Chiropractic Coding & Billing Terms: Comprehensive Guide

In chiropractic care, coding and billing are more than administrative functions—they’re the foundation of a practice’s financial viability and legal integrity. Precise coding of services using CPT, ICD-10, and HCPCS codes ensures appropriate reimbursement and compliance with payer requirements. Failure to accurately code treatments leads to claim denials, revenue loss, and potential penalties, directly affecting the bottom line.

This guide breaks down essential chiropractic coding and billing terms to empower chiropractors and billing professionals. Mastery of these concepts ensures accurate claims, optimized revenue, and a reduced risk of compliance issues. Chiropractors who prioritize proper coding and streamlined billing processes position their practices for sustainable growth, while errors can result in compliance violations and delayed payments.

Core Concepts in Chiropractic Billing and Coding

Understanding the Foundations of Chiropractic Coding

Chiropractic coding relies on the accurate use of Current Procedural Terminology (CPT), International Classification of Diseases (ICD-10), and Healthcare Common Procedure Coding System (HCPCS) codes to describe treatments and diagnoses. Each code carries specific meaning, distinguishing services provided and the complexity of the patient’s condition. CPT codes, such as those used for spinal manipulation, define the procedure performed. ICD-10 codes categorize the patient’s diagnosis, such as low back pain (M54.5) or cervicalgia (M54.2). HCPCS codes supplement this by indicating supplies or additional services not captured by CPT or ICD-10.

Correct code selection is not optional; it directly determines reimbursement levels from insurers. For example, misusing codes can result in underpayment or claim rejection. Accurate coding ensures revenue integrity while also maintaining compliance with payer guidelines. This section emphasizes the need for coders and chiropractors to maintain up-to-date knowledge of code sets, which change annually. Staying current reduces errors and enhances reimbursement potential.

Coders should also understand the interplay between primary and secondary codes. Combining procedural and diagnostic codes accurately conveys medical necessity, a critical factor in determining whether claims are approved or denied. Without this, practices risk compliance penalties and delayed cash flow. Mastery of these foundational concepts is essential to a thriving chiropractic practice.

Key Billing Principles for Chiropractors

Chiropractic billing requires more than code accuracy; it demands strict adherence to payer policies, thorough documentation, and precise claim submission. Insurers have varying rules on what services are covered, pre-authorization requirements, and documentation standards. Failing to meet these expectations results in claim denials, lost revenue, and potential legal repercussions.

Timely submission of claims is crucial. Delays can mean missed payment windows or additional scrutiny. Practices should establish streamlined workflows, including verification of patient coverage, pre-billing audits, and tracking mechanisms to monitor claim status. These processes ensure faster reimbursement and minimize the risk of non-compliance.

A critical aspect of chiropractic billing is documentation. Detailed records must support every code billed. Payers often request medical necessity documentation for chiropractic services, especially for treatments considered maintenance or wellness care. Proper documentation strengthens a practice’s legal standing and accelerates payment timelines.

Billing errors—whether coding mismatches, missing information, or incomplete records—create bottlenecks. Proactively identifying and correcting these issues through audits and staff training minimizes denials and supports steady cash flow. Staying compliant with changing payer requirements and regulatory standards protects the practice’s reputation and revenue.

By combining meticulous coding with strategic billing practices, chiropractors not only maximize revenue but also build a sustainable, compliant operation. Practices that embrace these core concepts are positioned for long-term financial stability and regulatory peace of mind.

Essential Chiropractic Codes and Their Usage

Most Frequently Used CPT Codes in Chiropractic

Chiropractic coding revolves around a handful of high-frequency CPT codes that define the core services provided. These codes not only distinguish treatments but also determine reimbursement levels from payers. For example, spinal manipulation codes such as 98940, 98941, and 98942 represent services based on the number of spinal regions treated. Proper use of these codes is essential for both reimbursement accuracy and compliance.

98940 (spinal manipulation, one to two regions) covers minimal treatment areas, often applied to cervical or lumbar segments.

98941 (spinal manipulation, three to four regions) indicates a more comprehensive adjustment involving multiple areas of the spine.

98942 (spinal manipulation, five regions) applies to full-spine adjustments, reflecting the most complex service level.

