Detailed Reference for CPT Coding Guidelines

CPT codes aren’t just administrative necessities—they’re the clinical coding language of every outpatient and ambulatory service. Created and maintained by the American Medical Association, Current Procedural Terminology (CPT) codes define the precise work that healthcare providers perform, from evaluation and management visits to complex surgical interventions. For medical coders, clinical staff, and billing professionals, knowing the logic behind CPT is non-negotiable—because it's the foundation of clean claims, accurate reimbursements, and full regulatory compliance.

But CPT isn’t static. Each year, new rules, code deletions, modifiers, and documentation standards shift the playing field—meaning yesterday’s coding accuracy can lead to denials and audit flags today. The consequences are real: improper CPT use can mean thousands in lost revenue or delayed patient care. This guide gives you a surgical-level breakdown of how CPT is structured, the most impactful changes for 2025, common traps, specialty variations, and the high-performance tools that make CPT coding faster, cleaner, and AAPC-compliant. Whether you're a certified coder, a physician office manager, or a new hire aiming for the CPC, this reference exists to make CPT coding your strongest asset.

CPT Structure and Category Overview

Category I, II, III Explained

CPT codes are divided into three primary categories—and each serves a unique purpose in healthcare documentation and reimbursement. Category I is the core set: five-digit numeric codes that describe services and procedures performed by physicians and qualified healthcare professionals. These codes are recognized by payers and are organized by body system or medical specialty.

Category II codes are optional tracking codes used for performance measurement, quality initiatives, and internal benchmarking. They’re alphanumeric (ending in “F”) and aren’t typically tied to payment—but can improve outcomes by supporting value-based care metrics.

Category III codes, on the other hand, are temporary codes that document emerging technologies, procedures, and services not yet part of standard clinical practice. These codes end in “T” and are critical for institutions participating in research, pilot programs, or advanced clinical trials. They’re also reviewed biannually for possible elevation to Category I if they become mainstream.

Understanding how these categories interact allows coders to select codes with surgical precision, ensuring that each line item on a claim aligns with payer expectations, service reality, and quality reporting requirements.

Codes by Type — E&M, Surgery, Pathology, and More

Within Category I, CPT codes are grouped by the type of service provided, and this structure is not random—it reflects the most common areas of patient care and intervention.

Evaluation and Management (E/M) codes are among the most used. They cover office visits, consultations, hospital admissions, and discharge services. Since 2021, E/M coding has shifted to emphasize medical decision-making and total time spent, rather than just history and exam, reshaping how coders interpret provider documentation.

The Surgery section of CPT spans from codes 10021 to 69990 and includes everything from minor in-office procedures to complex neurosurgical interventions. Each code must correspond to detailed operative notes, precise anatomical site, and any intraoperative complications noted.

Pathology and Laboratory codes range from 80047 to 89398, capturing diagnostic services that support clinical decision-making. Coders must be careful with bundling rules here—many lab services appear on National Correct Coding Initiative (NCCI) edits lists, which must be checked to prevent denied claims.

Other sections include Radiology (70010–79999), Medicine (90281–99607), and Anesthesia (00100–01999). Each has unique coding rules, modifiers, and documentation requirements. Knowing the code structure by type isn’t just for reference—it’s how professionals ensure CPT accuracy, reduce denials, and support compliant revenue cycles.

| Section | Details |

|---|---|

| Category I Codes |

- 5-digit numeric codes used for widely accepted, billable procedures - Organized by body system or specialty - Approved by FDA and reimbursed by payers |

| Code Types within Category I |

Evaluation & Management (99202–99499) – Office visits, hospital care, consultations Surgery (10021–69990) – Minor to major procedures Radiology (70010–79999) – Imaging like X-rays, CT, MRI Pathology & Laboratory (80047–89398) – Diagnostic panels, tests, biopsies Medicine (90281–99607) – Immunizations, dialysis, psychiatric care Anesthesia (00100–01999) – Regional and general anesthesia, time-based |

| Category II Codes |

- Optional alphanumeric codes ending in F - Used for tracking performance and quality measures - Not tied to reimbursement, but valuable for MIPS and internal metrics |

| Category III Codes |

- Temporary alphanumeric codes ending in T - Used for emerging tech, new procedures, experimental care - Reviewed biannually for potential elevation to Category I |

