Guide to Effective Payment Posting and Management

Managing payment posting and revenue collection is a critical part of the medical billing cycle. It ensures that healthcare providers are compensated for their services in a timely manner while maintaining the financial health of the practice. Proper payment posting helps to maintain accurate financial records, tracks revenue, and prevents discrepancies that could lead to audits or financial delays.

This guide is designed to help medical billing and coding professionals understand the steps, tools, and best practices required for effective payment posting. We will explore how efficient payment posting can improve cash flow, reduce errors, and ensure the financial stability of medical practices. Whether you're just starting in billing or looking to refine your processes, this comprehensive roadmap will help you master payment posting and management.

For more information, check out our Guide to Financial Audits in Medical Billing.

What Is Payment Posting and Why Is It Crucial?

Understanding Payment Posting in Medical Billing

Payment posting is the process of recording the payments made by patients, insurance companies, or other payers for healthcare services rendered. It's a key aspect of the revenue cycle because it ensures the accuracy of the financial records and tracks revenue properly. When payment posting is done efficiently, medical practices can prevent discrepancies and ensure that all accounts are up to date.

Without accurate payment posting, there can be delays in the revenue cycle, underpayments or overpayments that affect accounts receivable (AR), and potential issues with compliance. To improve revenue cycle management, it's essential to have a streamlined system in place to handle these transactions.

By managing payment posting effectively, practices can ensure accurate reimbursement and maintain a consistent cash flow. You can learn more about improving your accounts receivable process in our Understanding Accounts Receivable (AR): Complete Reference.

The Importance of Accurate Payment Posting

Accurate payment posting is crucial to avoid discrepancies and ensure financial efficiency. It directly affects the revenue cycle by helping practices identify and correct underpayments, overpayments, and billing errors promptly. Additionally, when payment posting is handled correctly, it ensures that healthcare providers are able to meet financial audit requirements and remain compliant with regulations.

A well-organized payment posting process reduces the chances of missing payments, which can delay the reimbursement process. It also helps in identifying any errors early on, allowing for quicker resolutions. The quicker you catch discrepancies, the faster you can maintain a healthy cash flow. For more details on improving your payment posting system, check out our guide to Fraud, Waste & Abuse (FWA) Terms for Coders.

What Is Payment Posting and Why Is It Crucial?

Payment posting records payments made by patients, insurers, or other payers, ensuring accuracy in the financial records. It helps prevent discrepancies, ensures timely reimbursement, and maintains a steady cash flow in medical practices.

A streamlined payment posting process improves revenue cycle management and ensures compliance with financial regulations. For more on optimizing this process, explore our guide on accounts receivable.

The Payment Posting Process: Key Steps

Receiving and Sorting Payments

The first step in the payment posting process is receiving and sorting payments. Payments can come in various forms, such as checks, electronic payments, or credit card transactions. It's essential to ensure that these payments are categorized accurately according to the payer, patient account, and type of service. Sorting payments properly helps prevent errors down the line and ensures that each payment is correctly attributed to the right service and account.

Using a system to track payments and sort them as they come in allows your medical billing process to run smoothly. Efficient sorting can prevent delays and mistakes in posting payments, which is critical for maintaining cash flow. To ensure accuracy in this process, make sure that all payments are sorted and logged appropriately before posting them. Learn more about managing Medicare reimbursement calculations to streamline this step.

Posting Payments to Patient Accounts

Once the payments are received and sorted, the next crucial step is posting payments to patient accounts. This involves matching the received payments with the correct accounts and services provided. It's important to update the patient’s account balance accordingly, ensuring that all payments are properly recorded.

In today’s medical billing systems, electronic health records (EHR) or billing software can automate this process, reducing human error and improving efficiency. Accurate payment posting prevents the occurrence of unprocessed claims or delayed billing, ensuring that the practice is reimbursed on time. Tools such as coding software terminology guides can assist with this process, ensuring the right codes are applied to each payment.

Handling Payment Adjustments

Payment adjustments are another essential aspect of the payment posting process. These include correcting underpayments, overpayments, and write-offs. Handling adjustments quickly and accurately ensures that the account balances are always correct and up to date.

When discrepancies are identified, it's important to act promptly to resolve them. This may involve reviewing the payment remittance advice (RA) or investigating the reason for the discrepancy. Proper documentation of these adjustments is also necessary for future audits and compliance purposes. For further details on managing adjustments and ensuring accurate billing practices, see our Comprehensive Guide to Denials Prevention and Management.

| Key Steps in Payment Posting | Description |

|---|---|

| Receiving and Sorting Payments | Payments are categorized by payer, patient account, and type of service. Sorting payments accurately helps prevent errors and ensures proper allocation. |

| Posting Payments to Patient Accounts | Payments are matched with the correct accounts and services, ensuring that patient account balances are updated properly and accurately. |

| Handling Payment Adjustments | Payment adjustments involve correcting discrepancies, such as underpayments and overpayments. These need to be resolved promptly to maintain accurate account balances. |