Understanding the distinctions between these codes allows chiropractors to appropriately document the complexity of care and ensure correct reimbursement. Coding errors, such as misclassifying a 98941 service as 98940, can result in underpayments or denials. Coders must also be alert to payer-specific rules regarding these codes, as variations in coverage policies and documentation expectations are common.

Accurate CPT coding in chiropractic doesn’t end with spinal manipulation. Chiropractors also use evaluation and management (E/M) codes for initial consultations and re-evaluations. These codes reflect the time and complexity of patient assessments and are critical for demonstrating medical necessity and supporting comprehensive care documentation.

ICD-10 Codes Specific to Chiropractic

ICD-10 codes in chiropractic care describe patient diagnoses that justify treatment and align with payer expectations. Common codes include M54.5 (low back pain), M54.2 (cervicalgia), and M99.01-M99.05 (segmental and somatic dysfunction). These diagnostic codes validate the necessity of procedures billed under CPT, forming the clinical justification for each claim.

Chiropractors must be precise in code selection. For example, pairing M54.5 with 98941 indicates a medically necessary spinal adjustment targeting low back pain affecting multiple regions. Using non-specific or generic codes may trigger payer rejections or downcoding, reducing reimbursement.

M54.5 applies to patients with localized lumbar discomfort affecting movement and quality of life.

M54.2 indicates cervical spine pain, often due to tension or disc issues.

M99.01-M99.05 describe dysfunctions at specific spinal regions, critical for conveying treatment targets.

Combining accurate diagnostic codes with corresponding procedural codes is essential for full reimbursement. Chiropractors should also stay updated on changes to ICD-10 coding to avoid claim denials due to outdated code usage. Mastery of diagnostic coding not only improves cash flow but also strengthens regulatory compliance and practice credibility.

| Code | Description | Application |

|---|---|---|

| 98940 | Spinal manipulation, one to two regions | Used for adjustments targeting one or two spinal areas, like cervical or lumbar segments. |

| 98941 | Spinal manipulation, three to four regions | Applied for more complex adjustments involving multiple spinal regions. |

| 98942 | Spinal manipulation, five regions | Represents full-spine adjustments, used for the most comprehensive treatment levels. |

| M54.5 | Low back pain | Used for patients with localized lumbar discomfort affecting movement and quality of life. |

| M54.2 | Cervicalgia | Indicates neck pain, often due to tension or cervical disc issues. |

| M99.01-M99.05 | Segmental and somatic dysfunction | Highlights dysfunctions at specific spinal regions, essential for establishing medical necessity. |

Advanced Coding Practices for Chiropractors

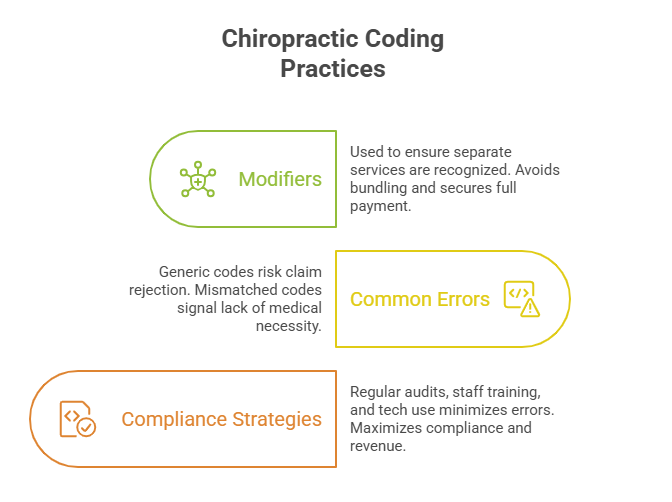

Modifiers in Chiropractic Coding

Chiropractic coding often requires the use of modifiers to convey additional information about the procedure or service. Modifiers ensure claims accurately reflect the treatment rendered, aligning with payer requirements. Common modifiers like -25 (significant, separately identifiable E/M service) and -59 (distinct procedural service) clarify the circumstances under which a procedure was performed, supporting the justification for full reimbursement.

Modifier -25 applies when an E/M service is provided on the same day as another procedure. For example, a chiropractor may perform an adjustment and separately evaluate a new complaint during the same visit. The modifier indicates that both services were distinct and necessary.