Key 2025 CPT Updates You Must Know

Revised E/M Guidelines

The 2025 CPT updates continue the refinement of Evaluation and Management (E/M) coding, following the landmark changes initiated in 2021 and expanded in 2023. In 2025, the AMA has further clarified time-based coding and medical decision-making (MDM) for both outpatient and inpatient settings. Key updates include stricter definitions for “independent interpretation,” “external physician,” and refined examples of data complexity levels to avoid subjective interpretation.

Telehealth E/M visits, now cemented as a permanent modality post-COVID, received modifier guidance updates. Coders must now use place-of-service codes more precisely, especially when providers deliver hybrid models (in-person and remote). This impacts Medicare and private payer reimbursements, with subtle differences between asynchronous reviews and synchronous video consultations.

Critical care services now require clearer documentation of interventions and time spent per calendar date—not per visit instance. This distinction affects high-complexity services like ventilator management, sepsis intervention, and ICU rounding, where time thresholds are often audited.

For 2025, understanding the new E/M hierarchy is critical—not just for accurate billing, but for preventing claim audits and payer scrutiny, particularly in multi-specialty or hospital-based practices.

Deleted/Introduced Codes Affecting Reimbursements

Each year, CPT undergoes code deletions, additions, and revisions—and 2025 is no exception. This year, over 50 codes have been deleted across surgical, diagnostic, and imaging categories due to low utilization or redundancy. Examples include legacy arthroscopic procedures now bundled under broader arthrodesis codes, and multiple digital x-ray codes replaced by single comprehensive codes.

Among the notable new codes: expanded sections under Category I for remote therapeutic monitoring, CPTs for AI-assisted diagnostic support (radiology and pathology), and new codes reflecting gender-affirming procedures, reflecting broader clinical adoption and payer recognition.

Remote physiological monitoring (RPM) codes have been realigned under chronic care management, which changes both the required documentation and frequency of billing. In short: if your team uses RPM tools, the coding now emphasizes ongoing engagement instead of episodic reviews.

Deleted codes no longer payable often get flagged by clearinghouses and Medicare MACs. Coders must update software tools (like AAPC Coder or EncoderPro) and internal cheat sheets to avoid denied claims or resubmission delays. Knowing what’s been introduced—and what’s been phased out—is crucial for clean claim submission and maximizing revenue cycle efficiency.

Common CPT Coding Errors and Fixes

Modifier Misuse and Overcoding

Modifier misuse is one of the most frequent causes of claim denials, audits, and recoupments. Modifiers are meant to clarify the context of a service—but when used incorrectly, they often trigger payer scrutiny instead. One common example is modifier 25, which indicates a significant, separately identifiable E/M service performed on the same day as another procedure. Many coders apply it by default, not realizing that documentation must clearly support the distinct nature of both services.

Overusing modifier 59, which denotes distinct procedural services, is equally risky. CMS has repeatedly flagged this as a compliance concern, urging coders to use more specific X-modifiers when appropriate (e.g., XE for separate encounters, XS for separate anatomical sites). When these distinctions aren’t properly justified, overcoding audits follow.

Overcoding itself often results from misunderstanding the clinical scope of the procedure or inflating service levels without matching documentation. For example, coding a high-level E/M visit based on time alone, without supporting notes on complexity or medical necessity, can lead to flagged claims and payment clawbacks.

The fix? Coders must pair every modifier with matching documentation, stay updated on payer-specific rules, and avoid using modifiers as “just-in-case” additions. When used strategically and supported by detailed provider notes, modifiers protect reimbursement—not jeopardize it.

Documentation Gaps Leading to Denials

Even a correctly selected CPT code can lead to denial if the supporting documentation is weak or ambiguous. Payors increasingly rely on automated claim reviews and natural language processing (NLP) tools to scan medical records for compliance. If documentation doesn’t reflect the intensity, time, and complexity claimed, denials or partial payments are inevitable.