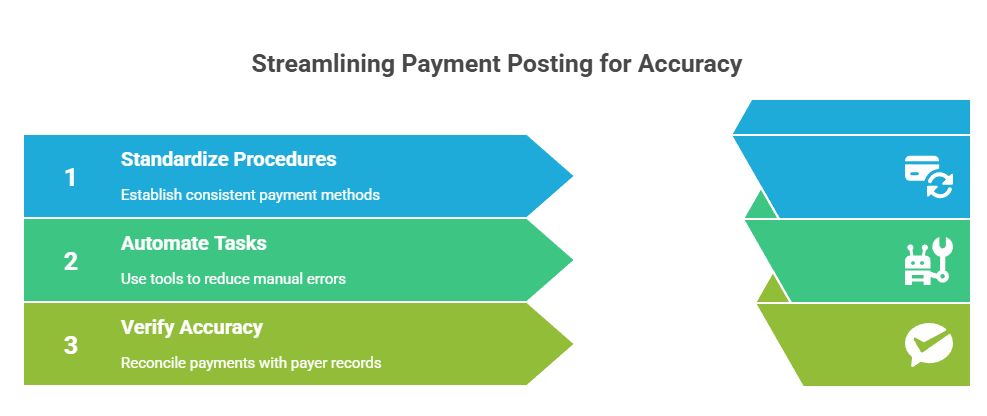

Payment Posting Best Practices for Accuracy

Standardizing Payment Posting Procedures

One of the most critical steps in ensuring accurate payment posting is standardizing the procedure. Having a consistent, repeatable process for handling payments across different payers ensures that every team member follows the same steps and reduces the risk of errors. It's essential that all staff members are trained on these procedures and that they understand the importance of consistency in the process.

By establishing a standardized method for managing payments, you can reduce confusion and improve accuracy. Ensure that the payment posting process is clearly defined and regularly reviewed to incorporate any updates or changes. A well-structured process, backed by comprehensive training, helps to maintain high standards in revenue cycle management. For more guidance on maintaining consistent practices, check out our Comprehensive Guide to Medical Coding Certification Flashcards.

Use Automated Tools to Reduce Errors

Incorporating automated tools into your payment posting process can significantly reduce human errors. Automated payment posting systems can handle a large portion of the work, such as logging payments, categorizing them, and updating patient accounts. These systems offer real-time tracking and reporting, ensuring that every transaction is accurately recorded and processed.

By integrating payment posting with your Practice Management Software (PMS), you can streamline the entire process, eliminate manual tasks, and enhance efficiency. Automated tools also help to keep track of payer-specific codes and simplify reconciliation. For more information on how to integrate payment posting with electronic claims processing systems, explore our Guide to Electronic Claims Processing Terms.

Verifying Payment Accuracy with Payers

Verifying the accuracy of payments received is essential to maintaining accurate financial records. Regular reconciliation with payer remittance advices (EOBs/ERA) ensures that the amount paid by the payer matches the expected reimbursement amount. This verification process helps identify any discrepancies, such as underpayments or overpayments, which can be addressed promptly.

Regular verification also ensures that any issues are detected early, preventing delays in the revenue cycle. By cross-checking payer payments with expected amounts, you can quickly identify any errors and take corrective action. To better understand how to verify payment accuracy, you can refer to our Comprehensive Guide to Medical Coding Audits.

Common Payment Posting Challenges and How to Overcome Them

Handling Complex Insurance Payments

Insurance payments can be complicated, especially when dealing with multiple insurance providers, each having different payment models. It’s essential to create a comprehensive guide or checklist to help you manage the varying reimbursement processes. Whether it’s Medicare, Medicaid, or private insurance, each payer has specific rules and criteria that must be followed when posting payments.

By understanding the unique nuances of different insurance models, you can ensure that payments are correctly recorded and prevent discrepancies. A well-organized system for handling complex insurance payments will help streamline your billing operations and reduce errors. For more information on how to handle complex claims, check out our CPT Codes for Ambulatory Surgery: Essential Guide & Examples.

Managing Patient Payments Effectively

Managing patient payments, including co-pays, deductibles, and co-insurance, can be challenging for medical billing professionals. Clear communication regarding patient responsibilities is vital to ensure that payments are collected on time. It’s essential to set up a straightforward payment policy and clearly communicate it to patients to prevent misunderstandings.

Offering online payment options can also increase collection rates and make it easier for patients to settle their balances. A transparent billing process combined with online payment systems ensures that both parties are satisfied, reducing friction in the payment collection process. Learn more about managing patient payments in our Guide to Durable Medical Equipment (DME) Coding.

Tracking Overpayments and Refunds

Overpayments from payers can occur and must be tracked to ensure that refunds are processed correctly. It’s essential to document all overpayment activities for auditing and reporting purposes. Keeping a detailed record of overpayments and refunds prevents financial discrepancies and helps maintain accuracy in accounts receivable.

