How to Become a Remote Overseas Medical Billing Specialist

Remote Medical Billing Specialists are no longer back-office clerks—they’re revenue engineers who convert clinical stories into clean claims, overturn denials, and guard compliance across borders. If you’re outside the U.S. (or planning to work from abroad), this roadmap shows the exact skills, portfolio artifacts, workflows, and governance you need to become hire-ready, audit-proof, and promotion-worthy. You’ll leverage AMBCI’s playbooks on career paths, compliance, automation, and analytics to build a portfolio that speaks CFO and passes payer scrutiny. Every section links to deep dives so you can execute with speed and precision.

1) What U.S. Employers Actually Buy When They Hire Remote Overseas Billers

Global teams win when they reduce friction between coding, documentation, edits, and payers. Employers aren’t buying keystrokes; they’re buying first-pass yield, lower DNFB, and fewer CO-16 or CARC 50 surprises. Start by understanding the revenue engine end-to-end—intake, eligibility, coding, charge capture, edits, submission, ERA/EOB posting, denial follow-up, appeals, and analytics. Map each step to a controllable KPI and a repeatable artifact (SOP, checklist, template, dashboard). For foundations, study these AMBCI primers: step-by-step career entry, CPC roadmap, salary benchmarks, and compliance essentials.

Pain points to solve from day one (and where to learn):

Pre-bill edit overload wastes hours—clean rules and document precision/recall using predictive analytics in billing and modifier accuracy patterns from this guide.

Policy drift across payers brings retro rework—build a monthly SOP update cadence with regulatory changes 2025–2030 and Medicare/Medicaid futures in this overview.

Automation risk: CAC/AI that can’t explain its outputs adds audit exposure—study AI-era skill guards in future skills for coders and RCM AI trends in this article.

| Capability | KPI / Result | Artifact to Show | AMBCI Deep Dive |

|---|---|---|---|

| Eligibility & benefits | Eligibility errors < 1% | Eligibility SOP + checklist | Career starter |

| Charge capture | Missed charges ↓ | Charge capture gap log | Compliance trends |

| Edits governance | False positives ↓25% | Edit tuning report | Predictive analytics |

| Modifiers (25/59/76) | Modifier denials ↓30% | Hot-modifier watchlist | Modifier mastery |

| Claim submission | First-pass >92% | FPY dashboard | Certification strategy |

| ERA/EOB posting | Posting lag <24h | Posting SLA sheet | Future-proof roles |

| Denial triage | Top-10 CARC playbooks | CARC root-cause board | Regulatory impact |

| Appeals | Overturn >40% | Payer packet templates | 2025–2030 changes |

| Medical necessity | CARC 50 ↓ | Evidence checklist | CMS primer |

| Documentation queries | Turnaround <48h | Query SOP & ledger | CPC roadmap |

| HCC/RAF basics | Evidence trails intact | HCC suspect list | Compliance trends |

| DNFB control | DNFB <2 days (coding) | Backlog burn-down | Remote trends |

| Productivity | Queue TAT met | WQ time-stamps | State benchmarks |

| HIPAA discipline | Zero major incidents | Access log SOP | Compliance guide |

| Time-zone coverage | SLA ≥98% | Shift rota plan | Remote work |

| Client reporting | Monthly KPI deck | Exec dashboard | Analytics |

| Automation oversight | Explainable CAC | Precision/recall log | AI in RCM |

| Learning agility | Code updates: 0 rework | Change-control memo | CE strategy |

| Specialty breadth | 2–3 specialties | Portfolio case set | Derm study |

| Appeal narrative | Template library | Packet exemplars | Reg changes |

| Career signaling | Interview hit-rate ↑ | Portfolio links | Ladders |

| Geo insight | Offer quality ↑ | Comp map | California guide |

| Remote etiquette | On-time standups | Meeting SOP | Remote trends |

| Quality loop | Post-ed errors ↓30% | Micro-module results | CE impact |

| Role mobility | Upskill to lead | CE ledger | Future-proof |

| State nuances | Zero mismatch | State policy table | State salary |

2) A 90-Day, No-Drama Skill Plan (Built for Overseas Talent)

Days 0–30 — Build the compliance spine and edit literacy.

Master payer language, denial codes, and documentation rules. Create three SOPs (eligibility, claim edits, appeals). Begin a “hot modifiers” tracker. Measure your first-pass yield on sample claims and log false-positive edits. For structure, study CMS compliance basics, modifier accuracy in this guide, and analytics framing via predictive billing trends.

Days 31–60 — Build a small but persuasive portfolio.

Assemble two anonymized micro-projects: (1) Edit tuning with precision/recall and FPY lift; (2) Appeals playbook for your top three CARC codes. Pair each with a one-page KPI summary. Layer CE using exam-prep strategies and career ladders in the CPC roadmap.

Days 61–90 — Demonstrate reliability at scale.