For instance, surgical codes require full operative reports that detail indication, technique, and post-op status. Failing to include critical terms like “complete excision,” “laparoscopic approach,” or “biopsy confirmed intraoperatively” can lead to rejections or downcoding.

In E/M coding, denials often occur when medical necessity isn’t demonstrated. Providers might include all the right checkboxes but fail to narrate the patient story clearly enough to justify the CPT level chosen.

What’s the fix? Implement a real-time documentation checklist for high-risk codes, train providers on defensible note-taking, and integrate smart prompts in your EHR to catch gaps before claims are submitted. Coders must act as the second line of defense, cross-checking clinical narratives against code-level criteria to reduce preventable denials.

| Common Error | Description | Recommended Fix |

|---|---|---|

| Modifier 25 Misuse | Incorrectly applied to E/M services performed on the same day as a procedure without sufficient documentation of distinct services. | Ensure detailed notes support the separate and significant nature of both services before applying modifier 25. |

| Modifier 59 Overuse | Used to unbundle procedures improperly, often without justification. CMS prefers more specific X-modifiers (XE, XS, XP, XU). | Use precise X-modifiers and document clear separation in time, location, or intent. |

| Overcoding E/M Services | Inflating visit levels without documenting medical necessity, complexity, or proper time justification. | Match coding levels to documented complexity and necessity. Avoid defaulting to highest E/M level. |

| Weak Surgical Documentation | Missing key terms or steps in operative reports that justify billed procedures. | Include full operative details like approach, technique, and findings to avoid downcoding or denials. |

| Medical Necessity Gaps | Lack of clear narrative supporting why services were required, even when checkboxes are complete. | Train providers to include patient context and rationale behind clinical decisions in their notes. |

| Missing Real-Time Review | Claims submitted with documentation gaps that could’ve been caught by coders or EHR tools. | Implement checklists and smart EHR prompts to catch and correct issues before submission. |

Coding for Specific Specialties

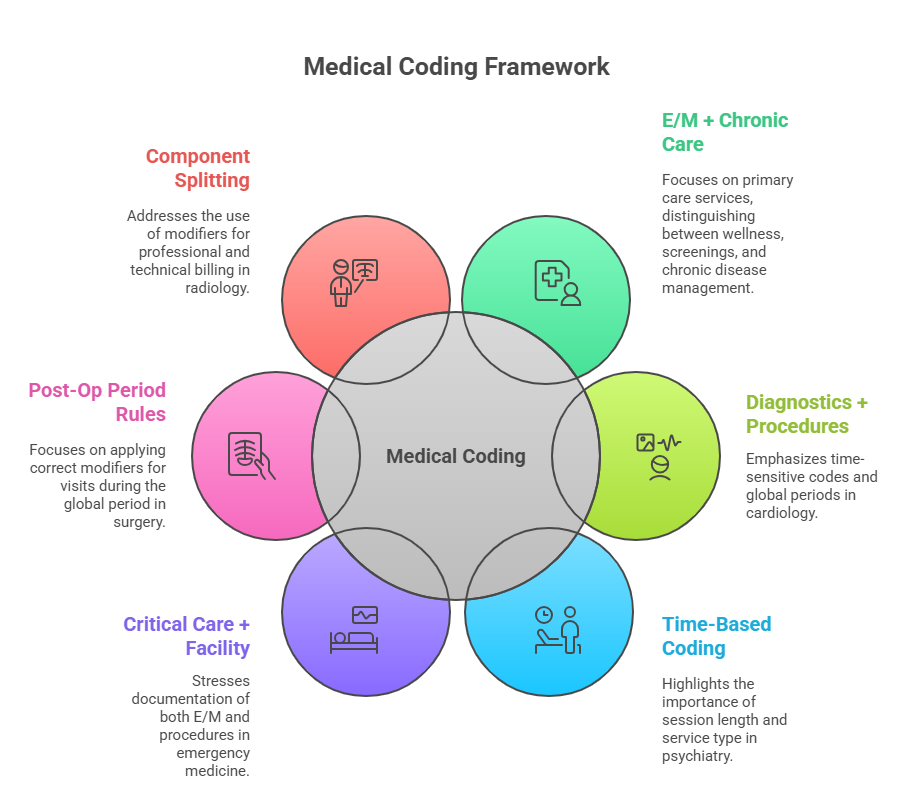

Primary Care, Cardiology, and Psychiatry

CPT application isn’t one-size-fits-all—each specialty has unique coding dynamics that coders must master. In primary care, Evaluation and Management (E/M) services dominate, but coding accuracy hinges on how well chronic disease management, preventive care, and minor procedures are differentiated. Annual wellness visits, immunizations, and screenings each require specific CPTs and modifiers, especially when multiple services are provided on the same date.

