Revenue Cycle Management Efficiency: Original Metrics & Benchmarks Report

Most revenue cycle teams feel busy but cannot prove whether they are truly efficient. Executives see AR creeping up, denials piling in work queues, and write-offs quietly eroding margin, while coders and billers insist they are overloaded. A real Revenue Cycle Management (RCM) efficiency report replaces opinions with hard numbers: precise metrics, credible benchmarks, and clear levers to move each indicator. This article pulls together those metrics, ties them to career-level skills from AMBCI’s resources, and shows you how to turn daily tasks into measurable financial wins.

1. Why RCM Efficiency Is the Real Profit Center in 2025

In most hospitals and large practices, the biggest “new revenue source” is not another service line; it is capturing income you already earned but lost to delays, denials, or underpayments. Every extra day in AR is an interest-free loan to payers, which is why benchmarks in the 2025 medical coding salary guide tie higher pay to teams that shorten cash cycles. When coders and billers understand RCM metrics, they move from data entry to revenue protection, a shift echoed in the career guide for revenue cycle managers.

Traditional productivity measures—claims per day, encounters coded per hour—miss the point if those claims are inaccurate or uncollectible. High performers link their daily queue work to clean claim rate, denial overturns, and net collection percentages, using references like coding denials management best practices and revenue leakage analytics. When leaders combine these KPIs with solid knowledge of accounts receivable principles and electronic claims workflows, RCM efficiency becomes a disciplined, measurable science rather than a vague, reactive grind.

| Metric | What It Measures | High-Performing Benchmark | Red-Flag Threshold | Primary Data Source |

|---|---|---|---|---|

| Gross Days in AR | Average time from charge to payment for all payers. | < 40 days | > 55 days | Billing system AR aging report |

| Net Days in AR | AR adjusted for credits and contractuals. | 28–35 days | > 45 days | Finance + AR aging |

| % AR > 90 Days | Share of receivables older than 90 days. | < 15% | > 25% | AR aging by bucket |

| Clean Claim Rate | Claims accepted on first pass without edits. | ≥ 95% | < 90% | Clearinghouse edit logs |

| Initial Denial Rate | % of claims denied on first submission. | < 5–6% | > 10% | Denial reason reports |

| Top 10 Denial CARCs Share | Concentration of denials in top codes. | > 70% of denials in top 10 | Highly fragmented mix | CARC/remark code analytics |

| Denial Recovery Rate | % of denied dollars overturned or paid. | ≥ 60% | < 35% | Appeal tracking + cash posting |

| Write-off Rate (Avoidable) | Lost revenue due to preventable issues. | < 1.5% of net revenue | > 3% | Contractual vs avoidable write-offs |

| Point-of-Service (POS) Collection Rate | Patient responsibility collected upfront. | ≥ 45–55% | < 30% | Front-desk collection logs |

| Authorization Denial Rate | Denials related to missing/invalid auth. | < 1% | > 3% | Denial code analysis |

| Eligibility Denial Rate | Coverage/eligibility-related denials. | < 0.5% | > 2% | Clearinghouse eligibility reports |

| Charge Lag (Days) | Time from encounter to charge entry. | < 2 days OP / < 4 days IP | > 5 days | Encounter vs charge date |

| DNFB (Days Not Final Billed) | Time inpatient accounts remain unbilled. | < 4 days | > 7 days | DNFB work queues |

| Net Collection Rate | Payments as % of expected allowed. | ≥ 96% | < 92% | Contract modeling + cash |

| Bad Debt Percentage | Uncollectible patient balances. | < 3% of net revenue | > 5% | Finance write-off reports |

| Coding Edit Rate | Claims stopped by coding-related edits. | < 4% | > 8% | Scrubber/CAC logs |

| Coder Productivity | Charts coded per hour by specialty. | Benchmark by CPT mix | Below specialty medians | Productivity dashboards |

| Coder Accuracy (QA) | % of audited charts with no changes. | ≥ 95% | < 90% | QA audit results |

| Underpayment Rate | Difference vs contract-allowed amounts. | < 1% of payments | > 2.5% | Underpayment detection tools |

| Self-Pay Collection Yield | % of self-pay balances recovered. | ≥ 35% | < 20% | Patient AR reports |

| Claim Rework Rate | Claims touched more than once pre-bill. | < 10% | > 20% | Workflow audit trails |

| Appeal Turnaround Time | Average days from denial to appeal. | < 10 days | > 20 days | Appeal task queues |

| Staff Cross-Training Index | % staff fully trained on ≥2 functions. | ≥ 40% | < 20% | HR training records |

| Automation Utilization | Share of tasks routed through bots/RPA. | ≥ 25% of repetitive work | < 10% | RCM software logs |

| Cost-to-Collect | RCM operating cost vs cash collected. | < 3% | > 5% | Finance + HR expense data |

| First-Pass Patient Statement Accuracy | Statements sent with correct balances. | ≥ 98% | < 95% | Customer service ticket review |

