Guide to Physician Fee Schedule Terms

The Physician Fee Schedule decides how many practices survive a denial spike and how many bleed revenue quietly through underpayments. If you do not understand its language, you cannot spot pricing errors, defend medical necessity narratives, or explain why two identical services pay differently across locations. This guide breaks down the core Physician Fee Schedule terms, what each one means in real billing workflows, and how to use them to build cleaner claims, stronger appeals, and tighter audit defense using the same process discipline behind medical claims submission and financial audit readiness.

1. What the Physician Fee Schedule is and why these terms control your revenue

The Physician Fee Schedule is a payment methodology that translates a service code into a dollar amount after multiple policy and math steps. Your biggest risk is assuming “correct code equals correct payment.” In reality, payment depends on factors like place of service, geographic adjustments, provider enrollment details, and whether the service is bundled or reduced. That is why fee schedule fluency pairs directly with strong coding compliance controls and clean claim submission workflows.

Fee schedule misunderstandings create predictable pain:

Teams write off underpayments because they cannot explain why a line item paid low, even though the fix is often a corrected claim or contract alignment supported by audit terminology and denial logic found in claims terminology.

Coders and billers fight payers using the wrong language, which weakens appeals and increases recoupment risk, especially in high scrutiny areas like emergency medicine CPT coding and procedural billing like cardiology CPT coding.

Practices miss payer policy shifts, which is how “sudden denials” happen when rules change and workflows do not, a pattern discussed in regulatory changes and broader Medicare and Medicaid billing regulation.

If you can read fee schedule language, you stop guessing. You build a repeatable system that prevents denials, catches underpayments early, and supports appeals with payer friendly logic using the same evidence discipline as clinical documentation integrity and risk framing from FWA terminology.

2. How to read fee schedule pricing like a revenue analyst

The fee schedule is not a single price list. It is a formula. The formula mindset helps you diagnose why a claim paid low without wasting weeks in back and forth. Start by confirming the code and setting because facility versus non facility pricing can change the practice expense portion dramatically. That is why POS accuracy is not “front desk stuff.” It is a payment driver tied to clean claim submission processes and it becomes a compliance risk when repeated errors show up in financial audits.

Next, understand the three RVU components. Work RVU explains provider effort. Practice expense RVU explains overhead. Malpractice RVU is smaller but still matters in some localities. When you review payment variance, you are not only checking “did they pay.” You are checking whether the correct setting and locality were applied. If you do not track this, you miss systematic underpayments, which is the same blind spot that causes recurring denials discussed in coding compliance trends and automation driven edits described in AI in revenue cycle management.

Fee schedule reading becomes even more important when codes are bundled or reduced. If a second line item pays less, it may be a multiple procedure reduction rather than an error. If a line item denies, it may be an edit that requires a modifier and distinct documentation. This is why coders who can connect fee schedule logic to procedure coding resources like cardiology CPT guidance and high volume coding like emergency medicine CPT coding become the people who stop revenue leakage instead of just reacting to it.

3. Fee schedule terms that prevent denials and help you win underpayment disputes

The best fee schedule skill is not memorizing definitions. It is using the terms to build a denial prevention system. Start with expected payment validation. When you post payments, compare paid to expected allowed, then classify variances. That is the same analytics discipline described in predictive analytics in medical billing, and it becomes more valuable as automation increases in billing role transformation.

When you find a variance, the fee schedule terms tell you where to look:

If the difference looks like a setting issue, verify POS and facility status using a clean submission checklist from medical claims submission terminology.

If the difference looks like bundling or edits, validate code pairing logic, then confirm whether documentation supports a modifier. Strengthen documentation consistency using CDI terms so your modifier use is defensible in audits.

If the line item denies as not medically necessary, your fix is not “change the code.” Your fix is documentation alignment. Connect symptoms, findings, assessment, and plan into a single logic chain that reviewers can follow, a discipline reinforced in coding compliance trends.

Fee schedule fluency also helps you avoid “appeal spam.” Many teams appeal everything. That is how they miss timely filing and lose winnable claims. Use fee schedule terms to decide whether the correct move is corrected claim, reconsideration, or full appeal, anchored in claims submission terminology and audit proof structuring from financial audit guidance. Your goal is precision. Fix what is fixable quickly. Appeal what is truly wrong. Document what is risky.