Cardiology presents higher complexity, with codes covering diagnostic testing (e.g., echocardiograms, stress tests), interventional procedures, and device monitoring. Coders must navigate global periods, supervision requirements, and ensure correct linkage between procedures and diagnosis codes. CPT also demands precise timing—such as in Holter monitor placement vs interpretation, which require separate CPTs often misapplied as bundled.

Psychiatry coding emphasizes time and intensity. Codes like 90834 or 90837 depend on documented session duration, presence of therapy vs medication management, and patient participation. The line between medical and behavioral health must be clearly drawn, especially when billing evaluation and therapy in one session—a scenario common in psychiatric practices.

Coders working across these domains must tailor their documentation review and code selection processes to each specialty’s expectations. What passes audit in psychiatry may be insufficient in cardiology, and vice versa.

How Rules Vary Across Departments

CPT guidelines don’t just vary by specialty—they evolve within departments based on workflow, provider roles, and service types. For example, in emergency medicine, coders must assess critical care thresholds, procedures like laceration repair, and how facility-level services intersect with provider billing. The same ER might bill for both E/M and procedures—but only if medical necessity and documentation justify both.

In surgical departments, understanding global surgical packages is non-negotiable. Minor and major surgeries come with predefined post-op periods (e.g., 10 or 90 days). Any post-op visits within this window must be coded with modifiers 24, 58, or 79, depending on the context. Missing these nuances can result in denials or duplicate billing flags.

Radiology departments, meanwhile, involve professional vs technical component splits. When interpreting an imaging report offsite, the radiologist uses modifier 26 (professional component), while the facility uses modifier TC (technical component). Coders must confirm documentation supports both sides before splitting claims.

Mastering CPT across departments means going beyond the book—coders must internalize real-world workflows, specialty habits, and payer expectations, or risk claim errors even with the right codes on paper.

Tools That Help You Code Faster and Better

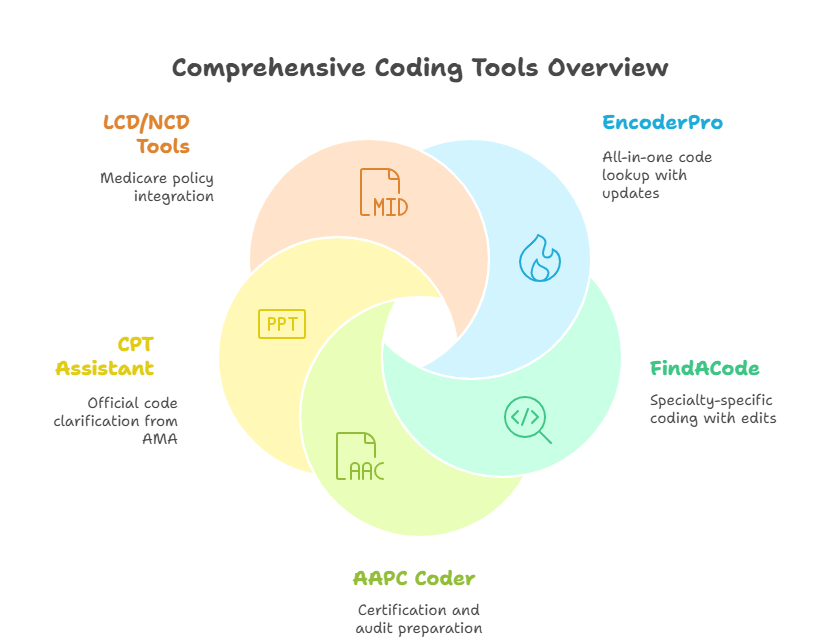

EncoderPro, FindACode, AAPC Tools

In high-volume environments, speed and accuracy aren’t optional—they’re survival metrics. That’s where coding software tools like EncoderPro, FindACode, and AAPC Coder step in. These platforms offer more than code lookups—they provide context, edits, and payer-specific rules that protect your claims from denials before submission.