Simulate SLA-based operations: publish a weekly WQ burn-down, DNFB trend, and query turnaround. Add a brief automation oversight memo (how you monitored CAC rules) using methods from future skills in AI and RCM AI in this primer.

3) Get Hired: Portfolio, Interviews, and Client-Grade Proof

Portfolio that wins interviews

Create a single-page case study for each core outcome: FPY lift after edit tuning; denial overturn rate with payer-specific appeals; DNFB reduction via queue redesign; refund governance measured against the 60-day rule. Tie every claim decision to a source and include before/after charts. For story structure, borrow value framing from career ladders, compliance rigor in CMS guide, and automation oversight in AI & RCM.

Interview answers that separate you from the pack

“How do you manage policy changes?” → Walk through your versioned SOP library, monthly policy council, and effective-date log; cite 2025–2030 changes.

“What is your appeals method?” → Show payer-specific packet templates, medical-necessity evidence, and overturn math; reference modifier risk in this piece.

“How do you prove remote reliability?” → Present SLA dashboards, time-zone coverage plans, and access-control logs; see remote norms in future of remote jobs.

“What analytics do you use?” → Describe precision/recall for edits, FPY trend lines, and CARC heatmaps anchored in predictive analytics.

Client types you can target first

Specialty clinics (dermatology, ophthal, GI) where modifier accuracy drives cash—prep with derm coding study guide.

Startups/expanding groups that tolerate process innovation—bring your edit tuning and FPY artifacts.

CROs/telehealth with cross-state volumes—lean on policy discipline from compliance trends.

Quick Poll: Your #1 blocker to landing a remote U.S. billing role?

4) Cross-Border Ops: Contracts, Taxes, Security, and Communication

Remote billing succeeds when operational risk is engineered out of the system. Build a lightweight but strict operating model:

Contracts & scope

Define SLA metrics (FPY, DNFB, TAT, denial overturn%). Tie invoices to outcomes where possible.

Specify data boundaries (no PHI on personal devices; VDI or approved VPN only).

Include policy-change handling and holiday coverage. Reference change discipline patterns in regulatory impact.

Security & HIPAA hygiene

Enforce least-privilege access, automatic screen locks, and no local downloads.

Use password managers, MFA, and audit logs. Map controls to HIPAA expectations with CMS/HIPAA primer.

Keep a breach playbook: contacts, steps, and timelines.

Time-zone & communication

Adopt a follow-the-sun rota: handoffs at fixed UTC times with a daily risk register.

Send Monday KPI summaries and Friday retros. Borrow reporting logic from analytics trends and remote norms in this guide.

Payments & taxes (general pointers, not legal advice)

Prefer transparent platforms (Wise/Payoneer) with contracts that specify currency, rate, and payment window.

Keep a compliance binder: contract, invoices, payment proofs, and country tax filings.

Record every refund against the 60-day expectation and log the root cause—governance posture matters to U.S. clients (see CMS compliance).

5) Career Ladder, Compensation, and Long-Game Positioning

Your early goal is proof, not perfection. With consistent FPY lifts and defensible appeals, you can move from Billing Specialist → Senior → Denials Lead → Revenue Integrity Analyst → Coding/Billing Operations Lead. Each step needs artifact-backed outcomes: fewer CO-16, CARC 50 reductions, cleaner modifier use, faster DNFB, and education with post-ed error deltas. For pace and signaling, combine targeted CE strategies in this certification guide with AI-era skills in future skills and automation-resilient roles in future-proofing careers.

Comp tactics that actually work (especially overseas):

Quote rate + ROI: “With my edit tuning, FPY rose from 87%→94% and DNFB dropped 1.2 days; projected cash acceleration $X.” Employers pay for lift, not location.

Build specialty stacks (e.g., derm + ophthal + urgent care) to command premium rates—start with derm study.

Publish a monthly outcomes memo (charts + one-page narrative). Use state salary and remote trend data to benchmark offers: state breakdowns and remote predictions.

When to pivot up the ladder:

If you’ve logged 3 straight months of FPY ≥92%, overturn ≥40%, and DNFB ≤2 days, ask to own a playbook (e.g., modifiers, payer X appeals) and lead micro-trainings. Tie it to promotion milestones aligned with career ladders.

6) FAQs — Remote Overseas Medical Billing Specialist (High-Value Answers)

-

Not strictly, but credible CE + proof beats letters alone. Pair local credentials with AMBCI-aligned outputs: SOPs, edit tuning reports, appeal templates, and before/after KPIs. Use exam-prep frameworks to structure study; show compliance literacy via CMS primer and AI oversight from future skills.

-

Deliver a two-page mini-portfolio: (1) FPY lift after cleaning 10 noisy edits, with precision/recall math; (2) payer-specific appeal that overturned denials. Anchor the narrative in predictive analytics and modifier mastery via this guide.