4. Fee schedule compliance and audit terms that protect you from recoupments

Auditors rarely say “you are wrong” directly. They use terms like insufficient documentation, incorrect setting, improper modifier, or non covered service. Fee schedule terms help you translate those phrases into a defensive strategy that protects cash flow. Start with the highest risk pattern: systematic errors. If POS is wrong across a provider group, it is not a one off. It is an operational control failure. That is why audit readiness begins with consistent workflow controls described in coding compliance trends and evidence packaging learned in financial audit terminology.

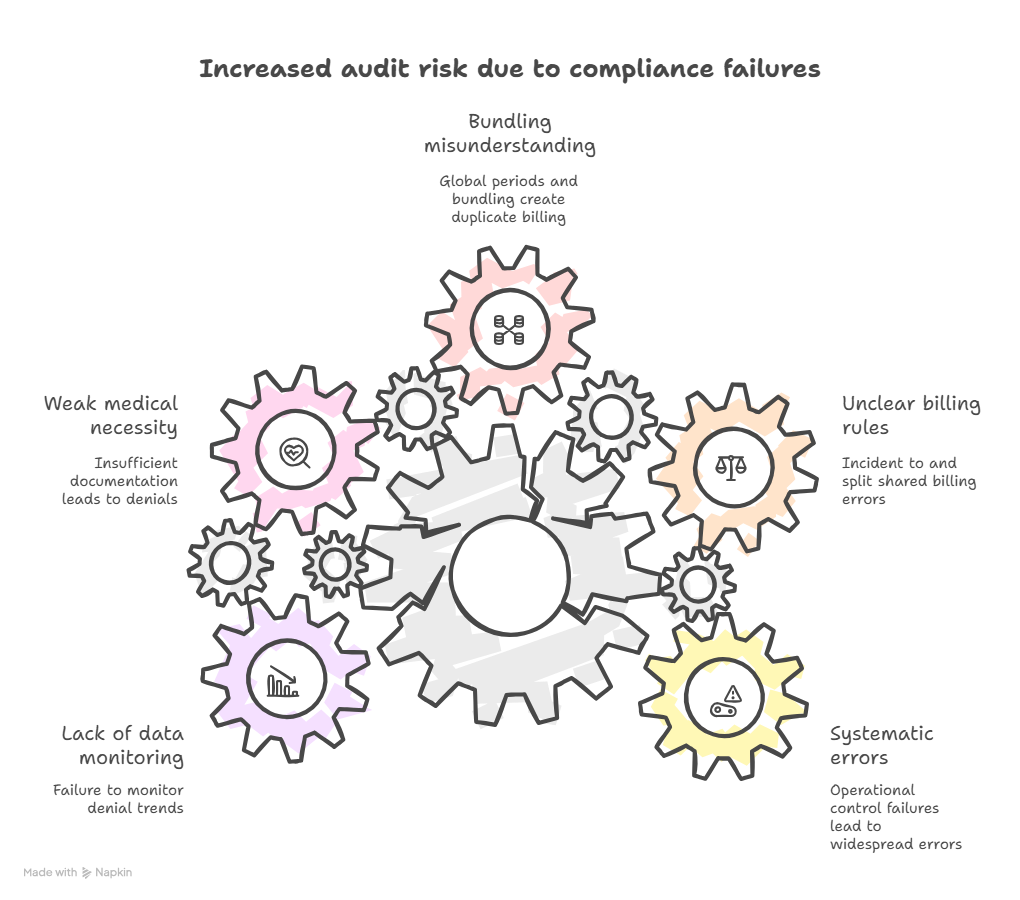

Next, understand how fee schedule rules amplify compliance risk:

Incident to and split shared billing can be payable but they are audit magnets when supervision and documentation rules are unclear. That is where tight documentation governance from CDI terminology reduces risk.

Global periods and bundling create “duplicate billing” findings when teams do not understand what is included. Your best defense is coding discipline plus clean submission logic anchored in claims submission terminology.

Medical necessity is the most expensive failure mode because it leads to denials and postpayment recoupments. Strengthen medical necessity narratives with structured documentation and compliance language, and understand how FWA framing can escalate audits using FWA terminology.