EncoderPro by Optum360 is known for its comprehensive content paired with regular AMA updates. It flags bundled codes, suggests appropriate modifiers, and offers detailed lay terms that explain procedures in plain language—a valuable training tool for both junior coders and provider education.

FindACode takes it further with customizable dashboards, specialty-specific widgets, and NCCI edit guidance built in. You can view code history, RVU data, and payer coverage policies in one interface. The tool also supports crosswalking between ICD-10, CPT, and HCPCS codes—critical for teams managing both diagnosis and procedural coding.

AAPC’s coding platform integrates certification prep, real-time policy updates, and auditing features. It’s tailored for CPC, CPB, and COC-certified coders, aligning with exam-level rigor. Its side-by-side code comparisons and coding scenario simulations make it indispensable for exam prep and real-world coding alike.

When used correctly, these platforms not only accelerate your workflow—they safeguard your revenue cycle by catching errors before the claim ever leaves your system.

CPT Assistant and LCD/NCD Integration

Understanding how a code works on paper is one thing. Knowing how it’s interpreted by CMS and payers is another. That’s where tools like CPT Assistant and LCD/NCD integrations add critical context.

CPT Assistant, published by the AMA, provides official clarifications, examples, and coding rationale that often become industry standards during payer disputes or audits. It’s the “why” behind the code, helping coders explain intent when questioned. Most top coding platforms integrate CPT Assistant archives or provide add-on access—coders should use this to pre-validate ambiguous scenarios, especially in surgical and diagnostic coding.

On the policy side, Local Coverage Determinations (LCDs) and National Coverage Determinations (NCDs) define what Medicare pays for—and under what conditions. When integrated with coding platforms, they create a feedback loop: coders can match CPT codes with approved ICD-10 diagnoses, ensuring medical necessity is satisfied. This is crucial for lab, radiology, and preventive care services, which often have tight diagnosis-to-procedure rules.

Using these tools together—CPT Assistant for clarification and LCD/NCDs for compliance—empowers coders to defend their choices confidently in both claim submissions and audits.

How CPT Mastery Powers Your Certification and Career

How the Medical Billing and Coding Certification from AMBCI Covers CPT in Depth

If you’re serious about medical coding, CPT isn’t just a language—it’s your professional currency. The Medical Billing and Coding Certification from AMBCI goes far beyond surface-level instruction. It’s built to help you code with real-world accuracy, optimize claim submissions, and handle payer-specific edge cases across specialties. And at the core of that training? CPT mastery, down to the last modifier.

This AAPC-aligned medical coding course is structured around hundreds of practical CPT examples: surgical procedures, E/M levels, bundled service rules, and more. You’ll decode case-based scenarios and learn how to select the correct CPT not just from a dropdown—but from clinical context, documentation clues, and service setting. The course also teaches how to flag errors before submission, use NCCI edits, and apply modifiers the way actual payers expect—not just how textbooks describe them.

On the billing side, CPB training makes sure you understand how CPT codes drive reimbursement, how denial management works, and how to connect diagnoses (ICD-10) to procedures (CPT) for clean claims. By the time you complete the certification, CPT becomes second nature—because that’s what certified, job-ready coders are expected to deliver in today’s revenue cycle teams.

Frequently Asked Questions

-

CPT (Current Procedural Terminology) codes represent the medical, surgical, and diagnostic services that providers deliver. They’re essential because they translate clinical work into billable data for insurers. Without accurate CPT codes, claims can be denied, delayed, or underpaid. CPT coding is especially important in outpatient settings where reimbursement relies on detailed procedure-level reporting. Every service—from flu shots to cardiac ablations—has a CPT code. These codes also drive quality tracking, payer metrics, and compliance audits. Mastering CPT means you’re fluent in the language of modern healthcare transactions, ensuring clean claims and full reimbursement cycles in any medical billing role.

