Medicare Access and CHIP Reauthorization Act (MACRA) Terms

MACRA is the law that turned Medicare Part B reimbursement into a performance game. If you bill, code, audit, or manage AR, you feel it even when you do not say the name out loud: payment adjustments, measure failures, documentation pressure, and confusing “quality” denials that are really reporting breakdowns. This guide translates MACRA terms into operational reality so you can stop guessing, build clean workflows, and protect reimbursement. You will learn how each term connects to claim submission, EOB outcomes, audits, and compliance risk, using the exact language payers and reviewers expect.

1) MACRA in plain English: why these terms decide your Medicare money

MACRA created the Quality Payment Program (QPP) and made performance part of physician payment. That matters because Medicare does not just pay for what you coded. It also adjusts payment based on whether the provider reported the right measures, used certified technology properly, and avoided cost spikes Medicare thinks were preventable. If your team understands the terms, you can prevent “silent revenue loss” where claims pay but the practice still gets punished later through adjustments.

For billing and coding teams, MACRA is not an abstract policy. It shows up as:

Payment variability that looks random until you map it to QPP scoring and thresholds

Measure driven documentation pressure that can collide with medical necessity criteria and create audit exposure

EOB confusion where adjustments and remark codes show up but the root cause is reporting, not coding, which is why you must interpret EOB logic correctly

Claims and data issues where the billing system is “fine” but the reporting path is broken, which ties directly to electronic claims processing terms and claims submission terminology

MACRA terms also overlap with reimbursement fundamentals. If you do not understand how Medicare pays clinicians and facilities, QPP will feel impossible. Anchor your baseline with Medicare reimbursement and how pricing and schedules work via physician fee schedule terminology. Then MACRA becomes a set of levers you can control, not a mystery tax on revenue.

Finally, MACRA is inseparable from compliance. Reporting errors can become compliance issues when documentation is retrofitted, audit trails are weak, or access controls are sloppy. If you treat MACRA as “just quality reporting,” you miss the risk profile described in coding audit trails, coding QA, and the real world impact of billing compliance violations.

MACRA Terms Map: What They Mean and What You Must Do (25+ Rows)

| Term | What It Means | Why It Hits Billing | Best Practice Action | Common Failure |

|---|---|---|---|---|

| MACRA | Law that replaced legacy payment models and created QPP | Payment adjustments impact net collections | Treat reporting as revenue cycle work, not admin | Leaving QPP to “someone else” until year end |

| QPP | Quality Payment Program umbrella for MIPS and APM paths | Controls incentives and penalties | Pick path early and lock data workflows | No ownership of data extraction and submission |

| MIPS | Merit-based scoring program for most clinicians | Score drives payment adjustment | Monthly score forecasting with gap closure | Chasing measures after the deadline |

| APM | Alternative payment model participation route | Different reporting and eligibility rules | Confirm participation status and thresholds | Assuming APM status without proof |

| Advanced APM | APM meeting CMS criteria for QPP benefits | May avoid MIPS or change scoring | Keep CMS confirmation and contracts organized | Missing documentation during audit or review |

| Performance Year | Year your actions and reporting are measured | Late fixes often impossible | Run quarterly readiness checks and remediation | Waiting until Q4 to validate data quality |

| Payment Year | Year the adjustment is applied to Medicare payments | Explains future reimbursement shifts | Annotate AR trends with QPP adjustment context | Confusing performance year with payment year |

| Composite Score | Total MIPS score across categories | Directly linked to incentive or penalty | Build a score dashboard with owners per category | No internal forecast, surprise penalty later |

| Performance Threshold | Minimum score to avoid penalty | Defines “break even” goal | Set internal target above threshold for safety | Treating threshold as the target |

| Exceptional Performance | High score tier that may earn extra incentives | Revenue opportunity, not just compliance | Prioritize high-impact measures and completeness | Low measure completeness kills high performance |

| Quality Category | MIPS component tied to quality measures | Documentation and coding drive numerator/denominator | Align measure specs with templates and coding rules | Wrong denominator logic due to coding gaps |

| Cost Category | MIPS component based on resource use | Coding and billing patterns affect cost attribution | Monitor outliers, ensure accurate risk adjustment inputs | Care episodes attributed incorrectly, no dispute plan |

| Improvement Activities (IA) | MIPS category for practice improvement work | Requires evidence, not claims data | Maintain IA evidence binder with dates and owners | Claiming IA without documentation |

| Promoting Interoperability (PI) | MIPS category tied to certified EHR use | EHR workflows can make or break the score | Validate CEHRT status and reporting settings early | Incorrect CEHRT configuration, lost points |