Compliance is also becoming more data driven. Payers use analytics to find outliers and target review. That is why adopting denial trend monitoring inspired by predictive analytics and preparing for automation based edits described in AI in RCM is no longer optional. The teams that survive tighten controls before the audit letter arrives.

5. Operational playbook and career leverage from fee schedule fluency

Fee schedule fluency is an operational advantage. It lets you move beyond coding output into revenue protection, denial prevention, and audit defense. If you can explain why a line item paid low using RVU components and setting logic, you become the person leadership trusts when payment trends shift. That skill becomes even more valuable as the industry moves toward automation and oversight discussed in medical coding with AI and future workforce change described in future skills for medical coders.

Use this simple playbook to turn fee schedule terms into daily control:

Build a quick reference list of your highest volume codes and the expected payment logic by setting, then tie it into your claims submission workflow.

Create a variance queue that flags payments outside a defined range, then use root cause categories aligned to audit terminology.

For denial prone specialties, build specialty playbooks using resources like emergency medicine CPT coding and cardiology procedure coding, then connect documentation prompts to CDI terms.

Keep a policy change log and align it to the broader environment described in regulatory changes and Medicare and Medicaid billing rules.

Career wise, fee schedule fluency supports advanced roles because it translates across settings. It helps coders grow into consulting paths like international medical coding consultant, remote opportunities like remote overseas billing specialist, and hybrid pathways connected to process heavy roles discussed in remote workforce management. It is one of the cleanest ways to become valuable without needing to code faster.

6. FAQs

-

The most actionable term is the allowed amount concept tied to RVUs and setting. If you compare expected allowed amounts to actual payments, you can detect underpayments early instead of discovering them months later in write off reports. Build the workflow using claims submission terminology and variance monitoring inspired by predictive analytics. When you find a gap, classify it as POS error, bundling reduction, or payer processing issue, then route it properly using audit style documentation habits from financial audits.

-

Geographic adjustments are a major reason. The GPCI modifies components of RVUs based on regional cost differences, which changes the final payment after applying the conversion factor. Payment can also differ based on facility versus non facility setting driven by POS and practice expense RVUs. This is why POS accuracy and provider setup control payment, and it connects directly to claims submission workflows and compliance expectations from coding compliance trends.

-

POS mistakes, modifier misuse, and unrecognized bundling edits create a large share of avoidable denials. These are usually workflow failures, not clinical failures. Tighten documentation and coding coordination using CDI terms, then standardize submission fields using claims submission terminology. For procedure heavy services, keep strong specialty references like cardiology coding and emergency medicine coding to reduce incorrect code pair choices that trigger edits.

-

Auditors want proof that the billed service was necessary, correctly coded, and billed under correct setting rules. Fee schedule terms help you build a clean narrative that explains why the service is payable and why the payment logic applies. Pair fee schedule language with evidence packaging from financial audit guidance and compliance framing from FWA terminology. Strong defense is structured and searchable, not emotional.

-

Build a small change management routine: track your top codes, monitor denial reasons weekly, and document changes as operational updates rather than random news. Use structured monitoring like predictive analytics and align your compliance education with regulatory change awareness and Medicare and Medicaid billing rules. As automation rises, keep your team sharp using insights from AI in revenue cycle.

-

It moves you from production output to revenue protection. When you can explain pricing logic, catch underpayments, and prevent denials, you become valuable to leadership and clients. This skill supports consulting work like international medical coding consultant and remote roles like remote overseas billing specialist. It also aligns with the future described in medical coding with AI and the new expectations described in future skills for coders.

-

Include the claim details, the paid EOB or remittance, your expected calculation rationale, and supporting documentation if the payer challenges setting or medical necessity. Keep the packet indexed and short, using structure principles from claims submission terminology and evidence habits from financial audit guidance. If the issue is documentation based, strengthen it using CDI terms so your argument is proof based.

-

To strengthen your operational skill, study medical claims submission terminology and financial audit terminology. To future proof your career, add AI in revenue cycle, predictive analytics in billing, and future coder skills. For specialty billing context, keep references like emergency medicine CPT coding and cardiology CPT guidance ready for real world claim defense.