Ethical Practices in Medical Billing: Key Principles

Ethical practices in medical billing are essential to maintaining the integrity of the revenue cycle and building trust with patients, providers, and payers. Inaccurate billing or unethical practices can lead to audits, financial penalties, and loss of credibility. This article provides a comprehensive guide to help medical billing professionals navigate ethical challenges by implementing key principles such as accuracy, transparency, and confidentiality.

By following these best practices, you’ll not only ensure compliance but also enhance the financial health of your practice. This guide will cover essential principles and actionable strategies that will help you streamline your billing processes while upholding the highest standards of ethics. For more information on how to maintain proper documentation and stay compliant, you can read our Guide to Clinical Documentation Integrity Terms.

Why Ethical Practices Matter in Medical Billing

The Role of Ethics in Medical Billing

Ethical billing practices are foundational to the smooth operation of the healthcare industry. Medical billing professionals play a critical role in ensuring fair reimbursement and transparent financial transactions. Maintaining ethical practices, such as submitting accurate claims based on documented services, fosters trust between healthcare providers, patients, and insurance companies. This trust is essential for smooth operations and lasting relationships within the industry. For more on how to ensure accuracy in your practice, read our Guide to Fraud, Waste & Abuse (FWA) Terms for Coders.

Avoiding Fraud and Legal Consequences

Engaging in fraudulent billing practices, such as upcoding or overbilling, can lead to severe legal consequences. These practices may result in hefty fines, lawsuits, or loss of certification. Ethical billing, on the other hand, ensures long-term success by preventing legal risks and maintaining professional credibility. Medical billing professionals must undergo regular training to stay compliant and reduce the chances of committing unintentional errors. You can read more about ethical coding and compliance in our Guide to Fraud, Waste & Abuse (FWA) Terms for Coders.

The Importance of Ethics in Medical Billing

Maintaining ethical practices in medical billing is essential for ensuring transparency, fairness, and trust across the healthcare industry. Billing professionals must ensure that all claims are accurate, based on documented services, to prevent fraud and maintain credibility. Engaging in fraudulent activities, such as upcoding or overbilling, can lead to serious legal repercussions, including fines or loss of professional certification. Ethical practices not only protect against legal risks but also strengthen relationships with patients, healthcare providers, and insurers. Regular training is crucial to stay compliant and avoid errors.

For more information on compliance and ethical practices, check out our Guide to Fraud, Waste & Abuse (FWA) Terms for Coders.

Key Ethical Principles in Medical Billing

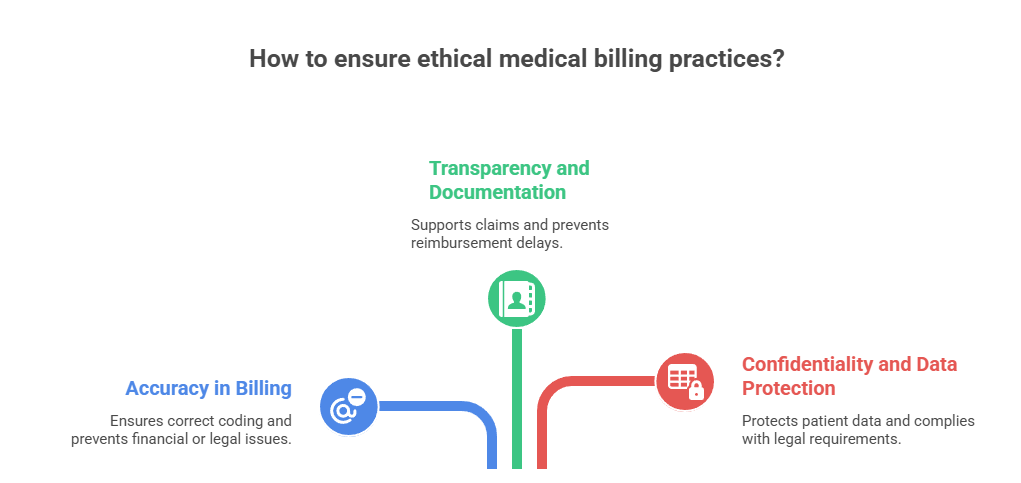

Accuracy in Billing

Accuracy is one of the cornerstones of ethical billing practices. Medical billing professionals must ensure that every claim submitted reflects the exact services rendered. This includes using the correct codes for diagnoses, treatments, and procedures. Failure to submit accurate claims can result in financial losses or legal consequences. Additionally, maintaining accuracy protects healthcare providers from audit discrepancies. For example, when billing for ambulatory surgery, it’s essential to use CPT codes for ambulatory surgery to ensure compliance.

