Impact of New Healthcare Regulations on Medical Billing in 2025

New 2025 healthcare regulations are forcing billing teams to rethink everything from code selection and prior authorizations to how they track denials and educate providers. Payers and regulators are aligning documentation standards, ICD-11 adoption, and reimbursement models in ways that directly change how your practice gets paid. If your billing workflows still look like 2022, you are already behind. In this guide, we will break down the key regulatory shifts, the concrete impact on daily billing tasks, and how to protect revenue using resources like AMBCI’s revenue-cycle benchmarks and coding accuracy reports.

1. Why 2025 Regulations Are Reshaping Medical Billing

The biggest regulatory theme of 2025 is tighter alignment between clinical reality, coding specificity, and financial outcomes. New payer rules and government policies are explicitly linking reimbursement to documented severity, risk scores, and quality measures. That means every billing specialist must understand how ICD-11, updated E/M rules, and bundled payment structures interact with day-to-day claim submission. If your codes are accurate but your documentation or modifiers fall short, regulators will still see a compliance gap.

Regulators are also using data from large health systems and vendors to identify patterns of over- and under-coding. These patterns feed payer algorithms, which then drive pre-payment edits, post-payment audits, and focused medical reviews. Billing teams must read these trends through resources such as AMBCI’s ICD-11 reimbursement studies, revenue-leakage analyses, and denials-management reports. The practices that thrive are the ones that treat regulations as design constraints for smarter workflows, not just legal checklists.

2. Regulatory Impact: Where 2025 Rules Hit Billing Workflows First

New regulations rarely appear as a single law; they show up as hundreds of micro changes that quietly rewrite your billing checklist. ICD-11 adoption requires coders to re-learn disease hierarchies while payers update coverage policies, which is why AMBCI’s ICD-11 guideline guide and terminology dictionaries are becoming daily references. Telehealth rules are moving from emergency flexibilities to permanent frameworks, so billing must align with claims-submission terminology and specialty-specific nuances highlighted in hospital reimbursement reports.

Simultaneously, regulators are tightening enforcement of “no-surprises” and price-transparency rules. That means billing errors are no longer just a denial problem; they become patient-experience and compliance issues. Teams that understand the financial stakes through revenue-leakage studies and financial-audit guides can redesign workflows proactively instead of responding to penalties.

3. Operational Changes Billing Teams Must Make Now

To keep up with regulatory pressure, billing departments are re-engineering core processes rather than just updating cheat sheets. The first step is mapping every major regulation to a specific workflow: scheduling, authorization, documentation, coding, claim submission, and appeals. Leaders then benchmark those workflows against AMBCI’s revenue-cycle efficiency report, coding-error analysis, and denials-management best practices.

Regulations also push organizations toward more frequent internal audits. Instead of annual reviews, high-performing teams run monthly or even weekly sampling, mirroring payer scrutiny described in AMBCI’s content on revenue leakage and future reimbursement models. Billing managers track findings over time, tie them to coder education plans, and log all remediation to satisfy compliance expectations.

Finally, regulations are making front-end data capture more critical than ever. Insurance verification, benefit checks, and financial consent forms all need to reflect updated rules. Smart teams pull definitions from AMBCI’s medical billing dictionary and DME coding guides to ensure that what front-desk staff collect actually supports clean claims.

Quick Poll: Where are 2025 regulations hitting your billing team hardest?

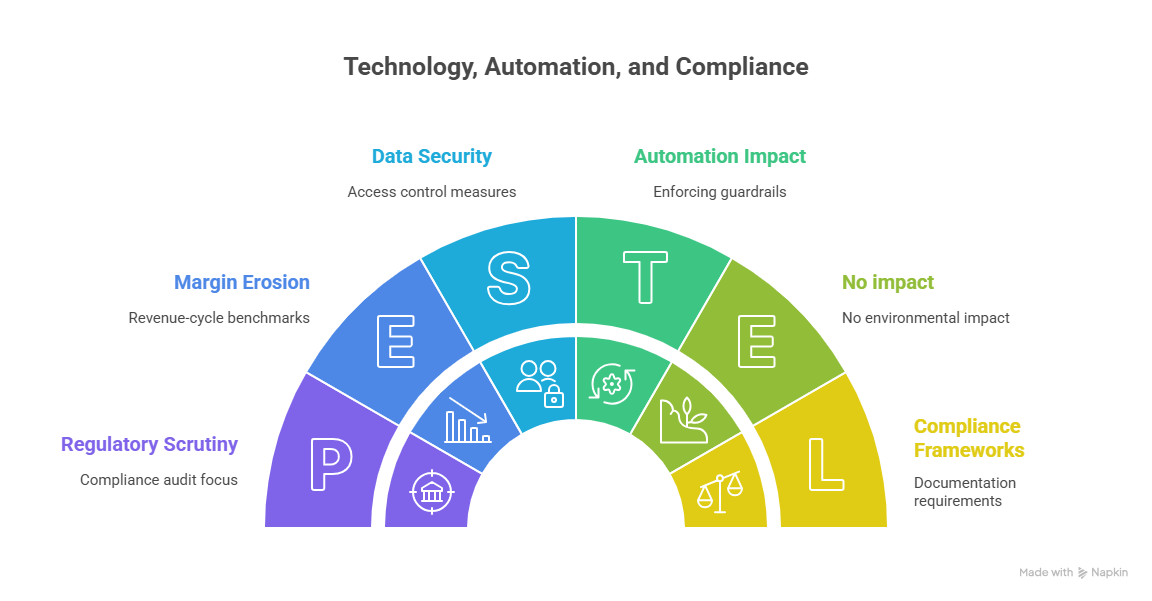

4. Technology, Automation, and Compliance Under New Rules

Regulators are not just looking at claims; they are examining the tools you use to generate them. Automated coding suggestions, charge-capture tools, and claim scrubbers must reflect updated regulations or they can propagate systemic errors across thousands of encounters. That is why forward-looking organizations pair new technology with structured guidance from AMBCI’s software innovation analysis, ICD-11 resources, and coding-compliance dictionaries.

