Understanding Coordination of Benefits (COB): Clear Definitions

Coordination of Benefits (COB) is the difference between a clean claim that pays the first time and a claim that gets stuck in a denial loop for weeks. It decides who pays first, what the secondary payer can cover, and what the patient truly owes after every adjustment. If you misunderstand COB, you end up with wrong payer order, missing EOBs, duplicate payments, angry patients, and avoidable write offs. This guide breaks COB down in plain language, ties it to real claim flow and denial triggers, and gives you checklists you can use inside your billing workflow starting today.

1) Coordination of Benefits (COB) Explained in Plain English

Coordination of Benefits (COB) is the process insurers use to decide which plan pays first when a patient has more than one active coverage. The goal is simple: prevent overpayment, stop duplicate reimbursement, and ensure the claim follows the correct payer order so the remaining balance is handled accurately.

COB is not a “nice to have.” It drives what happens on the claim line by line, how adjustments post, what appears on the Explanation of Benefits (EOB), and what ultimately lands in Accounts Receivable (A/R).

Here are COB definitions you should actually memorize because they change how you work:

Primary payer: The plan that processes the claim first and sets the baseline allowed amount.

Secondary payer: The plan that considers what’s left after primary payment and adjustments.

Tertiary payer: Rare, but exists. Processes after primary and secondary.

Allowed amount: The maximum reimbursable amount per contract or policy rules.

Patient responsibility: Copay, coinsurance, and deductible remaining after payer processing.

COB information: Data used to decide payer order (coverage effective dates, relationship, employer details, accident indicators, etc.). This often sits inside your medical claims submission terminology workflow.

Why COB becomes a mess in the real world: patients don’t know which plan is primary, employers change coverage mid year, family policies overlap, and front desk capture is inconsistent. Then billing inherits the chaos and the claim gets punished for it.

If you want COB to stay clean, treat it like eligibility plus documentation plus posting discipline, not a one time question at intake. Your COB work should be tracked like a measurable process, the same way you track coding productivity benchmarks or denial rate.

| COB Term | Clear Definition | Why It Matters on Claims |

|---|---|---|

| Primary payer | Plan that adjudicates first and sets the allowed baseline | Wrong primary triggers rejections, delays, and misposted balances |

| Secondary payer | Plan that pays after considering primary payment and adjustments | Requires primary EOB to process correctly |

| Tertiary payer | Third coverage that may pay after primary and secondary | Often missed, leaving collectible money unbilled |

| Allowed amount | Maximum reimbursable amount per policy or contract | Controls contractual adjustments and patient responsibility |

| Deductible | Amount patient must pay before plan pays certain benefits | Secondary may cover some portions depending on policy rules |

| Copay | Fixed patient amount per visit or service type | Can be non-covered by secondary or limited by plan design |

| Coinsurance | Patient percentage of allowed amount after deductible | Secondary may reduce it but not always eliminate it |

| Patient responsibility | Sum of deductible, copay, coinsurance after adjudication | Posting errors create patient disputes and bad debt risk |

| COB denial | Denial caused by missing or incorrect payer order | Fix requires updated COB and resubmission with proof |

| EOB / ERA | Payer explanation of how claim paid, adjusted, or denied | Secondary processing often fails without primary EOB/ERA |

| Rejection vs denial | Rejection: claim not accepted. Denial: processed but not paid | COB issues can cause both, with different fix paths |

| Eligibility verification | Confirm active coverage and plan details before billing | Prevents sending claims to inactive or wrong payer |

| Effective date | Coverage start date for policy benefits | Impacts which plan is primary for date of service |

| Termination date | Coverage end date for policy benefits | Avoids billing old plans and wasting claim cycles |

| Subscriber | Person who holds the policy (employee or purchaser) | Relationship rules can change primary determination |

| Dependent | Covered individual under subscriber’s policy | Birthday rule and custody rules often apply |

| Birthday rule | For dependents with two parents’ plans, earlier birthday is primary | Wrong application creates repeat denials and rebills |

| Non-covered service | Service not payable under a plan’s benefits | Secondary may still pay, but only with correct documentation |

| Authorization | Pre-approval required for select services | Missing auth can look like COB failure when it’s not |

| Medical necessity | Clinical justification required for reimbursement | COB fixes won’t save claims lacking necessity support |

| Accident indicator | Flags auto/work injury involvement for payer responsibility | Misflags can reroute payer order incorrectly |