Modifier -59 denotes procedures performed at different anatomical sites or on separate encounters during the same visit. This helps ensure payment when multiple services are billed together, avoiding bundling issues.

Incorrect or missing modifier use can trigger denials or audits. Therefore, chiropractors must maintain meticulous documentation demonstrating the necessity of services and the context for applying modifiers. Regular training and audits can minimize errors, ensure compliance with payer rules, and safeguard revenue.

Avoiding Common Coding Mistakes

Chiropractic practices face numerous pitfalls in coding, from misused codes to inadequate documentation. One common error is selecting a generic or incomplete code that doesn’t fully capture the patient’s condition or the complexity of care. For instance, using a non-specific musculoskeletal code instead of a precise ICD-10 diagnostic code risks rejection or downcoding.

Another frequent mistake involves incorrect linking of CPT and ICD-10 codes. Misalignment between procedures and diagnoses can signal a lack of medical necessity to payers, leading to claim denials or audits. Practices should implement robust pre-billing checks to ensure consistency between codes and supporting documentation.

Timeliness is also crucial. Submitting claims after payer deadlines or with incomplete information invites delays, rejections, and revenue loss. Chiropractors should leverage technology and dedicated billing staff to track claims, identify issues, and ensure accurate, timely submissions.

Regular coding audits and staff training not only reduce errors but also reinforce regulatory compliance. By embedding a culture of accuracy and vigilance, practices can minimize financial risk and maximize claim approval rates. Mastering these advanced coding practices elevates a chiropractic practice’s efficiency, legal standing, and financial performance.

Chiropractic Billing Workflows and Technology

Role of Billing Software and EHRs

Chiropractic billing workflows are increasingly powered by Electronic Health Records (EHRs) and specialized billing software. These systems integrate coding rules, payer requirements, and documentation tools, reducing errors and ensuring seamless claims submission. For chiropractors, adopting technology minimizes manual entry, cutting down on common billing errors like code mismatches or missed documentation.

Modern billing software automates charge capture, ensuring that CPT, ICD-10, and HCPCS codes are accurately linked to services. EHRs further enhance billing accuracy by embedding coding templates and alerts, ensuring providers document medical necessity and select appropriate codes. Integration between EHRs and billing systems reduces administrative overhead and accelerates claims processing, improving cash flow.

EHRs also support compliance by maintaining comprehensive records of patient encounters, ensuring that documentation is readily available in case of audits. Practices leveraging these technologies not only reduce errors but also position themselves for future payer and regulatory changes.

Best Practices for Claims Submission

Efficient claims submission begins with verification of patient coverage and benefits. Before rendering services, chiropractic practices should confirm insurance eligibility, identify any pre-authorization requirements, and ensure documentation aligns with payer policies.

Best practices include pre-billing audits, where claims are reviewed for accuracy and completeness. This proactive step reduces denials caused by coding errors, missing information, or non-compliant documentation. Practices should also maintain a clear system for tracking claim status, addressing payer queries, and following up on delayed payments.

Timely submissions are essential. Delays in filing can result in denied claims and lost revenue. Practices should establish internal deadlines well before payer cutoffs, ensuring claims are processed without unnecessary delays. Leveraging billing software with real-time tracking capabilities further supports this process.

Proper documentation is the backbone of successful claims. Chiropractors must ensure that patient records substantiate every code billed, especially for high-frequency procedures like spinal manipulation. Consistent, detailed documentation reduces the risk of denials, supports regulatory compliance, and expedites reimbursement.

Combining technology with streamlined workflows transforms chiropractic billing from a bottleneck to a strategic advantage. Practices that implement these best practices enjoy improved cash flow, reduced administrative burdens, and enhanced compliance—setting the stage for sustained growth and stability.

Compliance and Legal Considerations in Chiropractic Billing

Navigating Payer Policies

Chiropractors face a complex landscape of insurance payer policies that govern service eligibility, pre-authorization requirements, and reimbursement rules. Each payer has unique criteria, and non-compliance can result in claim denials, audits, and financial penalties. Chiropractors must stay updated on evolving guidelines and understand payer-specific documentation requirements.

For example, some payers require detailed medical necessity documentation, including progress notes and patient-reported outcomes, to support chiropractic claims. Missing or incomplete documentation can delay payments or trigger pre-payment reviews. Others mandate pre-authorizations for certain procedures, requiring practices to verify approvals before services are rendered.