Transparency and Documentation

Proper documentation is essential for maintaining transparency in medical billing. Every service provided to a patient should be clearly documented in the medical records, and these records should support the claims submitted to insurers. This level of transparency ensures that claims are justifiable, preventing discrepancies and delays in reimbursement. Medical coders and billers should make it a practice to keep detailed, organized records for future audits. This aligns with the Guide to Durable Medical Equipment (DME) Coding, which emphasizes the importance of comprehensive and transparent documentation.

Confidentiality and Data Protection

Upholding confidentiality and securing patient data is a legal requirement under HIPAA and an ethical necessity. All patient records must be stored securely to prevent unauthorized access or misuse. Medical billing professionals should follow established protocols to ensure that all sensitive patient information is kept private. In addition, billing and coding staff should be trained regularly on Confidentiality in Coaching to understand best practices in safeguarding confidential information.

Preventing Common Ethical Pitfalls in Medical Billing

Upcoding and Downcoding

Upcoding and downcoding are unethical practices that can lead to severe financial and legal consequences. Upcoding occurs when a healthcare provider uses a higher-level code than what was actually performed in order to receive a higher reimbursement. On the other hand, downcoding refers to reporting a lower-level code than the actual procedure, potentially leading to financial losses for the provider. Both practices compromise the integrity of the medical billing process and may result in legal actions. Understanding medical coding audits is essential to avoid these pitfalls and ensure that all services are billed accurately.

Overbilling and Underbilling

Overbilling and underbilling can both cause significant issues for healthcare providers. Overbilling inflates claims, which may lead to audits and potential fines, while underbilling results in financial losses as the provider does not receive the full payment they are entitled to. Proper training on accurate billing practices and the use of CPT codes can help prevent both overbilling and underbilling, ensuring a more sustainable revenue cycle.

Inaccurate or False Documentation

Inaccurate or false documentation is one of the most serious ethical issues in medical billing. This can include anything from missing or incorrect patient information to failure to document the services rendered. This type of error can delay payments, lead to claim denials, and increase the risk of fraud. By regularly performing internal audits and ensuring that all documentation complies with quality assurance in medical coding guidelines, you can avoid these issues and maintain the integrity of the billing process.

| Ethical Pitfall | Explanation | Prevention Strategy |

|---|---|---|

| Upcoding and Downcoding | Upcoding involves using a higher-level code to receive higher reimbursement, while downcoding is using a lower-level code, potentially leading to financial losses. | Ensure accurate coding based on actual services performed. Regular medical coding audits can help detect these unethical practices. |

| Overbilling and Underbilling | Overbilling inflates claims, risking audits and fines, while underbilling causes revenue loss by not receiving full reimbursement. | Proper training in accurate billing practices and the use of correct CPT codes can prevent both issues. |

| Inaccurate or False Documentation | This includes missing or incorrect patient information or failing to document services rendered, which can delay payments and increase fraud risks. | Conduct internal audits regularly and ensure compliance with medical coding guidelines to maintain accurate documentation. |

Best Practices for Ethical Medical Billing

Training and Education

To ensure compliance and maintain ethical practices, it’s crucial to provide regular training on coding guidelines, billing regulations, and best practices for ethical billing. Continuous education helps your team stay updated on the latest coding changes, regulatory updates, and potential pitfalls. A well-trained team can spot and avoid common billing errors, thus maintaining the integrity of the billing process and minimizing the risk of fraud.

Implementing Internal Audits

Internal audits are essential for identifying potential errors or discrepancies in your medical billing process. These audits ensure that all claims are accurate, compliant, and properly documented. Regular audits can help detect problems before they escalate, reducing the risk of fines or claim denials. Implementing a regular schedule of internal audits will give you the peace of mind that your practice’s billing processes align with fraud, waste, and abuse (FWA) regulations and coding standards.

Utilizing Coding and Billing Software

Using coding and billing software that integrates with your EHR systems helps ensure accurate billing, reduces errors, and improves efficiency. These tools help automate the coding and billing process, reducing the chance of human error. With integrated software, your team can quickly check codes, verify patient information, and ensure all documentation is complete. This minimizes the risk of incorrect claims and ensures compliance with the latest healthcare billing standards.

What do you think is the most important factor in ethical medical billing?

Legal and Regulatory Considerations in Medical Billing

HIPAA Compliance

Maintaining HIPAA compliance is crucial for protecting patient privacy and avoiding penalties. Medical billers must ensure that patient health information is securely handled and only accessible to authorized personnel. This includes securing all electronic, paper, and verbal communications containing patient data. By following HIPAA regulations, you ensure that your practice maintains confidentiality and avoids costly penalties associated with data breaches or non-compliance.

Medicare and Medicaid Regulations

Adhering to Medicare and Medicaid regulations is vital for ensuring accurate reimbursement and preventing audits. These programs have specific billing rules and guidelines that must be followed for proper reimbursement. Understanding the requirements and keeping up with updates from Medicare and Medicaid ensures your practice remains compliant with their billing rules, which is essential for minimizing the risk of claim denials or legal consequences.