-

CPT codes are updated annually by the American Medical Association (AMA). Each year brings new codes, deletions, and revisions—especially in fast-evolving fields like telehealth, cardiology, and AI-assisted diagnostics. Coders must track not only the codes themselves but also guideline changes, modifier rules, and bundled service alerts. In 2025, major shifts include time-based E/M refinements, new codes for virtual care, and updated bundling rules. Staying updated means using tools like AAPC Coder, EncoderPro, and official AMA CPT Assistant references. If you don’t track changes, you risk denials, downcoding, and revenue leakage—even if the service was clinically perfect.

-

The most common CPT errors include modifier misuse, overcoding, and insufficient documentation. Coders often apply modifiers like -25 or -59 incorrectly, triggering audit red flags. Overcoding—selecting higher-level CPTs than documentation supports—is another frequent issue. It leads to payment clawbacks and potential payer scrutiny. Another major problem is not aligning diagnosis codes (ICD-10) with CPT services, which causes medical necessity denials. Tools can help, but they’re only as good as the coder’s judgment. The best defense is a strong grasp of real-world documentation, compliance rules, and CPT category structures—skills emphasized in any medical billing and coding certification.

-

CPT codes describe what the provider did—the procedures, exams, and services rendered—while ICD-10 codes explain why the service was performed, describing the patient’s diagnosis or condition. CPT is procedure-driven and governs reimbursement amounts, whereas ICD-10 supports medical necessity and determines whether a payer will approve the billed procedure. Together, they tell the full story: a CPT for a chest X-ray must be paired with an ICD-10 for cough or pneumonia to be accepted. Misalignment leads to denials. Coders must link the right CPT-ICD-10 pairs and understand payer policies, which is a core part of any medical billing and coding certification.

-

The most trusted CPT coding tools include EncoderPro, FindACode, and the AAPC Coder platform. These tools offer code search, documentation tips, and payer-specific edits. For context and clarity, AMA’s CPT Assistant is invaluable—it explains code intent and common audit triggers. Coders also rely on LCD/NCD integrations to validate Medicare coverage. NCCI edit tools are essential to check for code pair denials or modifier requirements. The best tools are updated in real-time and allow you to crosswalk between CPT, ICD-10, and HCPCS. Mastering these platforms is part of what distinguishes entry-level coders from job-ready certified professionals.

-

Several tools can confirm CPT code billability. The most reliable include AAPC Coder, EncoderPro, and FindACode—which show real-time bundling edits, payer policy links, and RVU values. Additionally, Medicare's NCD/LCD databases help determine if a CPT is payable under certain ICD-10 diagnoses. These platforms integrate documentation rules and modifier usage alerts. Coders also use payer-specific portals or clearinghouse pre-checks to flag high-risk CPTs. A top-tier medical billing and coding certification should provide hands-on training with these tools to ensure your coding is audit-proof and revenue-positive.

-

Yes, CPT usage is specialty-specific, and rules often vary. For example, psychiatrists rely on time-based psychotherapy codes, cardiologists use procedural codes for stress tests and EKGs, and orthopedic surgeons work heavily with global surgical packages. Each specialty has its own documentation standards, typical modifiers, and payer expectations. Using the wrong code—even if technically correct—can result in denials if it's not customary for that specialty. A quality medical billing and coding certification teaches coders how to align CPT selection with specialty standards and ensure that every claim matches clinical reality.

Summing Up: Why CPT Precision Pays

CPT coding isn’t just about entering the right numbers—it’s about translating clinical work into compliant revenue. Every well-chosen CPT code secures faster reimbursements, reduces denials, and shields providers from audits. But every poorly applied code? It opens the door to payout delays, recoupments, or worse—legal penalties.

The difference between a rejected claim and a paid one often comes down to documentation alignment, modifier usage, and specialty-specific application. Coders who master CPT aren’t just technicians—they’re strategic assets in every healthcare practice. When you pair that mastery with the right training, like a medical billing and coding certification, you're not just coding—you’re powering the financial engine of modern healthcare with precision, speed, and trust.