Chiropractors should establish protocols for verifying payer requirements at the point of care, including pre-authorization checks, coverage verification, and clear communication with patients about their responsibilities. Practices should also track payer denials, identify patterns, and proactively adjust workflows to reduce errors and compliance risks.

By aligning billing practices with payer policies, chiropractors can minimize claim rejections, optimize cash flow, and protect their reputations. A proactive approach to navigating these complexities fosters trust with both payers and patients.

HIPAA and Billing Compliance

The Health Insurance Portability and Accountability Act (HIPAA) sets strict standards for patient data privacy and security in billing processes. Chiropractic practices must implement safeguards to protect sensitive information, including encryption, access controls, and audit trails within billing systems and EHRs.

Failure to comply with HIPAA can result in substantial penalties, including fines and reputational damage. For example, a data breach exposing patient billing records can trigger regulatory investigations and lawsuits. Practices must train staff to recognize potential HIPAA violations, such as unauthorized access or disclosure of billing information.

Regular compliance audits should be conducted to identify vulnerabilities in systems and workflows. These reviews ensure that processes align with both HIPAA regulations and payer documentation standards, reducing the risk of regulatory infractions. Practices should also establish incident response protocols to swiftly address any breaches and mitigate potential harm.

Combining robust privacy measures with meticulous billing compliance practices enhances a chiropractic practice’s credibility and financial health. Staying current with evolving HIPAA requirements and integrating them into daily workflows is essential for long-term success.

| What do you think is the biggest compliance challenge in chiropractic billing? | |

|---|---|

| Understanding evolving payer policies | |

| Maintaining HIPAA compliance | |

| Ensuring documentation accuracy | |

How AMBCI’s Certification Builds Expertise in Chiropractic Coding & Billing

In the evolving landscape of healthcare, proficiency in chiropractic coding and billing is not just advantageous—it's essential. Earning a Medical Billing and Coding Certification can significantly enhance a chiropractor's ability to navigate complex billing systems, ensure compliance, and optimize revenue cycles.

The Value of Certification in Chiropractic Practice

A Medical Billing and Coding Certification validates a professional's expertise in accurately translating patient services into standardized codes, a critical skill in chiropractic care. This certification ensures that practitioners are well-versed in the latest coding standards, including CPT, ICD-10, and HCPCS, which are integral to documenting chiropractic procedures and diagnoses.

Moreover, certified professionals are better equipped to handle insurance claims efficiently, reducing the likelihood of denials and delays. This proficiency not only streamlines the billing process but also enhances the financial stability of chiropractic practices.

Career Advancement and Professional Growth

Holding a Medical Billing and Coding Certification opens doors to advanced career opportunities within the healthcare sector. Certified individuals are often preferred by employers for roles that require meticulous attention to detail and comprehensive knowledge of billing protocols.

In the context of chiropractic care, this certification empowers practitioners to take on leadership roles in practice management, oversee billing departments, or even establish their own practices with confidence in their billing operations.

Commitment to Compliance and Ethical Standards

Certification programs emphasize adherence to ethical standards and compliance with healthcare regulations, such as HIPAA. For chiropractors, this focus ensures that patient information is handled with the utmost confidentiality and that billing practices meet legal requirements.

By integrating certified professionals into their teams, chiropractic practices demonstrate a commitment to integrity and excellence in patient care and administrative operations.

Final Thoughts

Mastering chiropractic coding and billing is not just an administrative task—it’s a strategic imperative for any practice aiming to thrive in today’s complex healthcare environment. Accurate coding with CPT, ICD-10, and HCPCS standards ensures that chiropractors receive proper reimbursement for their services while minimizing the risk of claim denials and compliance penalties. Efficient billing workflows, supported by technology and meticulous documentation, further optimize cash flow and protect against costly errors.

A deep understanding of these processes empowers chiropractic practices to not only remain financially healthy but also to build a reputation for reliability and professionalism. Whether through continuous education, certification, or adopting best-in-class billing systems, the commitment to excellence in coding and billing directly impacts both patient care and practice success.

This guide has equipped you with the core knowledge to navigate chiropractic coding and billing with confidence. Embrace these principles, stay updated with industry changes, and leverage every tool at your disposal to enhance your practice’s efficiency, compliance, and financial performance.

