Fraud, Waste, & Abuse in Medical Billing: Comprehensive 2025 Analysis

Fraud, waste, and abuse (FWA) are no longer abstract compliance buzzwords. In 2025, payers combine AI-driven analytics, pre-pay edits, and post-pay audits to aggressively hunt patterns that look like inflated charges, sloppy billing, or intentional deception. For billers and coders, that means every missed modifier, mis-sequenced ICD-11 code, or cloned note can trigger recoupments, penalties, or even exclusion. If you want to protect your revenue cycle and your career, you need a practical map of how FWA shows up in real workflows, which KPIs payers track, and how to build airtight compliance from scheduling to collections.

1) 2025 Definitions: How Fraud, Waste, and Abuse Actually Show Up in Daily Billing

Payers don’t care what your intent “felt” like; they care how your data behaves over time. Fraud involves intentional deception for payment, such as knowingly upcoding E/M visits or submitting claims for services not rendered. These patterns often surface when your coding profile deviates from peers, especially in high-risk specialties identified in analyses of reimbursement rates by specialty and coding accuracy impact on hospital revenue.

Waste reflects careless or inefficient processes that create avoidable costs. Examples include repeat lab claims because prior results weren’t checked, uncoordinated imaging orders, or chronic resubmission of claims without fixing root causes of revenue leakage in medical billing. Abuse is somewhere in between: patterns that technically follow the rules but clearly exploit loopholes or disregard medical necessity guidelines, as captured in many payer audits of medical claims submission terminology and medical coding compliance definitions.

For coders, a critical mindset shift is treating FWA not as “legal trouble far away” but as a data signature that auditors detect months later. That’s why strong foundations in ICD-11 guidelines, specialty terms like chiropractic coding, and durable medical equipment (DME) coding are now non-negotiable for anyone who wants to stay employable and audit-ready.

2) 2025 FWA Risk Map: Where Revenue Cycle Breakdowns Start

FWA issues rarely begin in the claims queue; they start at patient access, documentation, and clinical decision-making. When scheduling teams mis-capture insurance data or fail to verify COB, claim edits later look like sloppy billing rather than upstream workflow gaps. Cross-training front-office staff using resources like the medical billing dictionary of terms and claims submission terminology guide reduces this front-end waste.

In coding, the combination of complex ICD-11 implementation and specialty-specific rules creates fertile ground for both errors and abuse. Teams that haven’t deeply internalized ICD-11 reimbursement impacts, top coding errors, and denials management strategies often rely on guesswork or outdated code books. Over time, this guesswork turns into recognizable waste and abusive patterns, especially when case-mix or E/M distributions drift away from specialty benchmarks tracked in 2025 salary and job analyses.

On the back end, incomplete reconciliation between clinical encounters, charge capture, and payment posting hides true FWA exposure. Without structured audits grounded in revenue leakage research and future reimbursement model predictions, leadership underestimates long-term risk. They see denials as “payer noise” rather than signals that documentation, coding, or utilization patterns may cross the line from acceptable variance into abuse.

3) Root Causes of Fraud, Waste, and Abuse Inside Billing Teams

True fraud is usually driven by leadership or external actors, but waste and abuse are often the by-product of everyday pressure on coders and billers. When teams are measured only on throughput rather than accuracy, staff learn to prioritize speed over compliance. This culture becomes dangerous when combined with poor foundational training; coders who never received structured education such as a step-by-step career guide or CPC career roadmap lean heavily on shortcuts, templates, or copy-paste habits.

Another root cause is fragmented knowledge. Many organizations treat compliance as a separate silo rather than a skill embedded in every billing role. That means coders may never see how their choices affect hospital revenue performance, or how recurring denials trace back to misunderstood coding compliance terms. By contrast, high-performing teams deliberately integrate compliance education into everyday workflows using resources such as continuing education roadmaps and exam-focused educator AMAs.