-

Start with CO-16 (info missing), CARC 50 (medical necessity), CARC 97 (invalid coding), and CO-B7/B8 (bundling). Build templates with evidence checklists and link every appeal to policy citations. Learn drift patterns in regulatory changes 2025–2030 and governance from compliance trends.

-

Show a security binder: access-control SOP, device policy (no local PHI), MFA, password manager, VDI/VPN screenshots, and an incident response playbook. Map your controls to AMBCI’s CMS/HIPAA overview and include a monthly audit log sample.

-

Anything explainable with human-in-the-loop thresholds. Track precision, recall, and overturn effect after training. Summarize in an automation oversight memo aligned with AI in RCM and skills from future skills.

-

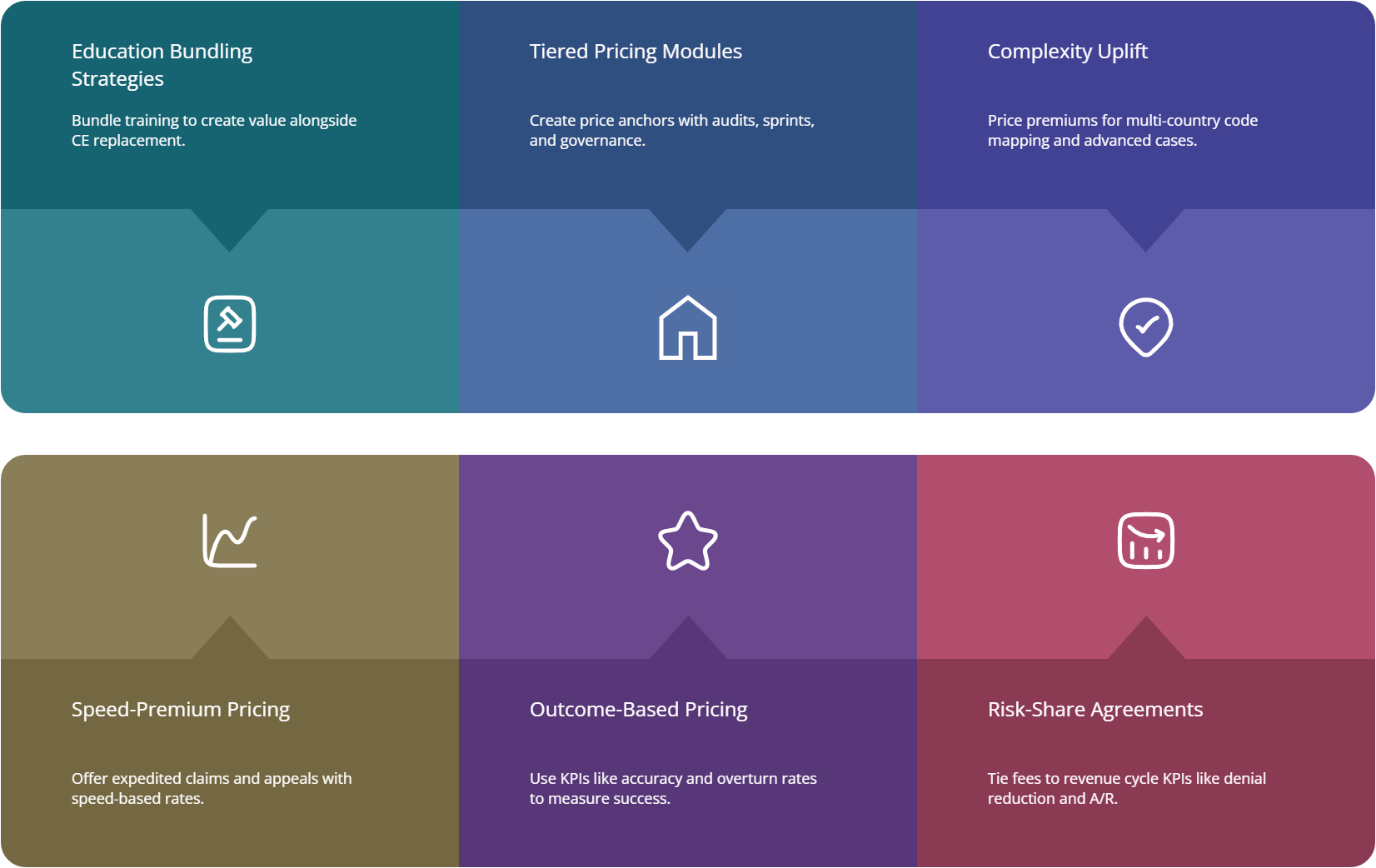

Price against outcome tiers: baseline billing, denial patrol, appeals ownership, analytics reporting. Support asks with state salary references (state guide) and your monthly outcomes memo. For specialty leverage, anchor to derm coding.

-

Build a translator portfolio: show how coding choices affect edits, payers, and appeals. Use coding-to-auditor transition logic in this roadmap and CPC laddering in career roadmap. Emphasize modifier accuracy, medical necessity evidence, and CARC playbooks.