2. Core RCM Efficiency Metrics: How to Read This Benchmarks Report

An efficiency report fails if leaders stare at numbers but cannot tell which metric to fix first. Start by mapping each KPI to a failure mode. Days in AR and % AR over 90 days tell you how long money sits idle; pair them with the AR reference guide to see whether the issue is front-end errors, payer delays, or weak follow-up. Clean claim rate and coding edit rate should be reviewed alongside CPT coding rules and surgery code directories, because poor documentation or outdated charge masters quietly generate avoidable edits.

Denial metrics need granularity, not vague percentages. Your top ten CARC codes, combined with the denials management analysis guide, reveal whether training, payer contracts, or prior auth workflows are the bottleneck. Net collection rate and underpayments cannot be interpreted without contractual knowledge, so pair them with the Medicare reimbursement calculator reference and payer fee schedules stored in the directory of insurance billing contacts. Finally, coder accuracy, audit trails, and QA metrics tie back to quality assurance in medical coding and coding audit trail fundamentals, helping you differentiate between process flaws and individual performance gaps.

3. Benchmark Ranges by Organization Type and Payer Mix

Benchmarks are only meaningful if adjusted for setting, specialty, and payer mix. A multi-specialty physician group with strong commercial contracts should not compare its AR to a safety-net hospital with a high Medicaid load. Use the state-by-state comparisons in the medical coding salary breakdown and the CBCS salary guide to understand labor expectations in your geography, then layer in payer data using your own mix of Medicare, Medicaid, and commercial plans.

Small practices running on starter software from the medical billing software directory may find it harder to track granular metrics but should at least monitor clean claim rate, denial rate, and days in AR monthly. Larger systems with robust tools and CAC technology, referenced in computer-assisted coding terminology guides, should be able to hit aggressive benchmarks for automation utilization and cost-to-collect. When comparing across peers, use trend direction as heavily as actual numbers: a team that improves denial recovery rate from 40% to 55% in six months, using strategies from revenue cycle manager career roadmaps, is building healthier muscles than a stagnant team sitting marginally above industry medians.

Quick Poll: Where Is Your Biggest RCM Efficiency Leak Today?

4. Operational Levers to Move Each Metric in 90 Days

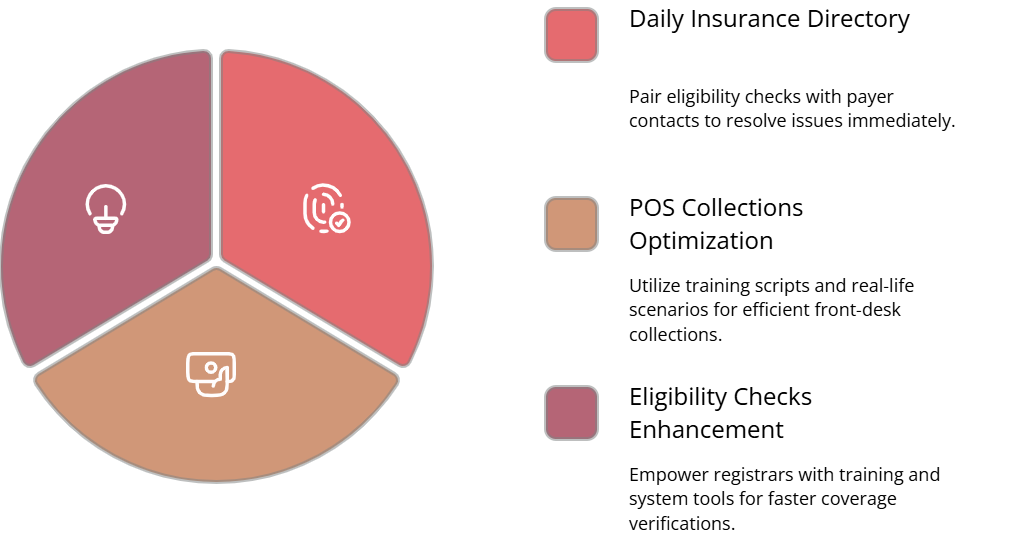

RCM efficiency improves fastest when you assign each metric to an owner and a lever rather than issuing vague “do better” mandates. For front-end metrics such as eligibility and POS collections, train registrars using content from the step-by-step billing career guide and reinforce scripts with real scenarios from the billing entrepreneurs AMA. Pair daily eligibility checks with payer contacts from the insurance directory so front-desk teams can quickly resolve coverage issues instead of letting claims fail weeks later.

