.

-

Medical coding auditors use a variety of tools to streamline their audit processes. These include EHR audit trail viewers, computer-assisted coding (CAC) platforms, and compliance dictionaries that help verify payer policies and clinical documentation standards. Audit management tools like iMedX, 3M CodeFinder, or Optum Encoder Pro assist in reviewing codes, tracking trends, and generating compliance reports. Many tools also offer real-time alerts for modifier errors, incomplete documentation, or guideline deviations. Proficiency in these tools is crucial for auditors to evaluate cases efficiently, flag inconsistencies, and provide actionable feedback to coders or providers.

-

The time it takes to transition into a medical coding auditor role varies depending on experience and education. For certified coders (CPC or CPB), adding audit-focused skills through AMBCI’s dual certification pathway can accelerate the transition within a few months. On-the-job experience in reviewing documentation, understanding audit trails, and working with compliance tools is also key. Most organizations look for 1–3 years of professional coding experience before promoting someone into an audit role. Continuous learning through specialty training or CCS certification can further shorten the path to audit leadership roles.