Career Roadmap to International Medical Coding Consultant

If you want location-independent income, global exposure to payer rules, and leverage to negotiate premium rates, becoming an International Medical Coding Consultant is your fastest asymmetric move. Unlike static in-house roles, consultants monetize deep CPT/HCPCS/ICD-10 mastery across markets, prove value with audit deltas, and scale by packaging SOPs, QA frameworks, and education tracks for clients. This guide gives you a battle-tested path: what to learn, which deliverables win contracts, how to price, and how to avoid cross-border compliance traps—grounded in portfolio assets you can build this quarter and reinforced with resources across AMBCI to accelerate outcomes.

1) What an International Medical Coding Consultant Actually Delivers (and Why Clients Pay Premiums)

Global buyers don’t pay for “hours coded”—they pay for measurable revenue integrity. High-value deliverables include denial-reduction playbooks built from CARC/RARC analytics (pair with the insights from accounts receivable (A/R) workflows), risk-weighted sampling plans and QA SOPs aligned to quality assurance in medical coding, and advanced E/M 2023–2025 training mapped to physician behavior. Consultants who combine coding accuracy with reimbursement strategy monetize faster—especially when supported by a solid knowledge base of CPT coding guidelines, specialty-specific CPT surgery directories, and CAC oversight from computer-assisted coding terms.

Your positioning is simple: “I cut denials, lift compliant revenue, and create inspection-proof audit trails.” Back it with artifacts like appeal packet templates, LCD/NCD compendia, and training micro-modules that you can later convert into a billable education product (see revenue ideas aligned with becoming a coding educator and how to become a billing & coding instructor). Tie outcomes to A/R days improvements, first-pass rate >96%, and appeal overturns >35%, then prove the link using before/after baselines and payer-specific rulebooks (cross-reference your claims knowledge with electronic claims processing terminology and Medicare nuances from the reimbursement calculator guide).

2) The Step-by-Step Roadmap: From Domestic Coder to Global Consultant

Step 1: Codify core credentials and specialization.

Anchor with CPC or CCS and build niche depth—orthopedics, cardiology, anesthesia, GI, telehealth. Use the CPC exam guide and the CCS exam guide to validate fundamentals. Pair that with a surgery-focused CPT directory and a second specialty directory (surgery directory #2) for depth.

Step 2: Build revenue-linked case studies.

Don’t present “tasks.” Present delta vs. baseline: downcoded E/M recovery, CCI edit bundling fixes, modifier 59/XS/95 governance. Track deltas using an A/R dashboard (leverage principles from A/R references) and quality assurance frameworks (QA primer).

Step 3: Productize knowledge.

Package a 60-minute E/M pitfalls module, a denial code playbook referencing the CARC top-10, and a specialty abstraction training. Price per module, then offer a bundle + quarterly refresh subscription. This pairs well with articles on continuing education for coders and career acceleration via medical billing certification strategies.

Step 4: Learn payer and platform diversity.

Demonstrate ability to switch between US Medicare, private payers, and international funders. Compile LCD/NCD summaries, and contrast these with APAC/EMEA payer rules. Keep a matrix mapping POS/telehealth rules and anesthesia unit calculations. For tooling, learn two of the top billing software directories (alt list) and stay fluent in EMR exports for audit trails (audit trail guide).

Step 5: Add compliance consulting.

International clients value consultants who flag OIG-style risks and build BAA/DPA templates. Study the pathway to OIG Healthcare Compliance Auditor and weave coding + compliance into a single offer: policy refreshers, audit schedules, risk registers, and CAPA workflows.

Step 6: Market entry strategy.

Piggyback on growth markets—GCC, Singapore, India—where providers serve US and EU contracts. Position yourself as a bridge: “We’ll align your coding to US payers while maintaining local privacy regs.” Use thought-leadership posts anchored in trends (e.g., emerging job roles, automation-proof roles) to pull in cross-border leads.