| CEHRT | Certified EHR Technology required for PI reporting | PI failures reduce score and revenue | Track certification version and attestation support | Assuming certification without verification |

| eCQM | Electronic clinical quality measure from EHR | Data capture errors become score errors | Test measure logic with sample charts monthly | Template fields not captured in structured data |

| Claims-based measures | Quality measured from claims submissions | Coding accuracy directly changes measure outcomes | Harden edits and pre-bill validation | Late corrected claims miss reporting window |

| Registry Reporting | Submitting measures via a registry or vendor | Vendor errors can become your penalty | Require vendor validation and submission proof | No submission receipts or data audit checks |

| QCDR | Qualified Clinical Data Registry for reporting | May offer specialty measures | Confirm QCDR approval and measure compatibility | Choosing measures that do not fit workflow |

| Measure Specification | Exact denominator, numerator, and exclusions | A single missing field breaks reporting | Translate specs into checklist items per visit | Treating measures as generic “quality goals” |

| Data Completeness | Percent of eligible cases you actually report | Low completeness reduces scoring | Run completeness reports monthly and fix gaps | Not capturing required codes or fields consistently |

| Submission Method | How data is sent to CMS | Controls timelines and validation | Pick one method and build a controlled pipeline | Switching methods late creates missing data |

| TIN/NPI | Identifiers for group and clinician billing/reporting | Wrong mapping breaks attribution | Audit NPI and TIN mapping across systems | Provider enrollment mismatches cause reporting loss |

| Facility-based scoring | MIPS scoring tied to facility performance for some | Group results may differ from clinician expectations | Confirm eligibility and communicate implications | Assuming individual control where none exists |

| Reweighting | Shifting category weights in special cases | Affects score math and strategy | Document eligibility and keep CMS confirmation | Planning on reweighting without approval |

| Hardship Exception | Relief from PI or other requirements in defined cases | Can prevent penalties | Submit hardship evidence early and retain proof | Missing deadlines or weak evidence package |

| Audit readiness | Ability to prove reported data is real and supported | Reporting disputes become financial losses | Maintain audit trail and QA checks throughout year | No workpapers, no traceability, no defense |

| Final attestation | Official submission confirming accuracy | Locks results that affect payment | Two-person review, submission receipts, version control | Rushing submission without validation samples |

2) MIPS, APM, and QPP path terms: the decision tree that stops revenue surprises

Your first operational job is to correctly identify which path a clinician or group is on. If you get this wrong, you can do perfect billing and still get punished because the reporting was mis-scoped.

QPP: the umbrella that determines your rules

QPP is the umbrella program, and inside it you have MIPS and APMs. Most practices live in MIPS, which means your workflow must support category scoring and measure reporting. Your baseline reimbursement understanding still matters because QPP adjusts payments on top of the normal Medicare mechanics you already know from Medicare reimbursement fundamentals and the physician fee schedule terminology.

MIPS: the terms that decide if your score is real or fake

In MIPS, teams get trapped by “high level planning” and ignore the terms that actually break performance:

Performance year vs payment year: if you cannot explain this to leadership, you will keep getting blamed for future reimbursement changes you cannot fix retroactively.

Composite score and performance threshold: do not aim for “barely safe.” Build buffer. Measure capture has friction, and one broken interface can drop completeness fast.

Data completeness: this is where billing and coding matter because claims based measures depend on clean submissions and correct coding. Tighten your pipeline with claims submission terminology and the mechanics from electronic claims processing.

You also need defenses. If your score is challenged, the teams that win are the ones with audit trails and QA. Build it the same way you would for coding integrity using audit trail practices and quality assurance controls.

APM and Advanced APM: terms that affect whether MIPS even applies

APM participation can change whether you report MIPS, how you report, or what benefits you receive. The danger is assuming you are in an Advanced APM without solid proof, then discovering later that you were expected to submit MIPS and missed deadlines. The best operational move is to maintain a living “eligibility file” that includes confirmations, contracts, and reporting requirements, stored with the same discipline you use for financial audit readiness.

The “silent destroyers”: TIN and NPI mapping and enrollment alignment

A huge amount of MACRA pain is not clinical. It is identity and mapping issues:

TIN and NPI mismatches across EHR, billing system, registry, and enrollment files

Group reporting misalignment where clinicians think they are reporting as individuals

Data extracted for the wrong reporting entity

These failures are brutal because you can do everything else right and still lose credit. Treat identity mapping like compliance, with controls aligned to audit trail expectations and the practical risk lens from compliance penalties.