| Subrogation | Payer seeks reimbursement from responsible party | Common in accident cases; impacts billing follow-up |

| COB questionnaire | Set of questions payers require to confirm other coverage | Incomplete answers can suspend benefits or deny claims |

| Timely filing | Deadline to submit claim after date of service | COB delays can push you past limits if not tracked |

| Appeal packet | Documents and narrative submitted to overturn denial | COB appeals often need proof of primary payment |

| Claim adjustment reason | Reason line was reduced or shifted to patient | Posting accuracy depends on reading adjustment logic correctly |

| Payer order audit | Review of primary/secondary sequence across claims | Finds systemic front-end capture failures fast |

| Posting reconciliation | Match payments/adjustments to ERA/EOB accurately | Prevents false balances and patient collections errors |

| COB workqueue | Dedicated queue for claims needing payer order fixes | Stops “random follow-up” and creates measurable closure |

2) How COB Works Inside Real Claim Flow (Not Theory)

COB is best understood as a sequence of gates. If any gate is wrong, everything downstream breaks. Start by anchoring your team on the same claim flow language using a clean electronic claims processing terminology reference, because COB errors usually show up as “random” rejections that were actually predictable.

Gate 1: Eligibility and coverage capture at intake

If the plan is inactive, the claim never had a chance. Confirm effective dates and identify if the patient is subscriber or dependent. Pair eligibility with a COB check so you do not send the claim to the wrong payer and then burn time chasing corrected EOBs.

Gate 2: Payer order determination

This is where your process needs rules, not guesswork. Your system should store payer sequence and the rationale. When staff rely on memory, COB becomes inconsistent across the same patient depending on who touched the account.

Gate 3: Primary adjudication establishes the baseline

Primary payment and adjustments create the “starting math” for secondary. This is why posting discipline matters. You cannot shortcut COB by guessing the secondary will pick up the rest. Secondary wants proof.

Learn to read the EOB structure like a coder reads a code book: line-level, not summary-level. A single adjustment can explain why secondary paid $0 and pushed balance back to patient.

Gate 4: Secondary requires clean inputs

Secondary typically needs primary payment data. If your team posts incorrectly, your A/R shows false balances and your patient statements become unreliable. That is how COB turns into patient trust damage and refund chaos.

This is why COB should be tracked as an A/R driver. If your A/R terminology is weak, you will mislabel COB delays as “payer slow,” when it was really internal processing failure.

Gate 5: Patient responsibility must be defensible

COB does not just affect payers. It affects what you can collect. If you bill the patient before secondary adjudication when the policy requires secondary to be billed, you trigger disputes and chargebacks. If you delay too long, you risk timely filing on secondary.

When COB is handled correctly, the patient responsibility number is not a guess. It is a documented outcome supported by EOB logic and policy rules.

3) The Most Common COB Scenarios and How to Decide Who Pays First

COB rules vary by plan type, but the scenarios repeat. The mistake is treating them like one universal rule. Build a scenario playbook and make it part of onboarding, alongside your medical billing certification terms dictionary so new staff stop learning COB by trial and error.

Scenario A: Patient has employer plan plus spouse plan

In many cases, the plan tied to the patient as subscriber is primary. The spouse plan is secondary. Where teams fail is not confirming subscriber status and relationship, which makes the “obvious” sequence wrong.

Scenario B: Dependent child covered by both parents

This is where the birthday rule is often applied. But the real operational pain is consistency: if your intake forms don’t capture parent subscriber details cleanly, you can’t apply rules correctly.

Scenario C: Medicare plus other coverage

Medicare coordination can be strict depending on the other coverage and patient status. If your Medicare rules and terminology aren’t sharp, you’ll lose time. Keep a Medicare reference close and train staff to use it before they move claims: Medicare reimbursement reference.

Scenario D: Auto accident or work injury involvement

Accident indicators can change who is responsible. If staff misflags accident involvement, claims go down the wrong route, and you spend weeks undoing it.

Scenario E: Telehealth and POS confusion plus COB

Telehealth claims can be uniquely sensitive to place of service reporting, which can interact with coverage rules. If your process already struggles with payer order, layer in telehealth and you get denial stacking. Pair your COB training with telehealth reimbursement awareness like telemedicine reimbursement trends.