Frequently Asked Questions

-

The most common chiropractic billing codes include CPT codes 98940, 98941, and 98942, which represent spinal manipulations of varying complexity based on the number of regions treated. These codes determine the level of reimbursement and must match the documented service provided. Additionally, chiropractors use ICD-10 codes like M54.5 (low back pain) and M54.2 (cervicalgia) to describe the patient’s diagnosis, justifying the procedure’s medical necessity. Accurate use of these codes prevents underpayments and denials. Incorporating HCPCS codes for ancillary services, when appropriate, further enhances reimbursement. Combining precise CPT and ICD-10 codes with correct modifiers ensures a clean claim that maximizes revenue and compliance.

-

To avoid claim denials, chiropractors must align CPT and ICD-10 codes precisely with the documented services and diagnoses. Implementing pre-billing audits identifies potential mismatches, missing codes, or incomplete documentation before submission. Staying updated on payer-specific policies is crucial, as rules can vary widely. Additionally, staff training on the proper use of modifiers like -25 and -59 prevents rejections for bundled or misclassified services. Leveraging technology, such as billing software and EHRs, automates checks for accuracy and compliance. Proactive communication with payers and maintaining complete, legible documentation are essential steps to reduce denials and secure timely reimbursements.

-

Modifiers provide essential context in chiropractic billing, signaling special circumstances that affect how services are reimbursed. For instance, modifier -25 clarifies that an E/M service was performed separately from a procedure during the same visit, while modifier -59 indicates a distinct procedural service. These modifiers prevent payers from bundling services or denying claims due to perceived duplications. Proper use of modifiers ensures that chiropractors receive accurate reimbursement for the full scope of care provided. However, misusing or omitting modifiers can result in denials, delays, and compliance risks. Therefore, mastering their application is critical for efficient, accurate billing.

-

Chiropractic billing codes must be backed by detailed, accurate documentation. This includes patient history, examination findings, treatment plans, and progress notes. Each entry must justify the procedure and reflect medical necessity. For example, spinal manipulation codes should be supported by clear records showing the regions adjusted, the condition treated, and the patient’s response to care. Payors often request documentation during audits, so maintaining complete records ensures compliance and expedites reimbursement. Using EHRs with embedded coding templates helps ensure consistency and thoroughness. Regular internal audits further safeguard against documentation gaps that could trigger claim denials or compliance penalties.

-

Technology, including billing software and EHRs, streamlines chiropractic billing by automating code selection, verifying insurance coverage, and ensuring complete documentation. Integrated systems flag mismatches between CPT and ICD-10 codes, suggest appropriate modifiers, and facilitate real-time claim tracking. EHRs also embed templates that guide providers through compliant documentation, reducing human error and strengthening legal defensibility. Automation minimizes delays caused by manual entry and missing data. Additionally, software can generate reports highlighting common billing errors or trends, enabling proactive corrections. Leveraging technology boosts efficiency, enhances accuracy, and fortifies a practice’s compliance posture, ultimately improving revenue and reducing audit risks.

-

Non-compliance in chiropractic billing carries significant legal risks, including fines, penalties, and potential criminal charges. Incorrect coding, lack of medical necessity documentation, or HIPAA violations can trigger audits by insurance payers or government agencies. For example, submitting claims with upcoded procedures or omitted documentation may be viewed as fraudulent activity. Violations of HIPAA regulations—such as breaches of patient data during billing—can lead to substantial financial penalties and damage to the practice’s reputation. Regular training, internal audits, and adherence to strict documentation and coding protocols are essential for minimizing legal exposure and maintaining a practice’s financial and ethical integrity.

-

A Medical Billing and Coding Certification equips chiropractic professionals with advanced knowledge of coding systems, documentation standards, and payer policies. Certified staff can accurately translate services into compliant claims, reducing denials and optimizing revenue. This certification demonstrates commitment to regulatory compliance, enhancing the practice’s credibility and reducing audit risks. Certified professionals also bring expertise in navigating complex payer policies, identifying billing errors, and implementing corrective actions. For chiropractors, integrating certified billing staff or obtaining certification themselves empowers them to manage billing operations confidently, ensuring both financial stability and legal compliance while enhancing overall practice performance.