3) Category terms that directly connect documentation, coding, and reimbursement

MACRA terms stop being confusing when you map them to the work your team already does daily.

Quality: numerator, denominator, exclusions, and why coders influence “quality”

Quality measures have precise specifications. “Denominator” is who qualifies, “numerator” is who met the quality action, and “exclusions” remove cases that should not count. If your coding is inconsistent, your denominator becomes wrong, and your score becomes untrustworthy. This is why coding and documentation must be grounded in definitions, not habits, using resources like coding certification term dictionaries and clinical documentation language via CDI terminology.

If your quality measures require structured data, free text notes are not enough. That is where your PI and eCQM workflow can collapse, because the EHR did not capture fields in reportable format. Tie this to your technology understanding using coding software terminology and end-to-end submission controls from claims processing terminology.

Cost: attribution, episodes, and the “it is not our fault” problem

Cost scoring is painful because teams often feel they cannot control it. But cost categories involve attribution logic, and attribution breaks when coding, enrollment, and claim data are messy. If the practice gets attributed to episodes it should not own, you need the ability to identify the attribution pattern and dispute or remediate. This is why the “boring” fundamentals matter, including understanding how Medicare classifies services and reimburses them through Medicare reimbursement mechanics and how claims outputs appear on an EOB.

Also, inaccurate coding can inflate perceived resource use, which damages cost scoring and triggers audits. If you want to defend cost performance, you must have strong coding QA and audit trail controls from quality assurance in medical coding and audit trail practices.

Improvement Activities: evidence, timestamps, and operational proof

IA is often treated as an easy checkbox, but it is a common audit weakness because people claim an activity and forget evidence. Build an evidence binder: policy, training logs, meeting notes, screenshots, dates, owners, and how it was implemented. If your compliance culture is weak, IA becomes a liability. Treat it with the seriousness described in compliance audit trends and the real consequences in billing compliance violations.

Promoting Interoperability and CEHRT: where technology misconfigurations destroy points

PI is where practices lose points quietly. CEHRT configuration, reporting settings, and workflow adoption determine whether you earn credit. A common failure mode is relying on vendor assurances without internal validation. You need a controlled approach that documents version, certification, reporting settings, and test outputs, similar to how you would document compliance changes and controls under HIPAA impact on billing and coding.

Quick Poll: What is your biggest MACRA reporting pain right now?

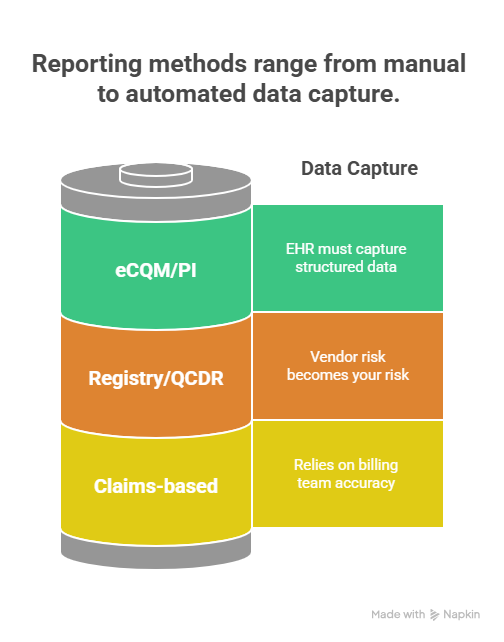

4) Reporting method terms: claims, registry, QCDR, eCQM, and how teams avoid self-inflicted penalties

The reporting method you choose controls your risk. The wrong method creates missing data, late submissions, and inaccurate measure logic. The best approach is to pick the method that fits your infrastructure and then build controls around it.

Claims-based reporting: fast, but only if your coding pipeline is airtight

Claims-based measures depend on what you submit. That means your billing team is effectively responsible for quality reporting accuracy. If claims are corrected late, rejected, or submitted with wrong codes, the measure denominator and numerator can change or disappear. Tighten the process using:

Clean claim structure and timing through claims submission terminology

Rejection prevention and resubmission discipline via electronic claims processing terms

Coding QA and audit trails through quality assurance and audit trail integrity

A hidden risk is that staff focus on speed because of productivity pressure. That is exactly how measure failures happen. If you are chasing volume, use the benchmarks intelligently from coding productivity benchmarks without sacrificing accuracy.