Technology can either amplify or reduce FWA risks. Poorly configured EHR templates encourage over-documentation and unnecessary services, while outdated billing software fails to enforce edits based on current ICD-11 rules, DME guidelines, or specialty-specific terms. Organizations that ignore technology upgrades or the future of billing software essentially choose to live with preventable waste and an ever-rising audit exposure curve.

Quick Poll: What’s Your Biggest FWA Challenge in 2025?

4) Building a Proactive Fraud, Waste, & Abuse Prevention Program

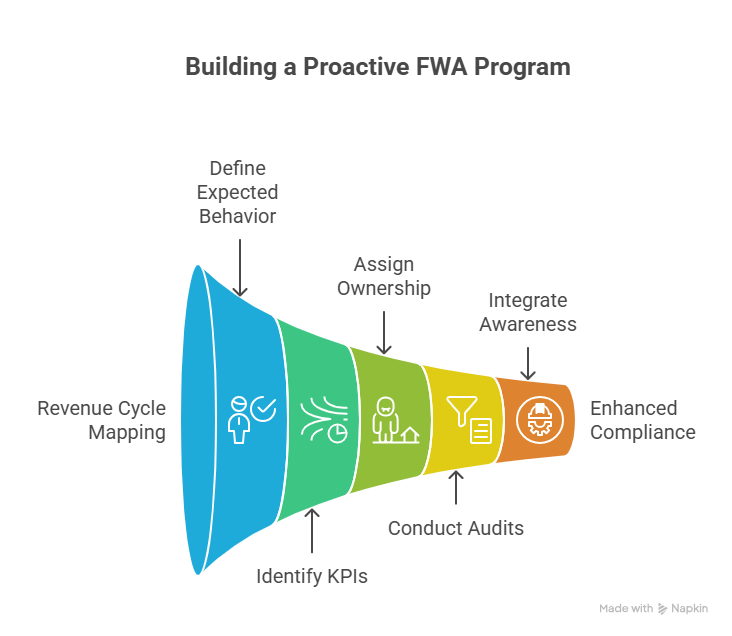

A serious FWA program doesn’t start with a policy manual; it starts with data, education, and governance. First, map your entire revenue cycle from scheduling to bad-debt write-off and overlay known FWA hotspots from the table above. For each point, define: what is the expected behavior, which KPI will signal deviation, and who owns remediation. Use benchmarks from RCM efficiency reports, reimbursement rate analyses, and revenue leakage studies to set realistic thresholds.

Next, design a tiered audit model. Prospective audits catch issues before claims go out; retrospective audits validate whether edits and training are working. High-risk areas like telehealth E/M, DME, and chiropractic services deserve routine review paired with refreshed training using resources such as coding error breakdowns and hospital revenue impact case studies. When issues are discovered, leaders must decide whether they indicate knowledge gaps, process gaps, or willful misconduct; each path demands different corrective actions, from extra CE credits to escalation via your financial audit playbook.

Finally, embed FWA awareness into daily operations. Make it standard practice to review payer bulletins, OIG updates, and major policy changes that influence future reimbursement models. Integrate these updates into huddles, learning modules, and documentation templates, so coders and billers see compliance not as an annual check-box but as a living part of their role. Over time, this culture of vigilance is what separates organizations that survive aggressive payer audits from those that accumulate costly corporate integrity agreements.

5) How Certification, Education, and Technology Reduce FWA Exposure

From a career perspective, FWA control is a powerful differentiator. Employers prefer professionals who can both code claims accurately and explain how those codes affect compliance risk. That is why structured certifications in billing and coding, combined with focused learning paths like expert strategies to maximize your certification and continuing education accelerators, directly translate into better job security. Candidates who demonstrate fluency in FWA concepts during interviews often access advanced roles discussed in emerging job role analyses and future-proofed coding career roadmaps.

Technology is the second pillar. Practices that still run on outdated systems without rules relevant to ICD-11 coding or modern billing software innovations invite waste. By contrast, organizations that invest in analytics dashboards, anomaly detection, and denial management platforms can monitor FWA indicators in near real-time. Ambitious professionals who learn these tools often transition into leadership roles such as compliance analyst, revenue integrity specialist, or educator, paralleling the paths outlined in career roadmaps for educators and salary optimization guides.