3) Portfolio Assets That Close Cross-Border Deals (Templates You Can Build This Month)

Audit-first case study. Pick a payer-dense specialty (orthopedics, GI, cardiology). Perform a pre-engagement audit on 50–100 encounters, document downcode/evidence gaps, and present projected lift with defensible references from CPT guideline details and surgery code directories (one, two). Attach a CAPA plan aligned with quality assurance controls and prove A/R impact via A/R metrics.

Denial playbook & appeal packets. Map Top-10 CARC codes for the target payer mix; include templated appeal letters with citations, medical necessity bullets, and modifier governance rules. Link this to clean claims literacy from electronic claims processing and Medicare reimbursement nuances (calculator guide).

Training stack. Record micro-modules for E/M pitfalls, specialty-specific abstraction (e.g., cardiology cath lab), and CAC supervision built off CAC terminology. Offer a quarterly update subscription as an upsell. Tie learning pathways to credential prep via CPC and CCS.

Regulatory & privacy binder. Build a BAA/DPA toolkit, a data-flow map, and a risk register referencing OIG themes from the OIG auditor roadmap. Add an audit trail SOP grounded in audit trail principles, plus a QA schedule from QA fundamentals.

Thought leadership. Publish “Country Primer: Coding for US Payers from Singapore/GCC/India,” featuring denial patterns, POS rules, and telehealth caveats—then funnel to lead magnets like a CPT device coding checklist (lifted from your surgery directory research) and a denial appeal swipe file. For sustained reach, align with trends from emerging roles for coders and automation-resilient jobs.

Quick Poll: What’s your biggest blocker to going international as a coding consultant?

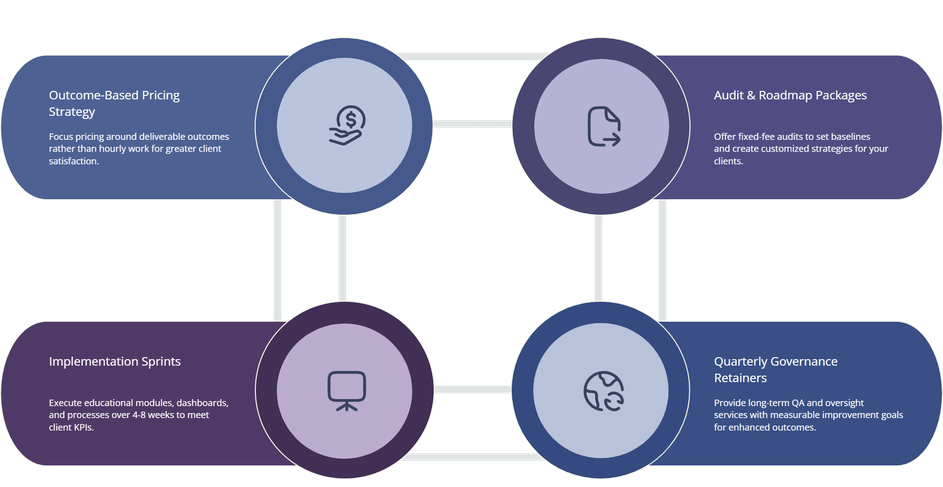

4) Pricing, Packaging, and Contracts (How to Stop Leaving Money on the Table)

Price for outcomes, not hours. Create a rate card with three anchors:

Audit & Roadmap (fixed fee): baseline audit, denial analysis, KPI targets, CAPA plan.

Implementation Sprint (4–8 weeks): education modules, SOP deployment, appeal packet library, KPI dashboard.

Quarterly Governance (retainer): QA cycles, sampling, LCD/NCD updates, CAC oversight.

Back each tier with defined KPIs—accuracy ≥95%, first-pass rate ≥96%, appeal overturn ≥35%, denial volume −25–35%. Use SOW language that clarifies scope, success metrics, data access, and privacy (attach BAA/DPA templates). In your SOW, reference coding quality standards and audit trails using the audit trail guide and QA using the QA reference.