By having a system in place to monitor overpayments, you can streamline the refund process and ensure that the correct amount is refunded to the payer. Managing overpayments efficiently also ensures compliance and enhances your practice’s financial integrity. For more on managing overpayments, see our Guide to Fraud, Waste & Abuse (FWA) Terms for Coders.

Which payment posting challenge do you find most difficult?

Tools and Technology to Improve Payment Posting

Implementing Automated Payment Systems

Automating your payment posting system is one of the best ways to improve efficiency and reduce human error. Automated systems allow payments from both payers and patients to be seamlessly recorded, categorized, and tracked. This not only saves time but also ensures that all payments are correctly matched to the appropriate accounts.

By implementing automated payment posting tools, you can streamline your revenue cycle, reduce delays in processing payments, and improve the overall accuracy of your records. It’s a crucial step towards creating a more efficient and error-free payment system. If you’d like to explore more about automating your payment processes, check out our Medicare Reimbursement Calculator: Complete Guide.

Using Analytics and Reporting Tools

Analytics tools are essential for tracking payment trends, identifying patterns in denials, and ensuring timely collections. These tools generate real-time reports that give insights into payment performance, allowing you to address potential issues before they escalate.

By using analytics, you can identify areas where payment posting may be delayed or where payer discrepancies commonly occur. Tracking these trends over time helps you streamline the revenue cycle, ensure efficient payment collections, and reduce outstanding receivables. Learn more about tracking trends in payment with our Comprehensive Guide to Medical Coding in Complex Trauma Cases.

Integrating Payment Posting with EHR/PM Systems

Integrating payment posting with your Electronic Health Records (EHR) and Practice Management (PM) systems can significantly improve speed and reduce errors. EHR/PM integration allows for real-time entry of payment data, ensuring that accounts are updated instantly.

This integration reduces manual data entry, improves accuracy, and speeds up the payment posting process. When combined with automated payment tools, it creates a seamless workflow that helps you stay on top of payments and improve financial efficiency. To learn more about optimizing your payment systems, check out our Top 10 Medical Billing Software Solutions Directory.

| Tool/Technology | Description |

|---|---|

| Automated Payment Systems | Automating payment posting systems streamlines your revenue cycle by reducing human error and ensuring payments are accurately recorded and tracked in real-time. |

| Analytics and Reporting Tools | Analytics tools help track payment trends, identify denial patterns, and improve collections by offering real-time reports and insights into payment performance. |

| EHR/PM Systems Integration | Integrating payment posting with Electronic Health Records (EHR) and Practice Management (PM) systems improves accuracy, reduces manual data entry, and speeds up the payment process. |

Conclusion: Ensuring Long-Term Success in Payment Posting and Management

Effective payment posting and management are essential to the financial health of any medical practice. By automating your systems, verifying payments, and reconciling discrepancies quickly, you can reduce errors, streamline the revenue cycle, and improve cash flow. Ensuring that your payment posting procedures are efficient is key to maintaining accurate financial records and achieving long-term success.

Consistent staff training and implementing standardized processes will help maintain the integrity of your payment posting system. As your practice grows, continuously evaluating and improving your procedures will support continued efficiency and accuracy. To maintain compliance and ensure long-term success, don't forget the importance of regularly updating and refining your payment posting practices.

For more insights on how to create a streamlined payment posting system, check out our Guide to CMS Compliance for Medical Coders.

Frequently Asked Questions

-

Payment posting refers to recording payments made by patients, insurance companies, or other payers into the appropriate patient accounts. On the other hand, payment reconciliation involves comparing these payments with the remittance advices (EOBs/ERA) from the payer to ensure accuracy. Payment reconciliation helps identify discrepancies and underpayments early, ensuring that revenue is accurately recorded.

-

To improve accuracy, implement standardized procedures for handling payments across various payers. Automated tools, integrated with your Practice Management Software (PMS), can help streamline the process, track payer-specific codes, and reduce human errors. Regularly verify payment details with payer remittance advices (EOBs/ERA) and ensure your team is trained in the latest coding and payment posting best practices.

-

Overpayments occur when a payer submits more than the required amount. These should be tracked and refunded promptly. To ensure proper handling, maintain detailed records of overpayments and the steps taken for refunding. Create a clear procedure for processing overpayments to ensure compliance and proper documentation, which will be helpful for audits and reporting.

-

Automated payment posting systems can help streamline your payment processes by automatically recording and categorizing payments from both payers and patients. Tools such as Medicare Reimbursement Calculators, electronic payment posting systems, and integrated Practice Management Software (PMS) offer real-time tracking and reporting, reducing manual entry errors and improving efficiency.

-

Use analytics tools to monitor payment trends, identify patterns in denials, and track collections. Real-time reporting systems can help you detect issues quickly and adjust your strategies accordingly. By regularly reviewing these reports, you can streamline your revenue cycle, address denials faster, and ensure more timely collections.