Scenario F: Plan changes mid-treatment

This is the COB disaster nobody wants. The patient changes jobs, a new plan starts, but the old plan still exists on file. If your system doesn’t enforce coverage effective dates, you’ll submit to the wrong plan repeatedly and blow timely filing.

COB success here is a workflow decision: run a coverage validation check at each major billing event, not only at first visit.

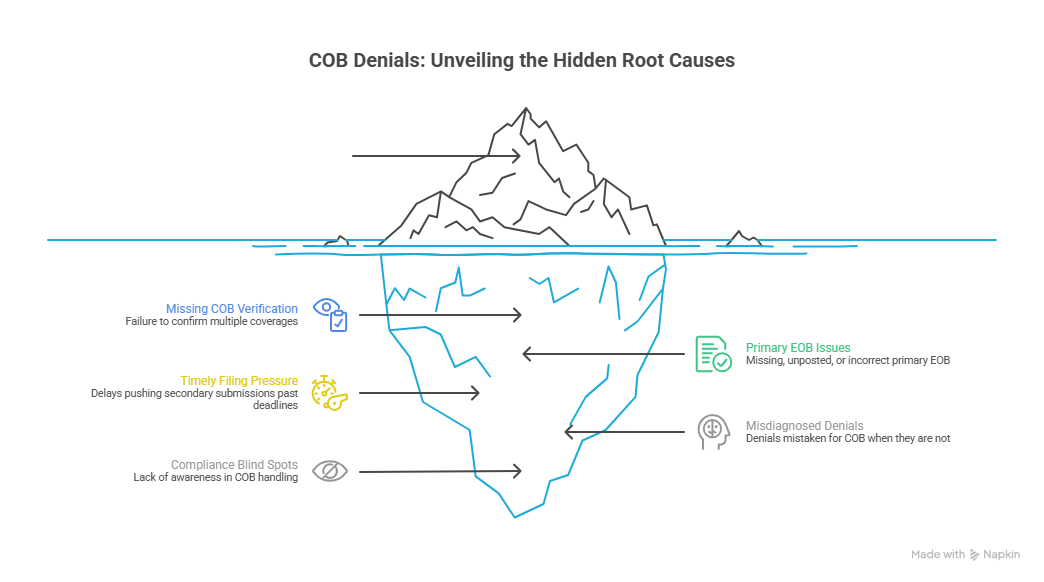

4) COB Denials: The Real Root Causes and How to Fix Them Fast

COB denials are brutal because they waste cycles twice: first on the denial itself, then on the “invisible” internal time spent reconstructing what should have been captured up front.

Here are the real root causes, not the generic ones:

Root cause 1: Missing COB verification at the point of service

If you do not confirm multiple coverages before billing, you are gambling with payer order. The fix is operational: make COB verification part of your front-end checklist and audit it the same way you audit coding accuracy. Use an internal language standard from coding audit terms so staff stop describing COB problems differently.

Root cause 2: Primary EOB is not attached, not posted, or posted incorrectly

Secondary doesn’t want your summary. It wants adjudication proof. Your team must be trained to read the EOB at the line level and reconcile it to the ledger. If you skip reconciliation, your A/R becomes fiction, and COB turns into collections damage.

Root cause 3: Timely filing pressure created by slow COB cleanup

COB delays are dangerous because they can quietly push secondary submissions past deadlines. The fix is to create a COB workqueue with aging rules. If it sits longer than X days, it escalates. No exceptions.

Root cause 4: COB looks like medical necessity but isn’t

Some denials are misdiagnosed as COB when the payer is actually asking for documentation or necessity support. This is where staff lose weeks because they “fix COB” repeatedly while the payer wants a clinical rationale. Keep a high-quality necessity reference like medical necessity criteria in the denial workflow so the team checks the right cause first.

Root cause 5: Compliance blind spots in COB handling

COB touches compliance because it involves accurate billing, correct payer billing, and accurate patient balances. If your team is cutting corners, the risk is not only denials. It is audit exposure. Anchor your process in compliance language from billing compliance violations and penalties and audit awareness like compliance audit trends.

A fast COB fix strategy that actually works:

Confirm active coverages and effective dates for the date of service.

Validate payer order and update the patient account.

Obtain primary EOB/ERA and post accurately.

Attach proof to secondary claim submission as required.

Track the claim in a COB queue until adjudication completes.

Reconcile patient responsibility before statements go out.

This is boring work, but it is high-value work. COB mastery is how billing teams stop bleeding time and start controlling outcomes.