International pricing levers.

Complexity uplift: Add premiums for multi-country code set mappings and device-heavy surgeries supported by citations from CPT guidelines.

Speed premium: 48-hour clean-claim turnarounds, expedited denial appeals.

Education multiplier: If your training replaces external CE spend, position your bundle alongside formal CE value from continuing education.

Risk-share models: For select clients, tie a portion of fees to measurable A/R improvement or denial reduction (know your baselines from A/R reference).

Contract pitfalls to avoid.

Never allow open-ended scope on “education” without module counts; enforce IP clauses that let you resell de-identified training assets. Include data-security deliverables (access controls, outbound transfers), and a jurisdiction clause consistent with the client’s data location. Maintain versioned SOPs and change logs as part of your inspection-readiness posture (connect to audit trails and QA).

5) Market Entry Playbooks: US, GCC, APAC (Where to Start and What to Watch)

United States (direct or via RCM/CROs).

Lead with Medicare mastery, denials intelligence, and E/M 2023–2025 updates. Offer a “30-Day Denial Stabilization” sprint that deploys Top-10 CARC playbooks, modifier governance, and appeal templates (tie to electronic claims terms, Medicare calculator guide). Reinforce via credential signaling with CPC and CCS.

GCC (UAE, KSA, Qatar).

Hospitals and vendor groups often service US claims while operating locally. Your edge: payers knowledge + privacy (BAA/DPA) and telehealth POS correctness. Offer train-the-trainer packages and quarterly LCD refreshes. Demonstrate A/R literacy (A/R reference) and QA frameworks (QA guide) that pass inspections.

APAC (India, Singapore, Philippines).

Pitch center-of-excellence consulting: sampling calculators, CAC supervision, and specialty education. Showcase software fluency using the billing software directories and your CPT surgery directories (one, two). Promise a go-live in ≤30 days: you deliver SOPs, metrics definitions, and a full appeals library.

Risk management everywhere.

Global clients fear recoupments and reputational damage more than fees. Calm that fear by embedding a risk register, audit schedule, and closed-loop education cycle (CAPA → micro-module → retest). Position yourself as the governance layer—the person who keeps CAC fair, physicians documented, and KPIs honest. For long-term differentiation, evolve into revenue cycle leadership (revenue cycle manager guide) or HIM transitions (HIM transition guide) while keeping a consulting revenue base.

6) FAQs — International Medical Coding Consultant

-

Lead with a paid diagnostic: a 2-week audit of 100 encounters producing denial heatmaps, modifier governance gaps, and appeal packet templates. Price it as a fixed-fee roadmap. Use references and checklists from CPT guideline details, A/R literacy from the A/R reference, and an audit trail SOP via the audit trail guide.

-

Start with CPC or CCS (see the CPC exam guide and CCS exam guide). Stack specialty authority using the CPT surgery directories (one, two) and keep CE pathways active with continuing education.

-

Create a tiered SOW: Audit & Roadmap → Implementation Sprint → Quarterly Governance. Add premiums for multi-code set mapping and device-heavy surgeries backed by CPT rules. Tie success fees to A/R improvements (A/R reference) and denial reductions using CARC playbooks.

-

Delta vs. baseline dashboards: accuracy %, first-pass %, overturn rate %, and E/M revenue integrity gains—supported by policy citations and operational SOPs. Attach appeal packet exemplars mapped to LCD/NCD identifiers (grounded in electronic claims terms) and Medicare reimbursement expectations (calculator guide).

-

Establish human-in-the-loop governance: manual review thresholds, false-positive audits, and specialty-specific rule tuning. Present a quarterly CAC performance report using terminology from CAC foundations and tie QA to coding quality controls.

-

You must keep privacy and security distinct: maintain BAA/DPA templates, define data access windows, and store de-identified training data. Borrow risk cues from the OIG auditor roadmap, maintain audit trails per the audit guide, and keep QA evidence from the QA reference.