Third-Party Payer Requirements

Each third-party payer has specific coding requirements and claim submission rules. Familiarizing yourself with these rules ensures that claims are processed smoothly and efficiently. Understanding these individual payer requirements is critical for maximizing reimbursements, preventing denials, and ensuring that billing codes are accurate. Keeping up with the latest payer guidelines can help avoid delays and improve cash flow for your practice.

| Regulation | Key Focus | Why It Matters |

|---|---|---|

| HIPAA Compliance | Protecting patient health information | Ensures privacy, avoids data breaches and penalties |

| Medicare & Medicaid | Following government billing guidelines | Prevents denials, ensures proper reimbursements |

| Third-Party Payers | Meeting payer-specific coding and submission rules | Reduces delays, increases cash flow accuracy |

Conclusion: Upholding Integrity in Medical Billing

Ethical practices in medical billing are essential to ensuring the accuracy and integrity of the revenue cycle. Key principles such as accuracy, transparency, confidentiality, and compliance are vital for maintaining trust with patients, payers, and healthcare providers. By adhering to these principles, billing professionals can avoid fraud, errors, and legal consequences, while also ensuring fair reimbursement and timely payments.

Building a reputation based on integrity will not only foster trust but will also help establish long-term success in the medical billing profession. It is essential to consistently apply ethical standards in every aspect of your work, from payment posting to coding and claims submission.

As you continue to grow in your career, remember that ethical practices serve as the foundation of a successful and sustainable medical billing business.

Call to action: Take actionable steps to implement these ethical practices and ensure that your medical billing operations remain compliant, transparent, and fair.

Frequently Asked Questions

-

The key ethical principles in medical billing include accuracy, transparency, and confidentiality. Accuracy ensures that all claims submitted are correct and reflect the services provided, preventing fraud or errors. Transparency involves maintaining open communication with patients and payers regarding billing practices, helping to build trust and avoid misunderstandings. Confidentiality is vital in safeguarding sensitive patient information, adhering to HIPAA guidelines to protect privacy. By following these principles, billing professionals can ensure compliance, reduce legal risks, and foster positive relationships with patients and insurance providers. Additionally, implementing regular audits and maintaining detailed documentation helps to uphold these ethical standards and ensures that all financial transactions are properly recorded and supported.

-

Accuracy in medical billing is crucial to ensure that healthcare providers receive the correct reimbursement for services rendered. Submitting inaccurate claims can result in underpayment or overpayment, leading to delayed reimbursements or even legal consequences. Accurate billing requires proper coding, correct patient information, and adherence to payer guidelines. By maintaining accuracy, billing professionals help prevent fraudulent activities, minimize the risk of denials, and ensure that both healthcare providers and patients are billed appropriately. Utilizing automated tools and maintaining standardized procedures for billing processes can further enhance accuracy and efficiency in the medical billing workflow, allowing for smoother operations and increased financial stability for healthcare organizations.

-

Transparency in medical billing is essential for building trust between healthcare providers, patients, and payers. By providing clear, upfront explanations of charges, payment expectations, and billing procedures, billing professionals help reduce confusion and disputes. Transparent billing allows patients to understand what services they are being charged for and why, preventing surprise bills. It also facilitates communication with insurance companies, ensuring that both parties are aligned on claims and payments. Billing transparency encourages healthcare providers to maintain detailed and accurate documentation, which supports the claims process and simplifies audits. Additionally, fostering transparency can help healthcare organizations stay compliant with regulations and avoid legal repercussions related to billing errors or fraud.

-

Confidentiality is one of the most important ethical practices in medical billing. Protecting patient data and ensuring its confidentiality is not only an ethical obligation but also a legal requirement under HIPAA regulations. Billing professionals must ensure that sensitive patient information, such as medical histories, diagnoses, and treatment plans, is securely stored and shared only with authorized individuals. Mishandling of patient data can result in severe penalties, loss of trust, and potential lawsuits. Therefore, healthcare organizations must have stringent data protection practices, including secure digital storage systems, restricted access, and regular employee training on confidentiality standards. By prioritizing confidentiality, billing professionals uphold patient trust and ensure compliance with privacy laws.

-

Regular audits are a key strategy to maintain ethical practices in medical billing. Auditing helps to identify any discrepancies or inaccuracies in billing processes, such as overbilling, underbilling, or coding errors. By conducting internal audits, billing professionals can detect and address issues early, preventing fraud and ensuring that all claims are properly substantiated. Audits also provide an opportunity to verify that billing procedures are compliant with payer guidelines and regulatory standards. Furthermore, audits create a culture of accountability within the organization, reinforcing the importance of ethical billing practices. Regular reviews and audits ensure that billing remains accurate, transparent, and aligned with industry regulations, ultimately improving financial performance and minimizing the risk of legal challenges.