Automation is most powerful when it enforces guardrails rather than replacing judgment. For example, rules engines can flag mismatched POS codes for telehealth, but coders still need to interpret whether the service fits payer definitions. Analytics dashboards built on revenue-cycle benchmarks and denials data help leaders see whether regulations are quietly eroding margins.

Regulators also care about data security and access control. Billing systems now fall squarely inside compliance audits, so organizations lean on frameworks discussed in AMBCI’s financial-audit guide and claims dictionaries to document who can change fee schedules, override edits, or resubmit claims.

5. Skills, Roles, and Certification Paths to Stay Competitive

New regulations create winners and losers in the job market. Billing professionals who only understand basic data entry will struggle, while those who master compliance and analytics will become indispensable. Entry-level staff can use AMBCI’s career-start guide and salary benchmarks to choose roles that grow with regulation-driven demand.

Mid-career professionals are moving into hybrid positions: revenue-integrity analyst, compliance billing specialist, and audit-focused coder. These roles rely on knowledge from coding educator roadmaps, emerging job-role reports, and automation-resilient career guides.

Continuous education is now the baseline. Coders who invest in ongoing CE, learn from Reddit-style AMAs with billing entrepreneurs, and follow LinkedIn Q&As with leaders are better equipped to interpret new rules. They understand not only how to bill correctly today but also how regulations will evolve over the next two to three years.

6. FAQs: Navigating 2025 Healthcare Regulations in Medical Billing

-

Start with the changes that directly alter claim acceptability and audit risk: ICD-11 adoption, updated E/M rules, permanent telehealth policies, and prior-authorization reform. These areas affect nearly every encounter type. Use AMBCI’s ICD-11 guideline guide, coding-error analysis, and denials-management content to map those regulations to your workflows. Once those foundations are stable, address supporting areas like price transparency, no-surprises billing, and quality-reporting alignment so that your claims data supports both reimbursement and compliance metrics.

-

Regulators are replacing temporary pandemic-era flexibilities with more permanent, but stricter, telehealth rules. Pay attention to site-of-service distinctions, eligible provider types, and modifier requirements. Incorrect POS codes or misuse of telehealth modifiers can easily trigger denials or audits. Billing teams should pair payer bulletins with AMBCI resources on claims terminology, specialty reimbursement trends, and revenue-cycle benchmarks to design telehealth-specific checklists. Training clinicians to document visit type, location, and technology used is just as important as selecting the right codes.

-

New rules standardize timeframes, increase transparency into denial reasons, and expect more structured appeals. That means informal, narrative-style appeal letters are no longer enough. Successful teams use denial data to build templates that explicitly reference coverage policies, coding guidelines, and medical necessity criteria. AMBCI’s denials-management guide, revenue-leakage analysis, and financial-audit guide can help you quantify which denial types cost the most and prioritize appeals accordingly. The goal is to turn regulatory structure into a playbook rather than a barrier.

-

ICD-11 isn’t just a coding update; it is the backbone of many regulatory initiatives. More granular codes feed risk-adjustment models, quality measures, and public reporting. Under-coding or mis-mapping diagnoses can distort severity profiles, lower reimbursement, and misrepresent patient outcomes. AMBCI’s ICD-11 reimbursement impact study and official-guidelines guide show how specificity affects payment and compliance simultaneously. Billing teams that treat ICD-11 training as a regulatory requirement – not just a coding preference – will avoid costly audits and missed revenue opportunities.

-

Smaller organizations can still stay compliant by building lightweight, repeatable routines. Start with a core policy manual summarized from AMBCI’s billing dictionary, compliance terminology, and financial-audit guidance. Run simple monthly internal audits using checklists from common error guides and log your findings. Finally, invest in targeted education through AMBCI’s career and CE resources so one or two “super-user” staff members can interpret new rules and translate them into practical steps.

-

Regulatory complexity actually increases the value of skilled billing and coding professionals. As rules multiply, organizations need people who can interpret policy language, collaborate with clinicians, and configure technology responsibly. AMBCI’s career-start guide, CPC and advanced roadmaps, and automation-resilient career insights show how regulation-aware specialists can command higher salaries and move into leadership roles. Professionals who combine certification, regulatory fluency, and data analysis will find themselves at the center of strategic decisions, not just back-office operations.

-

The best strategy is to build systems that adapt, not one-off fixes. Tie your policies, training, and audit tools to trusted references like AMBCI’s reimbursement-model forecasts, software innovation reports, and leadership Q&As. Schedule recurring policy reviews, maintain living documentation, and treat internal audits as your early-warning system. When you design your billing operation around continuous learning and measurable metrics, new regulations become manageable updates rather than disruptive crises.