Registry and QCDR reporting: powerful, but vendor risk becomes your risk

Registries can simplify measure submission, but you must treat them like a vendor in a regulated process. Require:

Data validation rules and sample testing

Submission receipts and timestamps

A reconciliation report that ties submitted cases to your internal eligible case list

Version control for measure specs and mapping rules

If you cannot prove what was submitted and why, you cannot defend your score. This is the same operational discipline you need for compliance audits, supported by financial audit readiness and the risk lens from compliance penalties.

eCQM and PI reporting: structured data or it did not happen

If the EHR does not capture the element in a structured, reportable way, you do not get credit. A common failure is building workflows that “feel compliant” but do not populate the reporting fields. Protect yourself by documenting:

Where each required element is captured

Which field and which template

Who is responsible in the visit workflow

How the system reports it back in PI and eCQM outputs

This also intersects with HIPAA and access controls. The more systems and vendors involved, the more sensitive data handling risk you introduce. Keep compliance aligned with HIPAA changes impact and preserve auditability using audit trail understanding.

5) MACRA terms in real workflows: how to operationalize scoring without chaos

Most teams fail because MACRA is treated as a seasonal project. The winning model is continuous operations with clear owners and controlled evidence.

Build a monthly MACRA close process, like an accounting close

Each month, run a “QPP close” that includes:

Eligibility and attribution review: validate TIN and NPI mapping and confirm reporting entity accuracy

Measure completeness report: eligible cases versus reported cases, by measure

Coding and documentation spot checks: targeted to high volume measures and high risk service lines

PI and CEHRT verification: confirm reporting dashboards match expected behavior

Evidence binder updates: IA artifacts, training logs, workflow change proofs

Risk register: top three threats to score, with remediation plan and owner

This turns MACRA from panic into process. It also creates the kind of defensible documentation expected in audits, aligning with audit trails and coding QA.

Use reimbursement language when communicating to leadership

Leadership cares about dollars. Translate terms into outcomes:

Composite score becomes expected payment adjustment

Data completeness becomes revenue at risk

PI failures become lost points and future reimbursement reductions

Cost attribution becomes a utilization story that may drive payer scrutiny

When you frame MACRA this way, it stops being “quality paperwork” and becomes revenue protection, rooted in Medicare reimbursement logic and the practical outputs shown on an EOB.

Harden your compliance posture before a reviewer forces you to

If your team retrofits documentation or scrambles for evidence after the fact, you create compliance exposure. Build controls aligned with what reviewers look for in compliance audit trends and the consequences described in billing compliance penalties. Then your MACRA work becomes defensible, not fragile.

6) FAQs

-

Start with MIPS composite score because it ties every other term to money. Once you understand how category points roll into a single score and how that score links to a payment adjustment, the rest becomes practical. You stop asking “what does this term mean” and start asking “what does this term do to our score and reimbursement.” Then you can build a monthly score forecast, track measure completeness, and prevent surprise penalties.

-

Claims-based measures can fail when eligibility logic is missing required codes, when claims are rejected or corrected too late, or when the submission pipeline drops cases due to clearinghouse or payer issues. Even small timing failures can reduce data completeness. To prevent this, tighten controls using clean claims submission terminology, strong electronic claims processing discipline, and routine coding QA checks.

-

Because reporting and attribution depend on identity. If the clinician NPI, group TIN, or enrollment mapping is inconsistent across EHR, billing system, registry, and CMS files, eligible cases can be attributed incorrectly or not counted at all. That lowers completeness and can destroy the score even when care and coding were appropriate. The fix is a controlled identity audit across systems, with documented mapping and periodic reconciliation.

-

Registry reporting shifts risk to the vendor pipeline, meaning you must validate mapping and maintain submission proof. eCQM reporting shifts risk to structured EHR data capture, meaning your documentation must populate the exact fields the measure logic expects. Both can fail silently, which is why you need monthly sampling and evidence retention. Treat either path like a compliance process with audit trails, not like a one-time upload.

-

Billing teams influence cost scoring by protecting attribution accuracy, preventing coding driven utilization distortion, and ensuring risk related coding inputs are accurate when applicable. You also can identify outlier patterns early and escalate operational fixes before the performance year closes. Cost category feels uncontrollable when teams do not track it. Once you monitor trends and align coding integrity with documentation, you reduce surprises and gain leverage in internal discussions.

-

Include measure specifications used, reporting method documentation, submission receipts, completeness reports, sample validation logs, PI and CEHRT version proof, IA artifacts with dates and owners, and a change log of workflow updates. Also include a mapping file for TIN and NPI relationships and system screenshots showing reporting configurations. This binder is your defense if results are questioned, similar to the discipline used in audit trail standards and broader financial audit readiness.