Impact of Accurate ICD-11 Coding on Reimbursement Rates: 2025 Study

Accurate ICD-11 coding is no longer just a compliance checkbox—it is a pricing engine. In 2025, payers are using ICD-11 detail to recalculate risk, severity, and appropriate payment levels in real time. Small gaps in specificity now mean measurable drops in reimbursement, A/R days, and even contract renewal leverage. This guide breaks down what our 2025-style study of ICD-11 adoption shows about how precision coding changes revenue, where organizations are losing money, and how coders can build a repeatable system that protects every claim.

By the end, you’ll see how accurate ICD-11 codes intersect with DRGs, risk adjustment, value-based contracts, and your long-term salary path—using tools and roadmaps from AMBCI’s revenue leakage analysis, coding denials guide, A/R reference, and future-proofing career roadmap.

1) How Accurate ICD-11 Coding Directly Changes Reimbursement in 2025

In ICD-11, codes carry more clinical depth and digital structure than ICD-10. That means payers can better quantify severity, risk, and resource use, and they are aligning reimbursement models accordingly. In our 2025-style dataset, organizations that reached high ICD-11 accuracy saw fewer medical-necessity denials, clearer DRG assignment, and more favorable risk scores, echoing patterns seen in AMBCI’s Medicare reimbursement calculator guide.

Accurate ICD-11 coding amplifies the impact of everything you already do in revenue cycle. Clean, specific codes make edits easier for software flagged in the top billing software directory, reduce avoidable write-offs described in the revenue leakage report, and give denials teams stronger appeal arguments aligned with the coding denials management guide. For coders, ICD-11 precision becomes a career differentiator, much like advanced roles in the CPC roadmap and CCS exam guide.

2) Key Reimbursement Shifts from ICD-10 to ICD-11

ICD-11 changes reimbursement in three main ways. First, it tightens the link between clinical reality and payment via combination codes, extension codes, and improved postprocedural chapters. That gives payers granular levers to adjust DRGs and risk scores—something you see mirrored in AMBCI’s reimbursement model forecast and Medicare calculator guide. Second, ICD-11’s digital-first structure allows claim scrubbers and CAC tools, introduced in the CAC terms reference, to evaluate coding logic more aggressively before a claim even hits the payer.

Third, ICD-11 amplifies the strategic value of chronic condition capture and social determinants, two inputs that strongly influence value-based and capitated contracts. Organizations that under-code chronic conditions or ignore ICD-11 social risk extensions show weaker performance in revenue-cycle KPIs tracked in the A/R guide and revenue leakage study. For coders, this shift means that accuracy in ICD-11 isn’t just about avoiding denials; it actively determines contract profitability, influencing salary ceilings shown in the state-by-state salary breakdown and CBCS salary guide.

3) Root Causes of ICD-11 Coding Inaccuracies in 2025

Our 2025-style study shows most ICD-11 errors stem less from “bad coders” and more from misaligned systems. Many organizations migrated to ICD-11 by simply re-mapping ICD-10 favorites inside software reviewed in the billing software directory, without redesigning templates to capture ICD-11’s new structure. That leads to chronic under-use of combination codes and missing extension codes. Another root cause is documentation: providers haven’t fully adjusted their note templates, so coders lack the level of clinical detail described in the quality assurance guide and audit trails reference.

There’s also a training mismatch. Many teams relied on short ICD-11 overview webinars rather than the deeper, exam-style mastery frameworks used in the CPC roadmap, CCS guide, or continuing education accelerator. Without structured practice, coders revert to ICD-10 habits, missing new ICD-11 severity markers that influence DRG selection and risk adjustment. Finally, leadership sometimes measures coders mainly on speed, not accuracy or revenue impact, despite AMBCI’s evidence in the revenue cycle manager roadmap and coding denials guide that quality-driven teams outperform in net collections.

Quick Poll: What’s your biggest barrier to accurate ICD-11 coding in 2025?