For coding-related metrics—clean claim rate, coding edit rate, coder accuracy—invest in continuing education using the CPC career roadmap, coding educator pathways, and medical coding education AMAs. Align QA findings with micro-lessons and use audit trails from coding audit references to show staff exactly how documentation drives denials or underpayments. On the back end, underpayment detection and denial recovery can be strengthened with analytic routines described in revenue leakage studies and automation ideas from electronic claims processing guides, focusing on short feedback loops instead of sporadic clean-up projects.

5. Building an RCM Metrics Culture: Dashboards, Education, and QA

A one-time efficiency report is useful, but a metrics culture transforms careers. Start by designing dashboards that mirror the table above, then map each metric to specific roles: coders, billers, denial specialists, and revenue integrity analysts. Use job frameworks from the emerging coder roles report and automation-proof coding careers guide to show staff how mastering metrics leads to higher-value positions such as compliance auditor or RCM manager.

Education cannot be an afterthought. Tie monthly workshops to concrete topics like “Denial Root Cause Deep Dive” or “Improving DNFB for Surgical Cases”, using curriculum ideas from the medical billing certification strategies guide and templates in the coding instructor roadmap. Encourage coders pursuing credentials through accredited billing and coding schools directories to bring back insights that tighten workflows. Finally, embed RCM metrics into performance reviews, drawing on quality assurance frameworks so staff see a direct link between their learning, the organization’s cash health, and their own salary growth documented in coding and billing salary guides.

6. Revenue Cycle Management Efficiency FAQs

-

Start where cash is trapped longest. For many organizations that means high AR over 90 days, which directly starves cash flow. Pair AR aging reports with the AR reference guide and identify which payer, specialty, or location contributes the most dollars, not just the most accounts. Often a small number of payers or service lines drive a disproportionate share of delays. Once you target those cohorts, apply denial-management tactics from the comprehensive denials guide and contract checks using the Medicare reimbursement calculator resource before expanding improvements system-wide.

-

Individual contributors often underestimate their leverage. A coder who consistently applies rules from the CPT guideline reference and stays current through continuing education roadmaps can materially reduce edits and denials on high-dollar cases. Billers who use payer contact lists from the insurance directory to chase status proactively lower days in AR. Specialists who master denial appeal tactics from the revenue leakage insights report improve denial recovery and net collection rates. When staff see dashboards that connect their queue work to these KPIs, they begin to act as micro-RCM managers, not just task processors.

-

You do not need an enterprise analytics platform to start; you need clean, consistent data feeds from your practice management system, EMR, and clearinghouse. Begin with basic AR aging, denial reason reports, and productivity summaries, then layer on specialized tools from the medical billing software directories as budget allows. Ensure staff understand electronic transactions using the electronic claims glossary and that leaders have contract modeling help from resources like the Medicare reimbursement calculator guide. The goal is a single source of truth where metrics from this report are visible weekly, not buried in quarterly spreadsheets.

-

Organizations increasingly reward staff who own business outcomes, not just credentials. Coders and billers who can demonstrate how their work improved denial rates or AR, using frameworks from the revenue cycle manager career guide and salary benchmarks from the CBCS compensation report, are first in line for lead or analyst roles. Educators trained via the medical billing and coding instructor roadmap often move into quality, compliance, or management positions because they can scale performance across teams. Efficiency metrics become proof points in promotion packets, interview conversations, and even negotiations with new employers.

-

Quarterly reviews are the minimum if you want metrics to drive behavior. Relying on annual reports means you are reacting to last year’s problems. Use monthly snapshots, tied to denial trends documented in the coding denials best-practices guide and AR movements tracked with the accounts receivable reference, to adjust workloads and training quickly. At least twice a year, revisit your benchmarks against updated tools from the billing software directories and any new payer policies covered in broader reimbursement outlooks like the healthcare reimbursement change forecasts. Treat the report as a living operational playbook, not a static compliance document.