Finally, community learning matters. Real-world stories shared through Reddit AMAs with billing entrepreneurs, LinkedIn Q&As with healthcare leaders, and educator-led sessions help you see how FWA risks appear in different practice models. When you combine structured certification, technology literacy, and community insights, you become the person in the room who can spot problematic patterns early and recommend fixes grounded in both compliance and business realities.

6) FAQs: Fraud, Waste, & Abuse in Medical Billing (2025)

-

Fraud is intentional deception for financial gain, such as knowingly billing for services not rendered or manipulating documentation to justify higher-paying codes. Waste reflects inefficient or careless use of resources, like repeatedly ordering unnecessary tests or resubmitting claims without fixing root-cause errors already identified in revenue leakage analyses. Abuse falls between the two: behavior that may technically meet minimal rules but clearly violates the spirit of medical necessity or fair billing, such as chronically exploiting modifier loopholes explained in coding compliance dictionaries. Regulators look at patterns over time, comparing your data with peers to decide whether your behavior fits “normal variance,” waste, abuse, or outright fraud.

-

Auditors focus on patterns rather than isolated claims. They compare your E/M level distribution, telehealth utilization, imaging frequency, DME replacement intervals, and modifier usage with specialty benchmarks derived from claims databases and reports like reimbursement by specialty analyses. High “unspecified” ICD-11 usage, unusual new-patient ratios, and spikes in medical necessity denials are major red flags often captured in RCM efficiency metrics. They also track appeals outcomes: frequent overturned denials may prove your documentation is strong, while repetitive failed appeals signal systemic misuse of codes, setting the stage for more aggressive post-pay audits and potential recoupments.

-

There is no one-size-fits-all rule, but high-performing organizations treat audits as a continuous process rather than an annual event. At minimum, you should conduct a targeted quarterly review of high-risk areas like telehealth, DME, and procedures with frequent denials, using frameworks similar to those in financial audit guides and denials management reports. Larger systems often run monthly prospective audits on new providers or services, then adjust sample sizes based on findings. The key is to formally document your audit plan, sampling logic, findings, corrective actions, and follow-up education; this documentation becomes critical evidence if you are later questioned by payers or regulators about how you control FWA risk.

-

First, prioritize education and credentials. Completing structured training such as medical billing and coding career guides, certification exam strategies, and continuing education roadmaps helps you rely on standards rather than guesswork. Second, document your concerns: if you feel pressured to upcode or override edits without clear medical necessity, escalate the issue via email or compliance channels and keep records. Third, push for written policies on defensive coding, audit response, and provider queries aligned with coding compliance terminology. When your decisions are rooted in national guidelines, payer policies, and internal procedures, it becomes much harder for organizations to scapegoat you during investigations.

-

ICD-11 offers far greater specificity and digital-friendly structure, which helps payers distinguish legitimate complexity from vague documentation. However, this same granularity creates new risk if coders use broad categories instead of precise codes or mis-understand post-coordination rules, leading to patterns that look like either waste or upcoding. Organizations that invest in serious ICD-11 training using resources like the official coding guidelines guide and reimbursement impact studies can actually reduce FWA risk because their claims data more accurately reflects clinical reality. Those that “wing it” risk chronic denials, distorted quality metrics, and data patterns that invite deeper payer scrutiny.

-

The biggest ROI comes from tools that close the loop between documentation, coding, denials, and analytics. That includes RCM platforms with real-time edits tuned to current coding dictionaries, denial management modules that categorize root causes using insights from revenue leakage studies, and dashboards that visually compare your key metrics to specialty norms referenced in reimbursement and salary guides. Forward-looking organizations also track innovation trends through resources on future billing software. Together, these tools help you detect suspicious patterns early, reinforce training, and demonstrate to payers that your compliance program is serious, proactive, and data-driven.