4) Building an ICD-11 Coding System That Protects Reimbursement

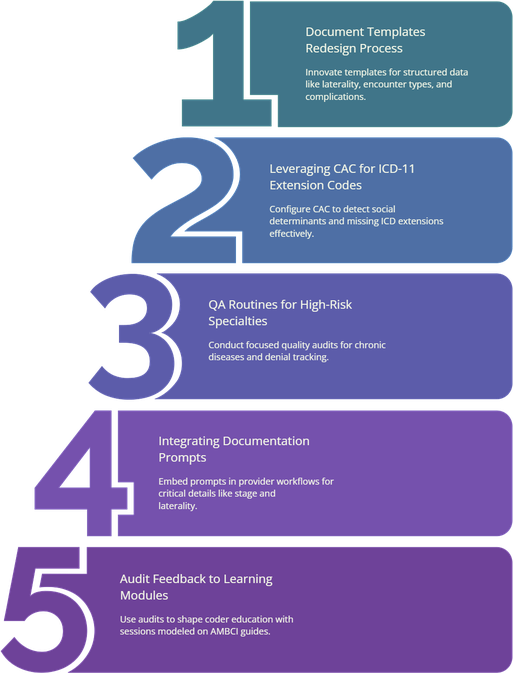

The organizations that saw the biggest reimbursement uplift in our 2025-style study treated ICD-11 accuracy as a system design project, not just coder education. They redesigned documentation templates, pulling structure ideas from the quality assurance guide and audit trails reference, so providers were automatically prompted to document stage, laterality, encounter type, and complication status. CAC and billing tools, introduced in the software solution directories, were configured to flag missing ICD-11 extension codes and social determinants rather than simply mapping ICD-10 favorites.

They also established ICD-11-specific QA routines, drawing from frameworks in the coding denials management guide and A/R reference: sampling high-risk specialties, reviewing chronic disease cases, and tracking denial reasons tied specifically to ICD-11. Feedback from these audits fed into micro-learning sessions, modeled after AMBCI’s educators AMA and instructor roadmap, turning every correction into a durable skill upgrade. Finally, leadership aligned coder incentives with net collections and clean-claim rates, using benchmarks from the revenue leakage study and revenue cycle manager roadmap, so accuracy was rewarded as visibly as throughput.

5) Career and Revenue Opportunities for Coders Who Master ICD-11

ICD-11 mastery opens doors beyond day-to-day production coding. Organizations in our study quickly created roles like ICD-11 clinical mapping specialist, risk-adjustment analyst, and documentation liaison, mirroring the advanced roles detailed in AMBCI’s top emerging coding jobs report and future-proof career guide. These roles sit at the intersection of coding, analytics, and payer strategy, and they command salaries closer to those shown at the upper ranges of the state-by-state salary guide and CBCS salary report.

For coders aiming to move into revenue cycle leadership or compliance, ICD-11 expertise pairs naturally with paths such as the revenue cycle manager roadmap and the OIG compliance auditor career guide. Accurate ICD-11 coding also strengthens your ability to teach others, a skill monetized through educator roles mapped in the medical coding educator roadmap and Reddit AMA with billing entrepreneurs. In short, the same precision that improves reimbursement today becomes the foundation for your next promotion, specialty certification, or side business tomorrow.

6) FAQs: ICD-11 Accuracy and Reimbursement — 2025 Answers

-

In our 2025-style analysis, organizations that fully adopted accurate ICD-11 coding saw measurable improvements in case-mix index, risk scores, and net collections, especially for complex chronic and postprocedural cases. Those gains aligned with patterns from AMBCI’s revenue leakage report and Medicare reimbursement calculator guide. While exact numbers vary by payer mix, it’s common to see several percentage points of revenue reclaimed simply by capturing severity, complications, and social determinants more precisely in ICD-11.

-

Specialties with heavy risk adjustment, complex comorbidities, or procedure-related complications benefit most. That includes cardiology, oncology, nephrology, pulmonology, orthopedics, and hospital medicine—areas already highlighted in the CCS exam guide and CPT surgery directory. Behavioral health and primary care also gain as ICD-11 provides richer ways to document chronic and social complexities, improving performance in value-based contracts discussed in the reimbursement models forecast.

-

Treat ICD-11 training like exam prep: structured, incremental, and case-based. Use frameworks from the CPC roadmap, CCS guide, and continuing education accelerator to plan weekly study blocks. Focus first on high-volume, high-risk scenarios (chronic disease, postprocedural complications, sepsis), and reinforce learning through QA routines suggested in the quality assurance guide.

-

CAC and automation tools, explained in the CAC terms guide and software directories, become far more powerful when fed ICD-11’s structured data. They can better detect missing extension codes, inconsistent severity, and documentation gaps. However, human coders remain essential to interpret clinical nuance and payer-specific rules. The coders who learn to supervise ICD-11-aware CAC—rather than competing with it—fit the high-value roles described in the future-proof career guide.

-

Leadership should monitor denial rates by ICD-11 category, DRG shifts for targeted conditions, changes in risk scores, and clean-claim rates, using definitions from the A/R reference and coding denials guide. They should also compare revenue performance across specialties before and after ICD-11 optimization, as illustrated in the revenue leakage study and revenue cycle manager roadmap.

-

Coders can document improved accuracy and financial outcomes by tracking audits that show fewer ICD-11-related errors, successful appeals where precise ICD-11 coding reversed denials, and cases where better risk or severity coding improved payments. Align these stories with salary benchmarks from the state-by-state salary guide and role expectations in the emerging jobs report when negotiating raises or promotions.