5) COB Metrics, Workqueues, and System Rules That Make It Measurable

COB is only “hard” when it’s unmanaged. When it’s structured, it becomes a measurable operational lever, just like charge entry turnaround or payment posting accuracy.

Track these COB KPIs the same way you track revenue cycle performance, using benchmark thinking from revenue cycle efficiency metrics:

COB denial rate: COB denials ÷ total claims, tracked by payer and by location.

Average days to COB resolution: How long it takes to correct payer order and resubmit.

Secondary submission lag: Days between primary adjudication and secondary submission.

Posting accuracy rate: % of ERAs/EOBs posted without later correction.

Refund rate tied to COB: Overpayments and refunds caused by wrong payer order.

Patient dispute rate: Billing complaints tied to incorrect responsibility due to COB errors.

Then enforce rules:

If a claim hits a COB denial, it must move into a dedicated COB queue.

If a COB item ages past a threshold, it escalates.

If a payer requires questionnaires, staff must trigger patient outreach with a script and deadline.

If the patient does not respond, document the outreach attempt and update next steps consistently.

Your documentation and terminology should be standardized so it is auditable. Use internal references like understanding quality assurance in medical coding and audit trails to make your COB process defensible.

One more reality: COB work is often done by your strongest people because it’s “hard.” That creates a bottleneck. Build repeatable SOPs so COB becomes trainable and scalable. If you’re hiring for future-proof roles, COB fluency is increasingly tied to modern billing performance and remote work readiness, which shows up in workforce analysis like remote workforce trends and workforce demographics.

6) FAQs: Coordination of Benefits (COB) Questions That Actually Matter

-

Tell them COB is how insurance decides who pays first when they have more than one plan. The first plan processes the claim and creates the baseline payment and adjustments, and the second plan reviews what remains. If the order is wrong, the claim can delay and the patient can receive incorrect statements. You can reinforce trust by explaining that the final patient balance is based on the payer’s EOB details, not an estimate, and that billing will be finalized only after both plans adjudicate.

-

Secondary insurance can pay $0 when the primary already paid up to the allowed amount, when the secondary policy does not cover that service category, or when the secondary requires the primary EOB and it was missing or incomplete. Another common cause is incorrect posting that makes the secondary think the primary paid differently than it did, which is why accurate reconciliation matters in A/R workflows. Always verify the denial reason using the EOB logic before resubmitting.

-

In most cases you need updated eligibility confirmation, proof of coverage effective dates, and a copy of the primary EOB/ERA showing payment and adjustments. If the payer requires a COB questionnaire, you may need completed responses from the patient. When the denial is actually documentation-related, not COB-related, you may need medical necessity support aligned with medical necessity criteria. Treat resolution as a packet: eligibility proof, payer order rationale, and adjudication evidence.

-

You prevent timely filing losses by turning COB into a tracked queue with aging rules. As soon as primary adjudication occurs, secondary submission should happen within a defined timeframe. Any COB denial should trigger immediate investigation, not “end of week cleanup.” This is operational discipline. Build your queue structure around claim cycle language from electronic claims processing terms and measure it like a revenue cycle KPI using efficiency benchmarks.

-

COB is about payer order and coverage coordination. Medical necessity is about whether the payer believes the service was justified based on documentation and policy rules. They can look similar because both result in nonpayment, but the fixes are totally different. COB requires payer sequence correction and often primary adjudication proof. Medical necessity requires clinical documentation alignment and sometimes an appeal. This is why teams should triage denials using a necessity guide like medical necessity criteria before they start “fixing COB” blindly.

-

The biggest mistake is treating COB as a one-time front desk question instead of a process. Patients change jobs, add coverage, lose coverage, and misunderstand their own policy structure. If you don’t revalidate coverage at key billing points, you will keep sending claims to the wrong payer and then spend weeks repairing downstream damage. The second biggest mistake is poor posting discipline, where EOBs are not interpreted correctly. If your posting is wrong, your A/R becomes unreliable and your secondary claims suffer.

-

Start with a scenario-based SOP, not a generic definition doc. Include: required intake fields, payer order rules by scenario, required documents for secondary submission, denial triage steps, and escalation timelines. Add standard terminology so everyone logs work consistently using references like coding audit terms and audit trails. The goal is repeatability: any biller should be able to resolve COB issues using the same steps and produce the same outcome.